Annual Report 2010 - CDON Group

Annual Report 2010 - CDON Group

Annual Report 2010 - CDON Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CDON</strong> <strong>Group</strong> AB<br />

<strong>Annual</strong> report <strong>2010</strong><br />

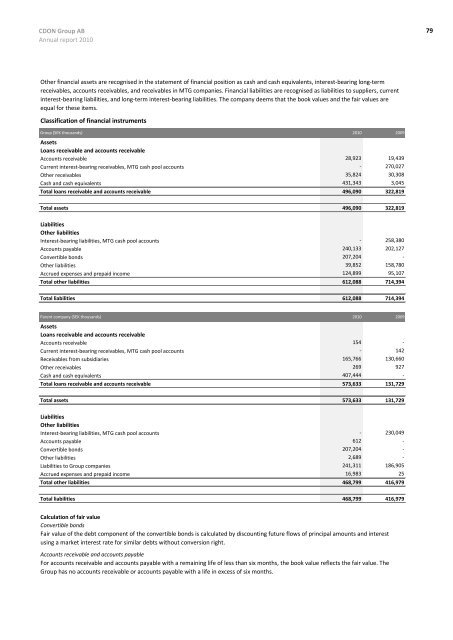

Other financial assets are recognised in the statement of financial position as cash and cash equivalents, interest-bearing long-term<br />

receivables, accounts receivables, and receivables in MTG companies. Financial liabilities are recognised as liabilities to suppliers, current<br />

interest-bearing liabilities, and long-term interest-bearing liabilities. The company deems that the book values and the fair values are<br />

equal for these items.<br />

Classification of financial instruments<br />

<strong>Group</strong> (SEK thousands)<br />

Assets<br />

Loans receivable and accounts receivable<br />

<strong>2010</strong> 2009<br />

Accounts receivable 28,923 19,439<br />

Current interest-bearing receivables, MTG cash pool accounts - 270,027<br />

Other receivables 35,824 30,308<br />

Cash and cash equivalents 431,343 3,045<br />

Total loans receivable and accounts receivable 496,090 322,819<br />

Total assets 496,090 322,819<br />

Liabilities<br />

Other liabilities<br />

Interest-bearing liabilities, MTG cash pool accounts - 258,380<br />

Accounts payable 240,133 202,127<br />

Convertible bonds 207,204 -<br />

Other liabilities 39,852 158,780<br />

Accrued expenses and prepaid income 124,899 95,107<br />

Total other liabilities 612,088 714,394<br />

Total liabilities 612,088 714,394<br />

Parent company (SEK thousands)<br />

Assets<br />

Loans receivable and accounts receivable<br />

<strong>2010</strong> 2009<br />

Accounts receivable 154 -<br />

Current interest-bearing receivables, MTG cash pool accounts - 142<br />

Receivables from subsidiaries 165,766 130,660<br />

Other receivables 269 927<br />

Cash and cash equivalents 407,444 -<br />

Total loans receivable and accounts receivable 573,633 131,729<br />

Total assets 573,633 131,729<br />

Liabilities<br />

Other liabilities<br />

Interest-bearing liabilities, MTG cash pool accounts - 230,049<br />

Accounts payable 612 -<br />

Convertible bonds 207,204 -<br />

Other liabilities 2,689 -<br />

Liabilities to <strong>Group</strong> companies 241,311 186,905<br />

Accrued expenses and prepaid income 16,983 25<br />

Total other liabilities 468,799 416,979<br />

Total liabilities 468,799 416,979<br />

Calculation of fair value<br />

Convertible bonds<br />

Fair value of the debt component of the convertible bonds is calculated by discounting future flows of principal amounts and interest<br />

using a market interest rate for similar debts without conversion right.<br />

Accounts receivable and accounts payable<br />

For accounts receivable and accounts payable with a remaining life of less than six months, the book value reflects the fair value. The<br />

<strong>Group</strong> has no accounts receivable or accounts payable with a life in excess of six months.<br />

79