The Basque Country (pdf, 4,3Mb) - Kultura Saila - Euskadi.net

The Basque Country (pdf, 4,3Mb) - Kultura Saila - Euskadi.net

The Basque Country (pdf, 4,3Mb) - Kultura Saila - Euskadi.net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

28<br />

Over the coming years, a large part<br />

of <strong>Basque</strong> Government investment<br />

will go toward promoting innovation<br />

as a stimulus to economic growth.<br />

Seed-bed for enterprise launched by<br />

the public development agency SPRI<br />

in the former ceramics factory of<br />

Laudio (Alava-Araba).<br />

<strong>The</strong> different types of tax are:<br />

• Direct taxes. Taxes on personal income. <strong>The</strong>se taxes are<br />

progressive (persons earning more income bear a greater tax<br />

burden) and are levied on:<br />

-Salary: Income Tax<br />

-Business profits: Corporation Tax<br />

-Wealth: property, stocks<br />

-Inheritances and donations<br />

• Indirect taxes. Taxes imposed on consumer products, sales<br />

and foreign trade.<br />

VAT and Special Taxes are co-ordinated for all European Union<br />

countries.<br />

No matter what the amount of taxes collected – regardless of the<br />

state of the <strong>Basque</strong> economy and assuming the risk of negative<br />

periods such as the 1980s – <strong>Euskadi</strong> must deliver a share or<br />

quota (Cupo) to cover general expenses which are the exclusive<br />

competence of the central government (international relations,<br />

defence, customs, general transportation, etc.) and which have<br />

not been devolved to <strong>Euskadi</strong>.<br />

Since 1981 <strong>Euskadi</strong>ʼs share is calculated at 6.24% of the annual<br />

General State Budget.<br />

After deducting the quota, the remaining income is split 70/30<br />

between the <strong>Basque</strong> Government and the Provincial Councils. In<br />

turn, the Provincial Councils earmark 50% of the amount received<br />

to finance the local councils.<br />

<strong>The</strong> <strong>Basque</strong> Government budget in 2007 was 8.740 million<br />

euros.<br />

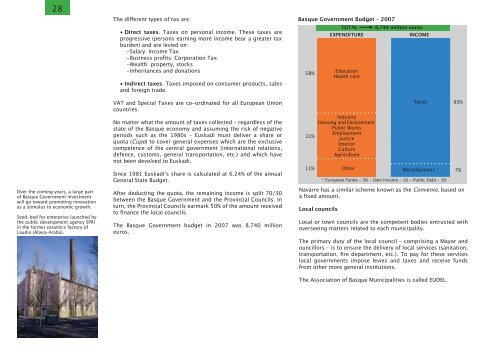

<strong>Basque</strong> Government Budget – 2007<br />

TOTAL 8,740 million euros<br />

EXPENDITURE<br />

INCOME<br />

58%<br />

31%<br />

Navarre has a similar scheme known as the Convenio, based on<br />

a fixed amount.<br />

Local councils<br />

Education<br />

Health care<br />

Industry<br />

Housing and Environment<br />

Public Works<br />

Employment<br />

Justice<br />

Interior<br />

Culture<br />

Agriculture<br />

Taxes<br />

11% Other Miscellaneous * 7%<br />

* European Funds – 3% - Own Income – 1% - Public Debt – 3%<br />

Local or town councils are the competent bodies entrusted with<br />

overseeing matters related to each municipality.<br />

<strong>The</strong> primary duty of the local council – comprising a Mayor and<br />

ouncillors – is to ensure the delivery of local services (sanitation,<br />

transportation, fire department, etc.). To pay for these services<br />

local governments impose levies and taxes and receive funds<br />

from other more general institutions.<br />

<strong>The</strong> Association of <strong>Basque</strong> Municipalities is called EUDEL.<br />

93%