ARTI Egitto definitivo - ARTI Puglia

ARTI Egitto definitivo - ARTI Puglia

ARTI Egitto definitivo - ARTI Puglia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

and private debt owed to non-residents repayable in foreign currency, goods, or services is<br />

estimated at US$29,898 million at the end of FY 2007.<br />

One major Egyptian success grew out of a provision in U.S. trade law designed to promote<br />

Arab-Israeli reconciliation. In 2004, the U.S. approved plans for Egypt to export to the USA<br />

products made in special export zones. So long as the goods derived at least 11.7% of their<br />

value from Israeli inputs, they could enter the USA duty-free. Annual sales and workforce<br />

of related companies nearly doubled.<br />

1.8. Public Finances<br />

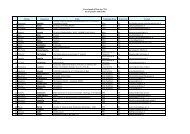

On the revenues side, total revenues of the government were EGP 78.32 bn (€ 14.17 bn)in<br />

FY2002 and are projected to reach EGP184.7bn (€ 22.9 bn)in FY2008. Much of the increase<br />

came from a rise in tax revenues, particularly personal income and corporate taxes which<br />

constituted the bulk of total domestic taxes, due to recent tax reforms. This trend is likely<br />

to gradually widen the tax base in the forthcoming years. Revenues, however, have<br />

remained more or less constant (about 21%)as a percentage of the GDP over the past few<br />

years.<br />

On the expenditures side, strong expenditure growth has remained a main feature of the<br />

budget. This is mainly a result of continued strong expansion of (1) the public-sector wages<br />

driven by government pledges. Wages and Compensations increased from EGP30.5 bn (€<br />

7.02 bn) in FY2002 to EGP59.6 bn (€ 7.39 bn)in FY2008; (2) high interest payments on the<br />

public debt stock. Interest payments rose from EGP21.8 bn (€ 5 bn)in FY2002 to EGP52.0<br />

bn (€ 6.45 bn)in FY2008. Importantly, dramatic increase in domestic debt which is<br />

projected to be roughly 62% of GDP in FY2008 up from 58.4% in FY2002; and (3) the costs<br />

of food and energy subsidies, which rose from EGP18.0 bn (€ 4.15 bn)in FY2002 to<br />

EGP64.5 bn (€ 8 bn)in FY2008.<br />

The overall deficit, after adjusting for net acquisition of financial assets, remains almost<br />

unchanged from the cash deficit. The budget’s overall deficit of EGP 43.8 bn (€ 10.07 bn)or<br />

-10.2% of GDP for FY2002 has become 49.2 bn (€ 6.35 bn)in FY2007, so that is narrowed<br />

to -6.7% of GDP. Deficit is financed largely by domestic borrowing and revenue from<br />

privatization sales, which became a standard accounting practice in budget Egypt. The<br />

government aims at more sales of assets in FY2008.<br />

1.9. Exchange Rate policy<br />

The exchange rate policy is linked to US Dollar. With the turn of the new millennium, Egypt<br />

introduced a managed float regime and successfully unified the Pound exchange rate vis-àvis<br />

foreign currencies. Currency black markets do not exist anymore.The transition to the<br />

unified exchange rate regime was completed in December 2004. Shortly later, Egypt has<br />

notified the International Monetary Fund (IMF) that it has accepted the obligations of Article<br />

VIII, Section 2, 3, and 4 of the IMF Articles of Agreement, with effect from January 2, 2005.<br />

IMF members accepting the obligations of Article VIII undertake to refrain from imposing<br />

restrictions on the making of payments and transfers for current international transactions,<br />

or from engaging in discriminatory currency arrangements or multiple currency practices,<br />

20<br />

THE RESEARCH AND INNOVATION SYSTEM IN EGYPT