Annual Report - Raiffeisen Bank Kosovo JSC

Annual Report - Raiffeisen Bank Kosovo JSC

Annual Report - Raiffeisen Bank Kosovo JSC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements<br />

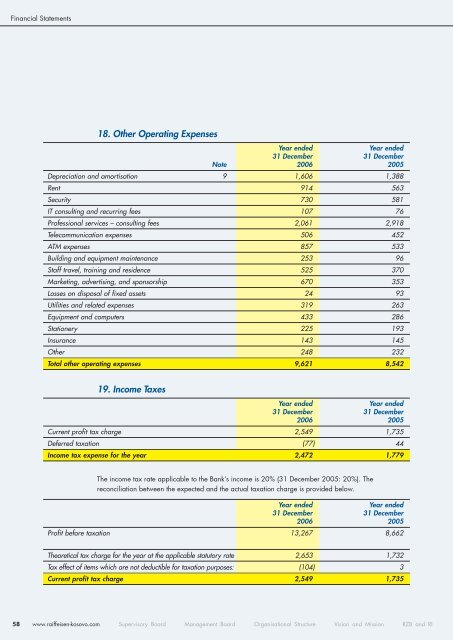

18. Other Operating Expenses<br />

Year ended<br />

Year ended<br />

31 December 31 December<br />

Note 2006 2005<br />

Depreciation and amortisation 9 1,606 1,388<br />

Rent 914 563<br />

Security 730 581<br />

IT consulting and recurring fees 107 76<br />

Professional services – consulting fees 2,061 2,918<br />

Telecommunication expenses 506 452<br />

ATM expenses 857 533<br />

Building and equipment maintenance 253 96<br />

Staff travel, training and residence 525 370<br />

Marketing, advertising, and sponsorship 670 353<br />

Losses on disposal of fixed assets 24 93<br />

Utilities and related expenses 319 263<br />

Equipment and computers 433 286<br />

Stationery 225 193<br />

Insurance 143 145<br />

Other 248 232<br />

Total other operating expenses 9,621 8,542<br />

19. Income Taxes<br />

Year ended<br />

Year ended<br />

31 December 31 December<br />

2006 2005<br />

Current profit tax charge 2,549 1,735<br />

Deferred taxation (77) 44<br />

Income tax expense for the year 2,472 1,779<br />

The income tax rate applicable to the <strong>Bank</strong>’s income is 20% (31 December 2005: 20%). The<br />

reconciliation between the expected and the actual taxation charge is provided below.<br />

Year ended<br />

Year ended<br />

31 December 31 December<br />

2006 2005<br />

Profit before taxation 13,267 8,662<br />

Theoretical tax charge for the year at the applicable statutory rate 2,653 1,732<br />

Tax effect of items which are not deductible for taxation purposes: (104) 3<br />

Current profit tax charge 2,549 1,735<br />

58<br />

www.raiffeisen-kosovo.com Supervisory Board Management Board Organisational Structure Vision and Mission RZB and RI .