BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

BMO Financial Group - Outlook 2005(1.1Mb pdf File) - Boardwalk REIT

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

7<br />

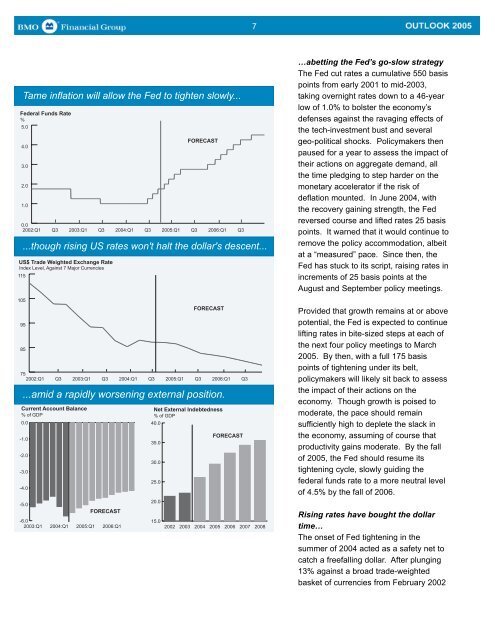

Tame inflation will allow the Fed to tighten slowly...<br />

Federal Funds Rate<br />

%<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

2002:Q1<br />

...though rising US rates won't halt the dollar's descent...<br />

US$ Trade Weighted Exchange Rate<br />

Index Level, Against 7 Major Currencies<br />

115<br />

Q3<br />

2003:Q1<br />

Q3<br />

2004:Q1<br />

Q3<br />

<strong>2005</strong>:Q1<br />

FORECAST<br />

Q3<br />

2006:Q1<br />

Q3<br />

…abetting the Fed’s go-slow strategy<br />

The Fed cut rates a cumulative 550 basis<br />

points from early 2001 to mid-2003,<br />

taking overnight rates down to a 46-year<br />

low of 1.0% to bolster the economy’s<br />

defenses against the ravaging effects of<br />

the tech-investment bust and several<br />

geo-political shocks. Policymakers then<br />

paused for a year to assess the impact of<br />

their actions on aggregate demand, all<br />

the time pledging to step harder on the<br />

monetary accelerator if the risk of<br />

deflation mounted. In June 2004, with<br />

the recovery gaining strength, the Fed<br />

reversed course and lifted rates 25 basis<br />

points. It warned that it would continue to<br />

remove the policy accommodation, albeit<br />

at a “measured” pace. Since then, the<br />

Fed has stuck to its script, raising rates in<br />

increments of 25 basis points at the<br />

August and September policy meetings.<br />

105<br />

95<br />

85<br />

75<br />

2002:Q1<br />

Q3<br />

2003:Q1<br />

Q3<br />

2004:Q1<br />

<strong>2005</strong>:Q1<br />

2006:Q1<br />

...amid a rapidly worsening external position.<br />

Current Account Balance<br />

% of GDP<br />

0.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

-4.0<br />

-5.0<br />

-6.0<br />

2003:Q1<br />

2004:Q1<br />

<strong>2005</strong>:Q1<br />

FORECAST<br />

2006:Q1<br />

Q3<br />

FORECAST<br />

Q3<br />

Net External Indebtedness<br />

% of GDP<br />

40.0<br />

35.0<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

2002<br />

2003<br />

2004<br />

FORECAST<br />

<strong>2005</strong><br />

2006<br />

Q3<br />

2007<br />

2008<br />

Provided that growth remains at or above<br />

potential, the Fed is expected to continue<br />

lifting rates in bite-sized steps at each of<br />

the next four policy meetings to March<br />

<strong>2005</strong>. By then, with a full 175 basis<br />

points of tightening under its belt,<br />

policymakers will likely sit back to assess<br />

the impact of their actions on the<br />

economy. Though growth is poised to<br />

moderate, the pace should remain<br />

sufficiently high to deplete the slack in<br />

the economy, assuming of course that<br />

productivity gains moderate. By the fall<br />

of <strong>2005</strong>, the Fed should resume its<br />

tightening cycle, slowly guiding the<br />

federal funds rate to a more neutral level<br />

of 4.5% by the fall of 2006.<br />

Rising rates have bought the dollar<br />

time…<br />

The onset of Fed tightening in the<br />

summer of 2004 acted as a safety net to<br />

catch a freefalling dollar. After plunging<br />

13% against a broad trade-weighted<br />

basket of currencies from February 2002