Annual Report 2010 - CDON Group

Annual Report 2010 - CDON Group

Annual Report 2010 - CDON Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6 <strong>CDON</strong> <strong>Group</strong> AB AB<br />

<strong>Annual</strong> report <strong>2010</strong><br />

Årsredovisning <strong>CDON</strong> <strong>Group</strong> AB <strong>2010</strong><br />

Årsredovisning <strong>2010</strong><br />

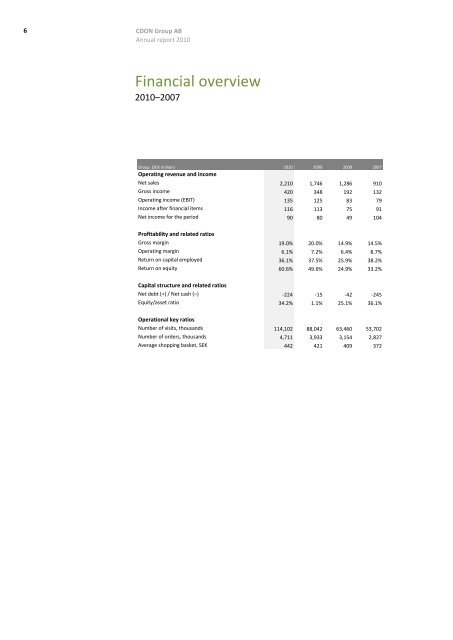

Financial overview<br />

Financial overview<br />

<strong>2010</strong>–2007<br />

<strong>2010</strong>–2007<br />

<strong>Group</strong> (SEK million) <strong>2010</strong> 2009 2008 2007<br />

Operating revenue and income<br />

<strong>Group</strong> (SEK million)<br />

Net sales<br />

Operating revenue and income<br />

Gross income<br />

Net sales<br />

Operating income (EBIT)<br />

Gross income<br />

Income after financial items<br />

Operating income (EBIT)<br />

Net income for the period<br />

Income after financial items<br />

<strong>2010</strong><br />

2,210<br />

420<br />

2,210<br />

135<br />

420<br />

116<br />

135<br />

90<br />

116<br />

2009<br />

1,746<br />

348<br />

1,746<br />

125<br />

348<br />

113<br />

125<br />

80<br />

113<br />

2008<br />

1,286<br />

192<br />

1,286<br />

83<br />

192<br />

75<br />

83<br />

49<br />

75<br />

2007<br />

910<br />

132<br />

910<br />

79<br />

132<br />

91<br />

79<br />

104<br />

91<br />

Net income for the period<br />

Profitability and related ratios<br />

90 80 49 104<br />

Gross margin<br />

Profitability and related ratios<br />

Operating margin<br />

Gross margin<br />

Return on capital employed<br />

Operating margin<br />

Return on equity<br />

Return on capital employed<br />

19.0%<br />

6.1%<br />

19.0%<br />

36.1%<br />

6.1%<br />

60.6%<br />

36.1%<br />

20.0%<br />

7.2%<br />

20.0%<br />

37.5%<br />

7.2%<br />

49.6%<br />

37.5%<br />

14.9%<br />

6.4%<br />

14.9%<br />

25.9%<br />

6.4%<br />

24.9%<br />

25.9%<br />

14.5%<br />

8.7%<br />

14.5%<br />

38.2%<br />

8.7%<br />

33.2%<br />

38.2%<br />

Return on equity<br />

Capital structure and related ratios<br />

60.6% 49.6% 24.9% 33.2%<br />

Net debt (+) / Net cash (–)<br />

Capital structure and related ratios<br />

Equity/asset ratio<br />

Net debt (+) / Net cash (–)<br />

-224<br />

34.2%<br />

-224<br />

-15<br />

1.1%<br />

-15<br />

-42<br />

25.1%<br />

-42<br />

-245<br />

36.1%<br />

-245<br />

Equity/asset ratio<br />

Operational key ratios<br />

34.2% 1.1% 25.1% 36.1%<br />

Number of visits, thousands<br />

Operational key ratios<br />

Number of orders, thousands<br />

Number of visits, thousands<br />

Average shopping basket, SEK<br />

Number of orders, thousands<br />

114,102<br />

4,711<br />

114,102<br />

442<br />

4,711<br />

88,042<br />

3,933<br />

88,042<br />

421<br />

3,933<br />

63,460<br />

3,154<br />

63,460<br />

409<br />

3,154<br />

53,702<br />

2,827<br />

53,702<br />

372<br />

2,827<br />

Average shopping basket, SEK 442 421 409 372