BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

33<br />

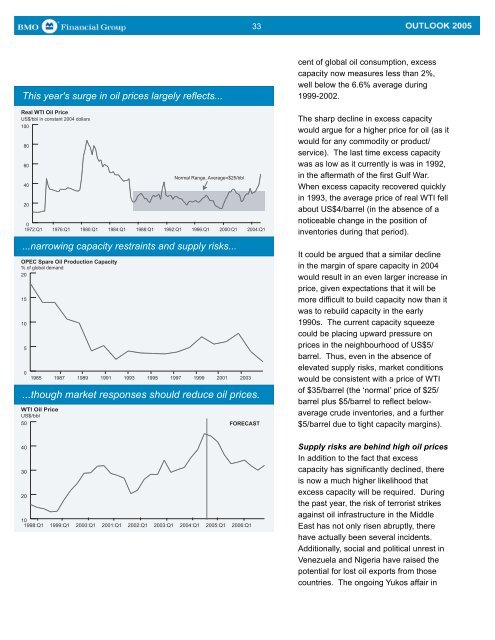

This year's surge in oil prices largely reflects...<br />

Real WTI Oil Price<br />

US$/bbl in constant 2004 dollars<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

1972:Q1<br />

...narrowing capacity restraints and supply risks...<br />

OPEC Spare Oil Production Capacity<br />

% of global demand<br />

20<br />

15<br />

10<br />

5<br />

0<br />

...though market responses should reduce oil prices.<br />

WTI Oil Price<br />

US$/bbl<br />

50<br />

1985<br />

1976:Q1<br />

1987<br />

1980:Q1<br />

1989<br />

1991<br />

1984:Q1<br />

1993<br />

1988:Q1<br />

1995<br />

1992:Q1<br />

Normal Range, Average=$25/bbl<br />

1997<br />

1996:Q1<br />

1999<br />

2000:Q1<br />

2001<br />

2003<br />

2004:Q1<br />

FORECAST<br />

cent of global oil consumption, excess<br />

capacity now measures less than 2%,<br />

well below the 6.6% average during<br />

1999-2002.<br />

The sharp decline in excess capacity<br />

would argue for a higher price for oil (as it<br />

would for any commodity or product/<br />

service). The last time excess capacity<br />

was as low as it currently is was in 1992,<br />

in the aftermath of the first Gulf War.<br />

When excess capacity recovered quickly<br />

in 1993, the average price of real WTI fell<br />

about US$4/barrel (in the absence of a<br />

noticeable change in the position of<br />

inventories during that period).<br />

It could be argued that a similar decline<br />

in the margin of spare capacity in 2004<br />

would result in an even larger increase in<br />

price, given expectations that it will be<br />

more difficult to build capacity now than it<br />

was to rebuild capacity in the early<br />

1990s. The current capacity squeeze<br />

could be placing upward pressure on<br />

prices in the neighbourhood of US$5/<br />

barrel. Thus, even in the absence of<br />

elevated supply risks, market conditions<br />

would be consistent with a price of WTI<br />

of $35/barrel (the ‘normal’ price of $25/<br />

barrel plus $5/barrel to reflect belowaverage<br />

crude inventories, and a further<br />

$5/barrel due to tight capacity margins).<br />

40<br />

30<br />

20<br />

10<br />

1998:Q1<br />

1999:Q1<br />

2000:Q1<br />

2001:Q1<br />

2002:Q1<br />

2003:Q1<br />

2004:Q1<br />

<strong>2005</strong>:Q1<br />

2006:Q1<br />

Supply risks are behind high oil prices<br />

In addition to the fact that excess<br />

capacity has significantly declined, there<br />

is now a much higher likelihood that<br />

excess capacity will be required. During<br />

the past year, the risk of terrorist strikes<br />

against oil infrastructure in the Middle<br />

East has not only risen abruptly, there<br />

have actually been several incidents.<br />

Additionally, social and political unrest in<br />

Venezuela and Nigeria have raised the<br />

potential for lost oil exports from those<br />

countries. The ongoing Yukos affair in