BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

13<br />

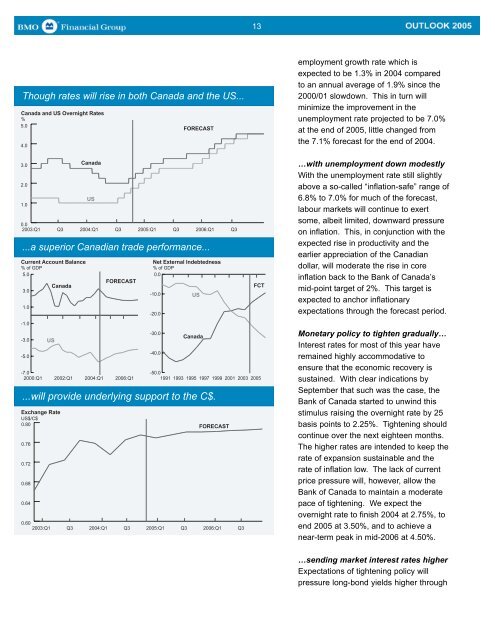

Though rates will rise in both Canada and the US...<br />

Canada and US Overnight Rates<br />

%<br />

5.0<br />

FORECAST<br />

4.0<br />

employment growth rate which is<br />

expected to be 1.3% in 2004 compared<br />

to an annual average of 1.9% since the<br />

2000/01 slowdown. This in turn will<br />

minimize the improvement in the<br />

unemployment rate projected to be 7.0%<br />

at the end of <strong>2005</strong>, little changed from<br />

the 7.1% forecast for the end of 2004.<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

2003:Q1<br />

Q3<br />

...a superior Canadian trade performance...<br />

Current Account Balance<br />

% of GDP<br />

5.0<br />

3.0<br />

1.0<br />

-1.0<br />

-3.0<br />

-5.0<br />

-7.0<br />

2000:Q1<br />

2002:Q1<br />

...will provide underlying support to the C$.<br />

Exchange Rate<br />

US$/C$<br />

0.80<br />

0.76<br />

0.72<br />

0.68<br />

0.64<br />

US<br />

0.60<br />

2003:Q1<br />

Canada<br />

Q3<br />

Canada<br />

US<br />

2004:Q1<br />

2004:Q1<br />

2004:Q1<br />

Q3<br />

FORECAST<br />

2006:Q1<br />

Q3<br />

<strong>2005</strong>:Q1<br />

-10.0<br />

-20.0<br />

-30.0<br />

-40.0<br />

Q3<br />

2006:Q1<br />

Net External Indebtedness<br />

% of GDP<br />

0.0<br />

Q3<br />

-50.0<br />

1991 1993 1995 1997 1999 2001 2003 <strong>2005</strong><br />

<strong>2005</strong>:Q1<br />

Q3<br />

US<br />

Canada<br />

FORECAST<br />

2006:Q1<br />

Q3<br />

FCT<br />

…with unemployment down modestly<br />

With the unemployment rate still slightly<br />

above a so-called “inflation-safe” range of<br />

6.8% to 7.0% for much of the forecast,<br />

labour markets will continue to exert<br />

some, albeit limited, downward pressure<br />

on inflation. This, in conjunction with the<br />

expected rise in productivity and the<br />

earlier appreciation of the Canadian<br />

dollar, will moderate the rise in core<br />

inflation back to the Bank of Canada’s<br />

mid-point target of 2%. This target is<br />

expected to anchor inflationary<br />

expectations through the forecast period.<br />

Monetary policy to tighten gradually…<br />

Interest rates for most of this year have<br />

remained highly accommodative to<br />

ensure that the economic recovery is<br />

sustained. With clear indications by<br />

September that such was the case, the<br />

Bank of Canada started to unwind this<br />

stimulus raising the overnight rate by 25<br />

basis points to 2.25%. Tightening should<br />

continue over the next eighteen months.<br />

The higher rates are intended to keep the<br />

rate of expansion sustainable and the<br />

rate of inflation low. The lack of current<br />

price pressure will, however, allow the<br />

Bank of Canada to maintain a moderate<br />

pace of tightening. We expect the<br />

overnight rate to finish 2004 at 2.75%, to<br />

end <strong>2005</strong> at 3.50%, and to achieve a<br />

near-term peak in mid-2006 at 4.50%.<br />

…sending market interest rates higher<br />

Expectations of tightening policy will<br />

pressure long-bond yields higher through