2010-2011 Catalog: PDF Format - The Citadel

2010-2011 Catalog: PDF Format - The Citadel

2010-2011 Catalog: PDF Format - The Citadel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10<br />

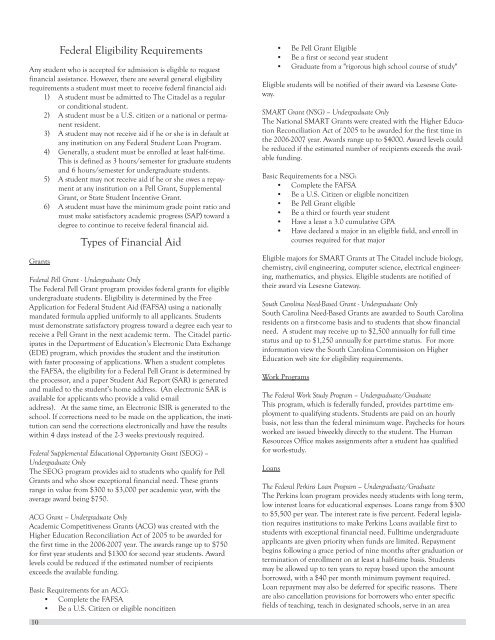

Federal Eligibility Requirements<br />

Any student who is accepted for admission is eligible to request<br />

financial assistance. However, there are several general eligibility<br />

requirements a student must meet to receive federal financial aid:<br />

1) A student must be admitted to <strong>The</strong> <strong>Citadel</strong> as a regular<br />

or conditional student.<br />

2) A student must be a U.S. citizen or a national or permanent<br />

resident.<br />

3) A student may not receive aid if he or she is in default at<br />

any institution on any Federal Student Loan Program.<br />

4) Generally, a student must be enrolled at least half-time.<br />

This is defined as 3 hours/semester for graduate students<br />

and 6 hours/semester for undergraduate students.<br />

5) A student may not receive aid if he or she owes a repayment<br />

at any institution on a Pell Grant, Supplemental<br />

Grant, or State Student Incentive Grant.<br />

6) A student must have the minimum grade point ratio and<br />

must make satisfactory academic progress (SAP) toward a<br />

degree to continue to receive federal financial aid.<br />

Grants<br />

Types of Financial Aid<br />

Federal Pell Grant - Undergraduate Only<br />

<strong>The</strong> Federal Pell Grant program provides federal grants for eligible<br />

undergraduate students. Eligibility is determined by the Free<br />

Application for Federal Student Aid (FAFSA) using a nationally<br />

mandated formula applied uniformly to all applicants. Students<br />

must demonstrate satisfactory progress toward a degree each year to<br />

receive a Pell Grant in the next academic term. <strong>The</strong> <strong>Citadel</strong> participates<br />

in the Department of Education’s Electronic Data Exchange<br />

(EDE) program, which provides the student and the institution<br />

with faster processing of applications. When a student completes<br />

the FAFSA, the eligibility for a Federal Pell Grant is determined by<br />

the processor, and a paper Student Aid Report (SAR) is generated<br />

and mailed to the student’s home address. (An electronic SAR is<br />

available for applicants who provide a valid e-mail<br />

address). At the same time, an Electronic ISIR is generated to the<br />

school. If corrections need to be made on the application, the institution<br />

can send the corrections electronically and have the results<br />

within 4 days instead of the 2-3 weeks previously required.<br />

Federal Supplemental Educational Opportunity Grant (SEOG) –<br />

Undergraduate Only<br />

<strong>The</strong> SEOG program provides aid to students who qualify for Pell<br />

Grants and who show exceptional financial need. <strong>The</strong>se grants<br />

range in value from $300 to $3,000 per academic year, with the<br />

average award being $750.<br />

ACG Grant – Undergraduate Only<br />

Academic Competitiveness Grants (ACG) was created with the<br />

Higher Education Reconciliation Act of 2005 to be awarded for<br />

the first time in the 2006-2007 year. <strong>The</strong> awards range up to $750<br />

for first year students and $1300 for second year students. Award<br />

levels could be reduced if the estimated number of recipients<br />

exceeds the available funding.<br />

Basic Requirements for an ACG:<br />

• Complete the FAFSA<br />

• Be a U.S. Citizen or eligible noncitizen<br />

• Be Pell Grant Eligible<br />

• Be a first or second year student<br />

• Graduate from a "rigorous high school course of study"<br />

Eligible students will be notified of their award via Lesesne Gateway.<br />

SMART Grant (NSG) – Undergraduate Only<br />

<strong>The</strong> National SMART Grants were created with the Higher Education<br />

Reconciliation Act of 2005 to be awarded for the first time in<br />

the 2006-2007 year. Awards range up to $4000. Award levels could<br />

be reduced if the estimated number of recipients exceeds the available<br />

funding.<br />

Basic Requirements for a NSG:<br />

• Complete the FAFSA<br />

• Be a U.S. Citizen or eligible noncitizen<br />

• Be Pell Grant eligible<br />

• Be a third or fourth year student<br />

• Have a least a 3.0 cumulative GPA<br />

• Have declared a major in an eligible field, and enroll in<br />

courses required for that major<br />

Eligible majors for SMART Grants at <strong>The</strong> <strong>Citadel</strong> include biology,<br />

chemistry, civil engineering, computer science, electrical engineering,<br />

mathematics, and physics. Eligible students are notified of<br />

their award via Lesesne Gateway.<br />

South Carolina Need-Based Grant - Undergraduate Only<br />

South Carolina Need-Based Grants are awarded to South Carolina<br />

residents on a first-come basis and to students that show financial<br />

need. A student may receive up to $2,500 annually for full time<br />

status and up to $1,250 annually for part-time status. For more<br />

information view the South Carolina Commission on Higher<br />

Education web site for eligibility requirements.<br />

Work Programs<br />

<strong>The</strong> Federal Work Study Program – Undergraduate/Graduate<br />

This program, which is federally funded, provides part-time employment<br />

to qualifying students. Students are paid on an hourly<br />

basis, not less than the federal minimum wage. Paychecks for hours<br />

worked are issued biweekly directly to the student. <strong>The</strong> Human<br />

Resources Office makes assignments after a student has qualified<br />

for work-study.<br />

Loans<br />

<strong>The</strong> Federal Perkins Loan Program – Undergraduate/Graduate<br />

<strong>The</strong> Perkins loan program provides needy students with long term,<br />

low interest loans for educational expenses. Loans range from $300<br />

to $5,500 per year. <strong>The</strong> interest rate is five percent. Federal legislation<br />

requires institutions to make Perkins Loans available first to<br />

students with exceptional financial need. Fulltime undergraduate<br />

applicants are given priority when funds are limited. Repayment<br />

begins following a grace period of nine months after graduation or<br />

termination of enrollment on at least a half-time basis. Students<br />

may be allowed up to ten years to repay based upon the amount<br />

borrowed, with a $40 per month minimum payment required.<br />

Loan repayment may also be deferred for specific reasons. <strong>The</strong>re<br />

are also cancellation provisions for borrowers who enter specific<br />

fields of teaching, teach in designated schools, serve in an area