BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

17<br />

have been trending downward since. Housing<br />

starts are expected to fall to a still relatively<br />

high 2,300 units in <strong>2005</strong>, as slower economic<br />

growth and rising interest rates take their toll.<br />

Fiscal policy also contributed to the slowdown<br />

in the Newfoundland economy in 2004, and will<br />

continue to do so in <strong>2005</strong>. With its 2004<br />

budget, the government implemented a plan to<br />

rein in the province’s burgeoning deficit, with a<br />

planned reduction in the consolidated deficit to<br />

$840 million in 2004-05 from an estimated<br />

$959 million in 2003-04. The 2003-04<br />

consolidated deficit represents about 5.3% of<br />

GDP, making it one of the largest provincial<br />

deficits, relative to the size of its economy, in<br />

Canadian history. The plan includes cutting<br />

about 4,000 of 32,000 civil service positions<br />

over the next four years and implementing a<br />

freeze on public sector wages for two years.<br />

The budget plan calls for the cash deficit to be<br />

eliminated over four years. This would still<br />

leave the consolidated deficit in the $400 -<br />

$500 million range.<br />

Despite the weaker economic conditions,<br />

employment held up rather well in 2004 and is<br />

projected to rise 1.8% for the year. Gains are<br />

likely to be much weaker in <strong>2005</strong>, with an<br />

accompanying rise in the jobless rate, as the<br />

economy slows further.<br />

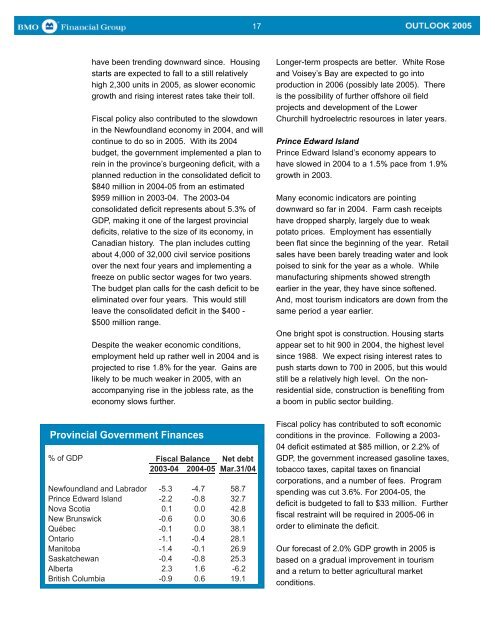

Provincial Government Finances<br />

% of GDP Fiscal Balance Net debt<br />

2003-04 2004-05 Mar.31/04<br />

Newfoundland and Labrador -5.3 -4.7 58.7<br />

Prince Edward Island -2.2 -0.8 32.7<br />

Nova Scotia 0.1 0.0 42.8<br />

New Brunswick -0.6 0.0 30.6<br />

Québec -0.1 0.0 38.1<br />

Ontario -1.1 -0.4 28.1<br />

Manitoba -1.4 -0.1 26.9<br />

Saskatchewan -0.4 -0.8 25.3<br />

Alberta 2.3 1.6 -6.2<br />

British Columbia -0.9 0.6 19.1<br />

Longer-term prospects are better. White Rose<br />

and Voisey’s Bay are expected to go into<br />

production in 2006 (possibly late <strong>2005</strong>). There<br />

is the possibility of further offshore oil field<br />

projects and development of the Lower<br />

Churchill hydroelectric resources in later years.<br />

Prince Edward Island<br />

Prince Edward Island’s economy appears to<br />

have slowed in 2004 to a 1.5% pace from 1.9%<br />

growth in 2003.<br />

Many economic indicators are pointing<br />

downward so far in 2004. Farm cash receipts<br />

have dropped sharply, largely due to weak<br />

potato prices. Employment has essentially<br />

been flat since the beginning of the year. Retail<br />

sales have been barely treading water and look<br />

poised to sink for the year as a whole. While<br />

manufacturing shipments showed strength<br />

earlier in the year, they have since softened.<br />

And, most tourism indicators are down from the<br />

same period a year earlier.<br />

One bright spot is construction. Housing starts<br />

appear set to hit 900 in 2004, the highest level<br />

since 1988. We expect rising interest rates to<br />

push starts down to 700 in <strong>2005</strong>, but this would<br />

still be a relatively high level. On the nonresidential<br />

side, construction is benefiting from<br />

a boom in public sector building.<br />

Fiscal policy has contributed to soft economic<br />

conditions in the province. Following a 2003-<br />

04 deficit estimated at $85 million, or 2.2% of<br />

GDP, the government increased gasoline taxes,<br />

tobacco taxes, capital taxes on financial<br />

corporations, and a number of fees. Program<br />

spending was cut 3.6%. For 2004-05, the<br />

deficit is budgeted to fall to $33 million. Further<br />

fiscal restraint will be required in <strong>2005</strong>-06 in<br />

order to eliminate the deficit.<br />

Our forecast of 2.0% GDP growth in <strong>2005</strong> is<br />

based on a gradual improvement in tourism<br />

and a return to better agricultural market<br />

conditions.