Annual Report 2010 - CDON Group

Annual Report 2010 - CDON Group

Annual Report 2010 - CDON Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

76 <strong>CDON</strong> <strong>Group</strong> AB<br />

<strong>Annual</strong> report <strong>2010</strong><br />

<strong>CDON</strong> <strong>Group</strong> AB<br />

<strong>Annual</strong> report <strong>2010</strong><br />

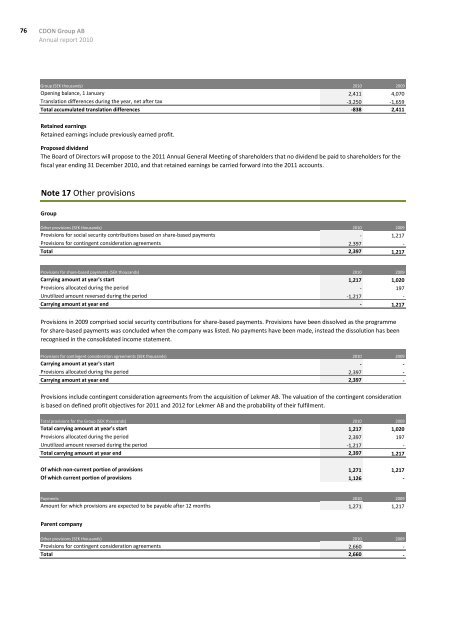

<strong>Group</strong> (SEK thousands) <strong>2010</strong> 2009<br />

Opening balance, 1 January 2,411 4,070<br />

Translation differences during the year, net after tax -3,250 -1,659<br />

Total accumulated translation differences -838 2,411<br />

Retained earnings<br />

Retained earnings include previously earned profit.<br />

Proposed dividend<br />

The Board of Directors will propose to the 2011 <strong>Annual</strong> General Meeting of shareholders that no dividend be paid to shareholders for the<br />

fiscal year ending 31 December <strong>2010</strong>, and that retained earnings be carried forward into the 2011 accounts.<br />

Note 17 Other provisions<br />

<strong>Group</strong><br />

Other provisions (SEK thousands) <strong>2010</strong> 2009<br />

Provisions for social security contributions based on share-based payments - 1,217<br />

Provisions for contingent consideration agreements 2,397 -<br />

Total 2,397 1,217<br />

Provisions for share-based payments (SEK thousands) <strong>2010</strong> 2009<br />

Carrying amount at year's start 1,217 1,020<br />

Provisions allocated during the period - 197<br />

Unutilized amount reversed during the period -1,217 -<br />

Carrying amount at year end - 1,217<br />

Provisions in 2009 comprised social security contributions for share-based payments. Provisions have been dissolved as the programme<br />

for share-based payments was concluded when the company was listed. No payments have been made, instead the dissolution has been<br />

recognised in the consolidated income statement.<br />

Provisions for contingent consideration agreements (SEK thousands) <strong>2010</strong> 2009<br />

Carrying amount at year's start - -<br />

Provisions allocated during the period 2,397 -<br />

Carrying amount at year end 2,397 -<br />

Provisions include contingent consideration agreements from the acquisition of Lekmer AB. The valuation of the contingent consideration<br />

is based on defined profit objectives for 2011 and 2012 for Lekmer AB and the probability of their fulfilment.<br />

Total provisions for the <strong>Group</strong> (SEK thousands) <strong>2010</strong> 2009<br />

Total carrying amount at year's start 1,217 1,020<br />

Provisions allocated during the period 2,397 197<br />

Unutilized amount reversed during the period -1,217 -<br />

Total carrying amount at year end 2,397 1,217<br />

Of which non-current portion of provisions 1,271 1,217<br />

Of which current portion of provisions 1,126 -<br />

Payments <strong>2010</strong> 2009<br />

Amount for which provisions are expected to be payable after 12 months 1,271 1,217<br />

Parent company<br />

Other provisions (SEK thousands) <strong>2010</strong> 2009<br />

Provisions for contingent consideration agreements 2,660 -<br />

Total 2,660 -