Free to Download - SCLG

Free to Download - SCLG

Free to Download - SCLG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EDITOR’S NOTE<br />

EDITORIAL<br />

Group Managing Edi<strong>to</strong>r<br />

Vigyan Arya<br />

vigyan@groupinfinity.com<br />

Edi<strong>to</strong>r<br />

Patrick Francis<br />

patrick@groupinfinity.com<br />

Contributing Edi<strong>to</strong>rs<br />

Priya Kumar<br />

Eric Francis<br />

Savio Pimenta<br />

Saida Samai<br />

Edi<strong>to</strong>rial Assistant<br />

Jessel Tan<br />

ART / PRODUCTION<br />

Aslam A.K<br />

Boban K.V<br />

Pho<strong>to</strong>grapher<br />

Amaresh<br />

Advertising & Marketing<br />

sales@groupinfinity.com<br />

COVER<br />

Issue 5 Vol 8 April 2010<br />

The Link is the official publication<br />

of <strong>SCLG</strong>ME. The opinions<br />

and views contained in this<br />

publication are not necessarily<br />

those of the <strong>SCLG</strong>ME as<br />

publishers. Readers are advised<br />

<strong>to</strong> seek special advice before<br />

acting on information contained<br />

in this publication, which is for<br />

general use and may not be<br />

appropriate for the reader’s<br />

particular circumstances. No part<br />

of this publication or any part<br />

of its contents thereof may be<br />

reproduced in any form without<br />

the permission of the publishers<br />

in writing.<br />

EDITORIAL PRODUCTION<br />

AND CONTENT PROVIDER<br />

Group Infinity FZC;<br />

P.O. Box 9733, Sharjah;<br />

United Arab Emirates<br />

Ph: 06-5571646; Fax: 06-5571656<br />

Email: link@groupinfinity.com<br />

Supplying the Vital Link<br />

The supply chain forms the spine of every economy and for<br />

a place like the Emirates – the trader’s paradise -- the supply<br />

chain and logistics are an essential nerve system running up<br />

the spine of the economy.<br />

Our publication, The Link, is the ear and eyes of the Supply<br />

Chain and Logistics Middle East (<strong>SCLG</strong>ME), which is arriving<br />

<strong>to</strong> you in a revamped shape with a more diversified edi<strong>to</strong>rial<br />

coverage of the industry and its complementary tributaries.<br />

With the intention of linking the industry and its<br />

prominent members in a string of information and functional<br />

communication, The Link, in its new format is an essential <strong>to</strong>ol<br />

and a mouth piece for the industry.<br />

Under the guidance of the members of the board of<br />

<strong>SCLG</strong>ME, The Link intends <strong>to</strong> gather the momentum of every<br />

member of the organization and offer a platform for all <strong>to</strong> voice<br />

their point of views and matters of concern. With a dedicated<br />

and guaranteed target audience, its commercial viability and<br />

reach is extremely affective and offers very productive response<br />

<strong>to</strong> all the advertisers in the publication.<br />

Our dedicated team of edi<strong>to</strong>rial, with a network covering the<br />

entire Middle East and beyond will bring <strong>to</strong> you the latest from<br />

the world of supply chain and logistics, that’s beyond borders<br />

and across all the oceans.<br />

Our visual approach of presentation is intended <strong>to</strong> offer<br />

illustrative spread <strong>to</strong> our edi<strong>to</strong>rial and hope <strong>to</strong> maintain a proactive<br />

interaction with all our readers, members of the <strong>SCLG</strong>ME<br />

and its board members for the purpose of continuously<br />

improving The Link and make it a global standard <strong>to</strong>ol for the<br />

establishment <strong>to</strong> communicate with industry representatives<br />

beyond all borders.<br />

Patrick Francis<br />

Patrick Francis<br />

Edi<strong>to</strong>r<br />

4 Link May 2010

INSIDE<br />

Contents<br />

COVER STORY<br />

16<br />

22<br />

TRANSPORTATION<br />

Transport 2010: Middle East’s<br />

Railway revival<br />

Countries across the region are upgrading<br />

their rail transport systems but investment in<br />

roads is lacking<br />

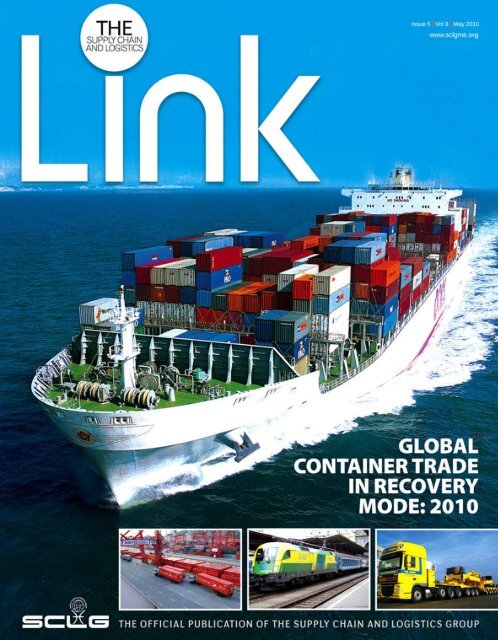

Global container trade in recovery mode: 2010<br />

Container trade is on a recovery path, led by res<strong>to</strong>cking in developed markets, even as the<br />

Middle East consolidates its position as a trans-shipment hub on the Asia-Europe trade<br />

26<br />

MANAGEMENT<br />

42<br />

28 OVERVIEW<br />

REAL REPORT<br />

UAE’s ambitious nation-wide<br />

rail network on anvil<br />

The UAE embarks on its first nation-wide<br />

1,500 km long freight and passenger rail<br />

Supply chain BPO in a<br />

consumer-driven world<br />

The fundamentals of supply chain remain<br />

unchanged since the inception of commerce<br />

Effective applications can<br />

save firms 30%<br />

Logistics and supply chain management<br />

companies can save up <strong>to</strong> 30 per cent<br />

of cost by using effective applications <strong>to</strong><br />

manage their systems<br />

REGULAR FEATURES<br />

10 GCC - NEWS<br />

New management system <strong>to</strong> ease<br />

logistics at AW Rostamani new<br />

warehouse<br />

34 INNER VIEW - DESTINATION<br />

DP World’s Djibouti Port stay unaffected by<br />

the debt woes of Dubai World and aims <strong>to</strong><br />

become main port in COMESA<br />

48 INTERNATIONAL - NEWS<br />

Japan Airlines will ground its freighter fleet<br />

after more than half a century of operations<br />

the loss making airline announced<br />

6 Link May 2010

<strong>SCLG</strong> INFO<br />

<strong>SCLG</strong> MEMBERSHIP<br />

Corporate Membership<br />

Membership with the Supply Chain and<br />

Logistics Group (<strong>SCLG</strong>) is open <strong>to</strong> all<br />

organisations. Corporate members may<br />

nominate four <strong>to</strong> six members, depending<br />

on the category of membership – basic,<br />

privileged or premier – they opt for. All<br />

nominated members shall be allowed <strong>to</strong><br />

vote at the Annual General Meeting (AGM)<br />

and at any Extraordinary General Meetings.<br />

The Board of Direc<strong>to</strong>rs (BoD) and Executive<br />

Committee (EC) members shall decide the<br />

annual fees for membership.<br />

Individual Membership<br />

This is open <strong>to</strong> any individual from any<br />

part of the world. The annual subscription<br />

shall be set from time-<strong>to</strong>-time as deemed<br />

necessary by the BoD and EC members.<br />

Student Membership<br />

Only full-time students can be <strong>SCLG</strong><br />

members, but this membership does not<br />

convey voting rights <strong>to</strong> the individual. The<br />

annual fee shall be set from time-<strong>to</strong>-time<br />

as deemed necessary by the BoD and EC<br />

members.<br />

Why be an <strong>SCLG</strong> Member<br />

A membership allows access <strong>to</strong> educational<br />

training, seminars and networking evenings<br />

at concessional and rebated rates. It<br />

also provides rebates on subscription<br />

of membership <strong>to</strong> <strong>SCLG</strong>’s international<br />

partners.<br />

There is also a certificate that<br />

distinguishes a member as a professionally<br />

focused individual or enterprise committed <strong>to</strong><br />

the cause of the supply chain and logistics<br />

industry.<br />

For more details, please visit our website<br />

on www.sclgme.org. If you wish <strong>to</strong> volunteer<br />

<strong>to</strong> help us foster a better supply chain and<br />

logistics community, please contact Kanchan<br />

Vora on admin@sclgme.org.<br />

The <strong>SCLG</strong> Middle East is a non-profit<br />

organization working under the umbrella<br />

of the Dubai Chamber of Commerce<br />

and Industry <strong>to</strong> promote the cause of the<br />

supply chain and logistics industry. It brings<br />

opportunities for personal and professional<br />

development through networking prospects<br />

GLOBAL THOUGHT AND<br />

INDUSTRY LEADERS<br />

Shashi Shekhar<br />

Founder & Group President<br />

<strong>SCLG</strong>ME<br />

Mishal Hamed Kanoo<br />

Kanoo Group<br />

Mohammed Sharaf<br />

DP World<br />

Michael Proffitt<br />

Clifford Cuttelle<br />

Sanjay Naik<br />

Emirates Group<br />

Jinendra Sancheti<br />

TNT Express<br />

Fadi Ghandour<br />

Aramex<br />

Saadi Al Rais<br />

RHS Logistics<br />

David Wild<br />

Hamdi Osman<br />

FedEx<br />

Essa Al Saleh<br />

Agility<br />

among like-minded professionals and<br />

corporations on a global basis.<br />

The <strong>SCLG</strong> was founded with the help<br />

of senior management professionals<br />

representing a wide spectrum of<br />

industries in the supply chain. It strives<br />

<strong>to</strong> bring the best in education, seminars<br />

and interaction through partnerships and<br />

alliances with a variety of similar bodies<br />

across the globe.<br />

The group’s official magazine, The<br />

Supply Chain and Logistics Link, addresses<br />

the needs of the supply chain professionals<br />

in the Middle East. It presents news, views,<br />

developments and information drawn from<br />

industry experts.<br />

The first of its kind in the region, The Link<br />

aspires <strong>to</strong> be a benchmark for the industry<br />

community, offering valuable insights<br />

and information <strong>to</strong> the target market. The<br />

magazine’s articles and news features cover<br />

innovative supply chain practices, emerging<br />

technologies, e-commerce and market<br />

information from industry leaders.<br />

<strong>SCLG</strong>’S Mission<br />

The group aims <strong>to</strong> provide an accessible<br />

and dynamic networking environment that<br />

facilitates the achievements of its members<br />

in a community that encourages professional<br />

development and diversity in the logistics<br />

and supply chain management.<br />

<strong>SCLG</strong>’S Objectives<br />

¢ To promote the cause of the supply<br />

chain and logistics industry and raise the<br />

standards of all industries on end-<strong>to</strong>-end<br />

supply chain<br />

¢ To protect the interests of member<br />

organisations and support government<br />

bodies in the formulation of policy<br />

frameworks for logistics organisations.<br />

¢ To encourage the free exchange of<br />

knowledge and skills relating <strong>to</strong> supply chain<br />

and logistics among its members<br />

¢ To provide members the opportunity<br />

<strong>to</strong> network among one another and <strong>to</strong> help<br />

facilitate an efficient commercial environment<br />

¢ To undertake studies and gather<br />

information, statistical data and official<br />

documents relevant <strong>to</strong> the industry<br />

¢ To establish and maintain good relations<br />

with similar international organisations and<br />

other professional groups, and <strong>to</strong> provide<br />

members the opportunity <strong>to</strong> network with<br />

like-minded organisations<br />

¢ To conduct training courses, seminars,<br />

conferences and studies relating <strong>to</strong> logistics<br />

and supply chain and <strong>to</strong> establish a<br />

library and research centre <strong>to</strong> expand the<br />

knowledge base information on the industry<br />

¢ To promote the cause of education in<br />

supply chain and logistics among the UAE<br />

nationals, thereby contributing <strong>to</strong> build a<br />

cadre of professionals and highly-skilled<br />

citizens <strong>to</strong> take up current and future<br />

challenges in the industry.<br />

www.sclgme.org

<strong>SCLG</strong> INFO<br />

REGIONAL DEVELOPMENT<br />

COMMITTEE<br />

Dr. K. M. Madrecha<br />

Dubai World<br />

Dr. Ernst Schmied<br />

East Europe, CIS,<br />

Russia<br />

Madhav Kurup<br />

Hellman Worldwide<br />

Logistics<br />

Capt. Arup Gupta<br />

Sharaf Logistics<br />

INTERNATIONAL ADVISORS<br />

Dr. Dermot Carey<br />

Ireland<br />

Dr. Ernst Schmied<br />

Austria<br />

Dr. Dermot Carey<br />

UK & Ireland<br />

Nigel Moore<br />

Logistics Recruitment<br />

Khalid Bichou<br />

Morocco<br />

Usha Kaul<br />

University of Dubai<br />

Sanjay Babur<br />

Cosmos Insurance<br />

Alan Waller<br />

UK<br />

Ravi Kashyap<br />

Steinweg Sharaf<br />

Mark Millar<br />

Asia Pacific<br />

Dirk Van Doorn<br />

DHL<br />

CONSULTATIVE COMMITTEE<br />

Tim Sensenig<br />

USA<br />

Mark Millar<br />

Asia Pacific<br />

Dr. Dermot Carey<br />

UK & Ireland<br />

Paul Lim<br />

Singapore<br />

Johnson Soans<br />

Extron Electronics<br />

Reinhard Wind<br />

Dr. Craig Voortman<br />

South Africa<br />

Jassim Saif<br />

Emirates SkyCargo<br />

Dr. Cedwyn Fernandes<br />

University of Middlesex<br />

Prof Donald Tham<br />

Canada<br />

Pradeep Melakandy<br />

Pan-Pacific Logistics<br />

Michael S<strong>to</strong>ckdale<br />

Tom <strong>Free</strong>se<br />

USA<br />

Dave Tootle<br />

Southern Africa<br />

Mohsen Al Awadhi<br />

Dubai Logistics City<br />

Mahendra Agarwal<br />

Singapore<br />

Dany Vermeulen<br />

Australia & New Zealand<br />

Andreas Dur<br />

Xvise Logistics<br />

Vineet Agarwal<br />

India<br />

Tom Nauwelaerts<br />

Al-Futtaim Group<br />

John Halpin<br />

Dominique De Froberville<br />

Mauritius<br />

Melvin Varghese<br />

Transworld Group<br />

Dr. Ganesh Natrajan<br />

India<br />

Brian Forbes<br />

DHL Express<br />

Edward Sweeney<br />

Ireland<br />

BOARD OF DIRECTORS<br />

Stephen Cross<br />

ATMS<br />

Dimitriy Bulaenko<br />

Ukraine<br />

Tayssir Awada<br />

FedEx<br />

Roy Patterson<br />

UTi<br />

Naveen Arun<br />

Hemant Barke<br />

Prudence Insurance<br />

Brokers<br />

Igor Hribar<br />

Slovenia<br />

Dr. Tom Gulledge<br />

USA<br />

Geoff Wheatley<br />

SSI Schaefer (ME)<br />

Dr. Satish Mapara<br />

GlobeApex Management<br />

Consultants<br />

Soma Shekhar<br />

<strong>SCLG</strong> President<br />

TrackIT<br />

Sebastian Thomas<br />

Terry Lee<br />

Taiwan<br />

Tony Walford<br />

Switzerland<br />

www.sclgme.org

GCC<br />

News<br />

RMM Global FZCO at<br />

DAFZA a boon<br />

For most of the 1,450 companies at the<br />

Dubai Airport <strong>Free</strong>zone, tax free incentives<br />

such as no levying of company and personal<br />

income taxes are the major fac<strong>to</strong>rs in the<br />

decision for a multinational company <strong>to</strong> open<br />

a branch or regional office in the <strong>Free</strong>zone.<br />

DP World posts 8% decline<br />

in 2009 volumes<br />

Ports giant DP World has faced an 8% down in container volumes in 2009 as against the<br />

previous year earlier, due <strong>to</strong> the “challenging” conditions facing the global shipping industry.<br />

Excluding the performances of the new terminals that joined the network during the course<br />

of last year, volumes declined by 10 percent - an improvement on a drop of 13 percent in<br />

the first half. Across all 50 of DP World’s terminals, twenty-foot equivalent (TEU) volumes<br />

dropped by 6 percent during 2008, the company announced.<br />

Recall puts brakes<br />

on Toyota’s growth<br />

Toyota has had what might be perceived<br />

<strong>to</strong> be a nightmare start <strong>to</strong> the year with<br />

the issue of two recall notices affecting<br />

seven million vehicles globally across its<br />

model range built over the last five years.<br />

Alarmingly the concerns are over cars<br />

accelerating out of control which, thus<br />

resulting in accidents involving several<br />

fatalities in the last decade. Whilst the first<br />

recall issued a few months ago related <strong>to</strong><br />

floor mats riding up and catching under<br />

accelera<strong>to</strong>rs – which alone affected over<br />

four million vehicles, the latest relates <strong>to</strong> the<br />

pedal mechanism becoming sticky, causing<br />

it <strong>to</strong> stay depressed, or returning <strong>to</strong>o slowly<br />

<strong>to</strong> idle.<br />

“The company’s annual turnover in 2009<br />

<strong>to</strong>uched AED 62 million,” said Naim Zehil,<br />

Direc<strong>to</strong>r of RMM Global FZCO. “For RMM<br />

Global FZCO, a commodities trading, and<br />

logistics company Dubai’s strategic location<br />

between the Far East and European market,<br />

transparency, security, stability and probusiness<br />

policies of Dubai and<br />

the UAE’s visionary leadership were the<br />

main fac<strong>to</strong>rs in RMM Global’s decision<br />

<strong>to</strong> base their worldwide operations’ main<br />

office in Dubai from its earlier location in<br />

London,” he added.<br />

“In 2003 while scouting for a business<br />

location for our company, I <strong>to</strong>ld my partner<br />

that I would base the decision <strong>to</strong> shift based<br />

on the friendliness of the businessmen,<br />

inves<strong>to</strong>rs, business environment and<br />

cus<strong>to</strong>mer services,” Zehil said.<br />

This was a very positive indication of<br />

Dubai’s welcoming attitude for inves<strong>to</strong>rs<br />

and one of the fac<strong>to</strong>rs in my decision <strong>to</strong><br />

move <strong>to</strong> Dubai.” “As companies engaged in<br />

international commodities, trading partners<br />

in our main markets are Japan, Europe, US,<br />

Middle East, UAE and India. He added that<br />

in his business, his trading partners would<br />

look for the location of trading partners and<br />

would not look kindly <strong>to</strong> a company based in<br />

a country with in security, instability or follow<br />

laws not accepted in other major countries.<br />

10 Link May 2010

News<br />

GCC<br />

CEVA expands<br />

presence in Middle<br />

East with new<br />

warehouse<br />

CEVA Logistics, a leading global supply<br />

chain management company, <strong>to</strong>day<br />

announced that a new state of the art<br />

warehouse and office facility will be built<br />

in Jebel Ali <strong>Free</strong> Zone, Dubai, expanding<br />

CEVA’s presence in the Middle East.<br />

The new warehouse supports CEVA’s<br />

growth strategy in the Middle East, which<br />

is focused on increasing its cus<strong>to</strong>mer base,<br />

and through a truly integrated service, offer<br />

shared user and consolidated services<br />

<strong>to</strong> existing cus<strong>to</strong>mers <strong>to</strong> realize cost and<br />

operating efficiencies. The opening of this<br />

facility will enable the expansion of CEVA’s<br />

contract logistics capabilities in<br />

the region and goes a significant way<br />

<strong>to</strong>wards achieving an ambitious plan <strong>to</strong><br />

have 100,000 sqm of warehouse space by<br />

the end of this year.<br />

The new purpose built facility, scheduled<br />

for completion by the end of 2010, will<br />

incorporate the latest technology features<br />

and will be LEED (Leadership in Energy and<br />

Environmental Design) certified. The new<br />

warehouse is developed in collaboration<br />

with Gazeley, global developer of highly<br />

efficient, environmentally friendly logistics<br />

and industrial spaces and designed <strong>to</strong> meet<br />

the highest standards in environmental<br />

construction and efficiency. This is the<br />

second project CEVA with Gazeley have<br />

partnered on, beginning last year when<br />

CEVA leased a unique 12,000 sq m pyramid<br />

building in Dubai. This state of the art office<br />

and warehousing facility has a pyramidal<br />

structure <strong>to</strong> embody CEVA’s distinct brand<br />

and now acts as a central hub for all regional<br />

cus<strong>to</strong>mers, also serving as the Company’s<br />

Middle East headquarters.<br />

New import online system<br />

from TNT Express UAE<br />

TNT Express UAE launched its new Express Import system that gives cus<strong>to</strong>mers complete<br />

control over their import shipments. As a net importer serving as a hub for the region,<br />

cus<strong>to</strong>mers in the UAE will be able <strong>to</strong> use this new web based <strong>to</strong>ol <strong>to</strong> order the collection<br />

of import shipments with quotations and billing in their local currency <strong>to</strong> better control<br />

shipping costs. One unique feature of TNT’s Express Import system is the option <strong>to</strong> request<br />

a quotation before the booking is completed. “TNT Express aims <strong>to</strong> make importing easier<br />

for its cus<strong>to</strong>mers across the region,” Mark Woodcock, Sales and Commercial Direc<strong>to</strong>r, TNT<br />

Express UAE, announced when speaking <strong>to</strong> the media.<br />

Dubai records 30%<br />

pearl trade increase<br />

A <strong>to</strong>tal of AED99.6m ($27.12m) worth of<br />

pearls was transacted in Dubai in 2009,<br />

Dubai Pearl Exchange (DPE), a subsidiary<br />

of Dubai Multi Commodities Centre Authority<br />

(DMCCA), announced. According <strong>to</strong> statistics<br />

from Dubai World Statistics Department, the<br />

pearl trade rose from AED95m <strong>to</strong> AED99.6m<br />

last year, driven by a 30% increase in imports.<br />

The trend <strong>to</strong>wards high-quality pearls has<br />

increased significantly in Dubai, highlighting<br />

a shift in consumer preference <strong>to</strong>wards<br />

exclusive pearls, the DPE said in its press<br />

release. Consumption levels for pearls in<br />

Dubai have also increased over the last<br />

year, reflected through lower exports than<br />

the previous year. This increase was driven<br />

by substantial growth in the natural pearls<br />

segment, where volumes increased by 50%<br />

and values tripled, it added.<br />

May 2010 Link 11

GCC<br />

News<br />

Khalifa port<br />

operations <strong>to</strong> start<br />

in 2012<br />

The new Khalifa Port is expected <strong>to</strong> have a<br />

capacity of 15 million TEUs and 35 million<br />

<strong>to</strong>nnes of general cargo. The first phase<br />

of Abu Dhabi’s US$2.18 billion (Dh8bn)<br />

Khalifa Port will become operational in<br />

2012 and the emirate plans <strong>to</strong> develop<br />

smaller ports <strong>to</strong> cope with increasing<br />

traffic, according <strong>to</strong> a senior port official.<br />

The initial capacity of the new port is<br />

two million TEUs and eight million <strong>to</strong>nnes<br />

general cargo annually, nearly four times<br />

more than the current capacity of the<br />

largest existing port. “The Khalifa Port will<br />

be built in five phases. Phase one will be<br />

ready end 2012,” Mohamed Al Shamsi,<br />

Port Unit Vice-President, Khalifa Port &<br />

Industrial Zone (KPIZ) <strong>to</strong>ld the media.<br />

The KPIZ is also focusing on<br />

developing small ports around the<br />

emirate. At least four smaller ports are<br />

under development, including the Mina<br />

Mussafah. The approximately $408 million<br />

Mina Mussafah channel relocation project<br />

is expected <strong>to</strong> be completed by this June.<br />

“This port will service existing and<br />

future clients in the Mussafah industrial<br />

area and the nearby industrial zones,”<br />

Shamsi said, adding that the port would be<br />

transferred <strong>to</strong> Abu Dhabi Ports Company<br />

in July. The other ports being developed<br />

are the Shahama port, Ras Al Ghaf and<br />

Al Sadr. An upcoming aluminum smelter<br />

and other plants in sec<strong>to</strong>rs such as<br />

chemicals, glass and paper in the<br />

industrial zone will ensure steady traffic at<br />

the Khalifa port. “By 2030 when all phases<br />

of the port are completed, its capacity will<br />

be 15 million TEUs and 35 million <strong>to</strong>nnes<br />

of general cargo,” Al Shamsi added,<br />

thus contributing up <strong>to</strong> $22 billion of Abu<br />

Dhabi’s GDP in 2030.<br />

New management system<br />

<strong>to</strong> ease logistics at AW<br />

Rostamani new warehouse<br />

A W Rostamani Logistics, joint venture of<br />

AW Rostamani Holding in Dubai, Mitsui & Co<br />

and Mitsui-Soko, Japan officially inaugurated<br />

its new warehouse in the South Zone of the<br />

Jebel Ali <strong>Free</strong> Zone recently.<br />

The new 46,000 square metre facility<br />

which includes 21,000 sq mts of covered<br />

cargo area and over 15,000 pallet positions,<br />

hosts a new management system allowing<br />

barcode control and set up rack services.<br />

A W Rostamani Logistics specialises<br />

in logistics and distribution, warehousing,<br />

freight forwarding, cus<strong>to</strong>ms clearance,<br />

shipping and container freight station<br />

service and trading. Established in 1997, the<br />

company is the primary logistics partner <strong>to</strong><br />

the Dubai metro project as well.<br />

The inauguration of the warehouse<br />

was hosted by the Chairman and Vice<br />

Chairman of AW Rostamani, <strong>to</strong>gether<br />

with Japanese partners Mitsui & Co and<br />

Mitsui-Soko Company and Jafza officials.<br />

“The inauguration of this new facility has<br />

marked the next chapter in our company’s<br />

growth,” commented Mitsui & Co and<br />

Mitsui-Soko Company, Managing Direc<strong>to</strong>r,<br />

Hajime Ogawa. Dr. Mohammed Al Banna,<br />

VP Commercial Sales - Jafza <strong>to</strong>ld the media.<br />

“We congratulate AW Rostamani on its<br />

ambitious endeavor and we are sure the<br />

company’s excellent logistics services will<br />

be further enhanced by the newly<br />

developed facility. We remain committed<br />

<strong>to</strong> giving our valued cus<strong>to</strong>mers the best<br />

possible infrastructure <strong>to</strong> help support their<br />

growth aspirations.”<br />

Qatar Shipping joins<br />

hands with Qatar Navigation<br />

Qatar Shipping Co and Qatar Navigation Boards of Direc<strong>to</strong>rs have approved the merger<br />

unanimously. Under the terms of the transaction, Qatar Navigation will acquire all the<br />

outstanding shares of Qatar Shipping in exchange for new shares of Qatar Navigation.<br />

The deal, which is subject <strong>to</strong> shareholders’ approval, will create a company capable of a<br />

leading role in Qatar with the potential of a major regional role and international presence,<br />

the two firms stated.<br />

12 Link May 2010

News<br />

GCC<br />

VLCC rates jump most<br />

in five weeks<br />

The cost of delivering Middle East crude<br />

oil <strong>to</strong> Asia, the world’s busiest route for<br />

supertankers, rose the most in more than<br />

five weeks as the volume of shipments<br />

increased. According <strong>to</strong> analysts reports,<br />

charter rates for very large crude carriers, or<br />

VLCCs, on the industry’s benchmark Saudi<br />

Arabia-<strong>to</strong>-Japan route gained 8.7% <strong>to</strong> 83.24<br />

Worldscale points, the biggest climb since<br />

February 22, according <strong>to</strong> the Londonbased<br />

Baltic Exchange. Returns from the<br />

voyage surged 19 per cent <strong>to</strong> US$44,576<br />

(Dh163,716) a day.<br />

Crude shipments <strong>to</strong> Asia from the Middle<br />

East are expected <strong>to</strong> increase <strong>to</strong> 12.86<br />

million barrels a day, up 390,000 barrels<br />

from a month ago, Oil Movements, a Halifax,<br />

England-based company that tracks tanker<br />

deals, said in a report recently. VLCCs haul<br />

two million-barrel cargoes.<br />

“There is a lot of new refining capacity<br />

coming on stream in Asia, and refiners<br />

see this as a time <strong>to</strong> build s<strong>to</strong>cks,” Oil<br />

Movements founder Roy Mason said. It is a<br />

“bullish signal” for oil prices, he said.<br />

The supply of vessels competing for<br />

cargoes in the region is “balanced” after<br />

demand advanced, Per Mansson, managing<br />

direc<strong>to</strong>r of Nor Ocean S<strong>to</strong>ckholm AB, said.<br />

He also cited an increased demand for ships<br />

<strong>to</strong> s<strong>to</strong>re cargoes at sea. Daily returns for<br />

suezmax tankers that haul one million- barrel<br />

cargoes added 5.6 per cent <strong>to</strong> $23,293,<br />

according <strong>to</strong> the Baltic Exchange.<br />

Returns from aframaxes that carry<br />

650,000 barrels fell for a seventh session,<br />

dropping 19 per cent <strong>to</strong> $15,634 a day, for a<br />

62 per cent plunge since March 23.<br />

SP Jain Centre of<br />

Management Dubai receives<br />

DED support<br />

The Dubai Department of Economic<br />

Development (DED) in collaboration with its<br />

Foreign Investment Office (FIO) hosted the<br />

Action Learning Programme research teams<br />

of SP Jain Centre of Management (SPJCM)<br />

Dubai <strong>to</strong> present their research findings in<br />

the logistics sec<strong>to</strong>r. This initiative is part of<br />

DED’s continuing support <strong>to</strong> the Emirate’s<br />

logistics sec<strong>to</strong>r.<br />

A 9-member team of the Global Masters<br />

in Business Administration (GMBA)<br />

programme, led by the Direc<strong>to</strong>r of Industry<br />

Interface Dr Dhrupad Mathur, presented<br />

their research findings <strong>to</strong> a DED panel<br />

chaired by His Excellency Sami Daen Al<br />

Qamzi, Direc<strong>to</strong>r General, DED, and Fahad Al<br />

Gergawi, Chief Executive Officer of FIO.<br />

The research studies were conducted<br />

over the last few months in Dubai under<br />

the supervision of David Harris, Direc<strong>to</strong>r of<br />

International Logistics, FIO and Dr. Rajiv<br />

Aserkar of SPJCM. The three research<br />

projects brought out several strategic<br />

findings that will greatly enhance the<br />

efficiency of the logistics sec<strong>to</strong>r.<br />

The team reviewing the international<br />

supply chain interacted with industry<br />

experts, wherein process walkthroughs<br />

and existing challenges were collated. The<br />

process was benchmarked against the<br />

leading ports and a strategic improvement<br />

plan in line with the best practices was<br />

recommended. During the course of this<br />

project, the students got a chance <strong>to</strong> gain<br />

the insights in<strong>to</strong> the operations of the<br />

industry which would not have been<br />

possible otherwise.<br />

The project <strong>to</strong> identify barriers dealt with<br />

identifying the operational and entry barriers<br />

for the third party logistics companies in<br />

Dubai. An extensive questionnaire survey<br />

was conducted which was backed by focus<br />

group interviews with the CEOs of world<br />

class 3PL companies. The responses<br />

gathered captured the obstacles that they<br />

faced during the 3PL operations.<br />

The subsequent data analysis helped us<br />

form recommendations for the DED which<br />

would help them reduce the impact of the<br />

barriers that the firms face.<br />

May 2010 Link 13

GCC<br />

News<br />

World’s largest airport <strong>to</strong><br />

open on June 27<br />

Paul Griffiths, CEO of Dubai Airports Co<br />

announced that the Al Mak<strong>to</strong>um International<br />

Airport will open on June 27. The company<br />

is in advanced talks with airlines, both<br />

passenger and cargo, across the globe<br />

<strong>to</strong> start operations from the new airport,<br />

he said. The new airport, which will be<br />

the largest in the world, is part of the<br />

US$ 33bn Dubai World Central (DWC)<br />

development in Jebel Ali. Besides the<br />

DWC-Al Mak<strong>to</strong>um International, DWC is<br />

designed <strong>to</strong> comprise five more specialised<br />

clustered zones: Dubai Logistics City (DLC),<br />

DWC Commercial City, DWC Residential<br />

City, DWC Aviation City and DWC Golf<br />

City. Designed <strong>to</strong> have a capacity of more<br />

than 12 million <strong>to</strong>nnes of cargo a year<br />

and 160 million passengers a year, the<br />

initial investment in<strong>to</strong> DWC-Al Mak<strong>to</strong>um<br />

International rested at about US$ 10<br />

billion (Dh 36.72bn). DWC-Al Mak<strong>to</strong>um<br />

International airport would open for business<br />

with freighter operations followed by<br />

passenger operations at a later stage. Once<br />

operational, DWC-Al Mak<strong>to</strong>um International<br />

would also be capable of handling all newgeneration<br />

aircraft such as the Airbus A380<br />

super jumbo.<br />

The first phase of the airport is being built<br />

<strong>to</strong> accommodate future traffic expansion<br />

with a single A380 compatible runway, a<br />

passenger terminal with capacity of five<br />

million passengers per annum expandable<br />

<strong>to</strong> seven million passengers per annum,<br />

a cargo terminal building capable of handling<br />

250,000 <strong>to</strong>nnes per annum expandable <strong>to</strong><br />

600,000 <strong>to</strong>nnes per annum and a dedicated<br />

road link <strong>to</strong> the region’s largest port in<br />

Jebel Ali, according <strong>to</strong> Dubai Airports’<br />

recent statement.<br />

Drydocks World<br />

creates new<br />

marketing unit<br />

Drydocks World announced the<br />

establishment of Drydocks World<br />

- Offshore - as a new entity within the<br />

group. This new entity is a marketing arm<br />

specifically set up <strong>to</strong> sell the significant<br />

offshore capabilities of Drydocks<br />

World, which will move <strong>to</strong>wards offering<br />

complete Engineering, Procurement<br />

and Construction (EPC) solutions <strong>to</strong> the<br />

company’s clients, as well as continuing<br />

its original core business of ship repair.<br />

Drydocks World - Dubai is already<br />

a facility with an unparalleled capability<br />

for FSO, FPSO and FSRU conversions.<br />

The company’s core business will be<br />

supported by an enhanced engineering<br />

capability focused on concept, basic<br />

and detailed design for both vessel and<br />

<strong>to</strong>psides, along with project management<br />

and procurement resources <strong>to</strong> enable it<br />

<strong>to</strong> offer complete one s<strong>to</strong>p shop services<br />

<strong>to</strong> its clients.<br />

The Dubai yard has been extended<br />

with 670 meters’ of dedicated conversion<br />

quayside supported with travelling cranes<br />

and fabrication areas. In addition a new<br />

state of the art pipe fabrication facility will<br />

be commissioned mid-year.<br />

Drydocks World’s offshore capabilities<br />

are not limited <strong>to</strong> vessel conversions;<br />

the company also has a huge capacity<br />

for rig building and offshore fabrication<br />

at its Batam facilities in Indonesia.<br />

Drydocks World - Graha currently has<br />

five rig building slips supported by very<br />

large fabrication areas and specialist<br />

workshops.<br />

Emirates Airline has ‘rethink’ and<br />

delays relocation<br />

Emirates Airline will not move its operations <strong>to</strong> the new Al Mak<strong>to</strong>um International<br />

Airport until some time between 2022 and 2030, the airline’s president said.<br />

Tim Clark said, Dubai’s national carrier had had a “rethink” about moving<br />

from its base at Dubai International Airport. “We have refocused here [at Dubai<br />

International],” Mr Clark said. “With a certain amount of investment here, you can<br />

get a lot more out of this airport,” he added.<br />

The airline had planned <strong>to</strong> move <strong>to</strong> the airport between 2018 and 2020. Dubai<br />

Airports has added new infrastructure at Dubai International <strong>to</strong> increase capacity<br />

<strong>to</strong> 90 million passengers a year.<br />

14 Link May 2010

News<br />

GCC<br />

DP World reports ‘better<br />

than expected’ results<br />

Port opera<strong>to</strong>r DP World, a subsidiary of<br />

state-owned Dubai World, announced that<br />

its full-year profit fell 46 per cent <strong>to</strong> US$333<br />

million (Dh1.2 billion) in 2009 from US$621<br />

million in 2008.<br />

The decline, however, was less than<br />

expected as the company beat analyst<br />

expectations in an industry that has<br />

suffered a global decline in trade volumes.<br />

The company’s revenues fell 14 per cent<br />

<strong>to</strong> US$2.8 billion (Dh10.3 billion) on the<br />

negative effects of pricing pressure and a<br />

volume decline of 8 per cent.<br />

Last year the opera<strong>to</strong>r handled more than<br />

43.4 million TEUs (twenty-foot equivalent<br />

container units) across its portfolio from the<br />

Americas <strong>to</strong> Asia. The company, however,<br />

expects capacity <strong>to</strong> increase <strong>to</strong> around 95<br />

million TEUs over the next ten years, riding<br />

on the back of expansion and development<br />

projects in key growth markets that include<br />

India, China and the Middle East. The port<br />

opera<strong>to</strong>r performed better than the rest of<br />

the market as global gross volumes fell<br />

by almost 12 per cent and witnessed a<br />

substantial reduction in the volumes of noncontainer<br />

cargo.<br />

“We are confident about the long-term<br />

outlook for the container terminal industry,”<br />

chairman Sultan Ahmad Bin Sulayem said<br />

in a statement. During the first two months<br />

of this year, the opera<strong>to</strong>r’s growth s<strong>to</strong>od at 4<br />

per cent over the same period last year.<br />

“So far, in 2010, we have seen good<br />

signals and we hope it stays that way,” the<br />

opera<strong>to</strong>r’s chief executive officer Mohammad<br />

Sharaf <strong>to</strong>ld the media at a press conference.<br />

The company reduced fixed costs by 7 per<br />

cent last year, including 1,200 jobs, and<br />

aims <strong>to</strong> maintain a 3-4 per cent reduction<br />

of fixed costs.<br />

In 2009, it started operations at two<br />

new developments, Doraleh in Djibouti and<br />

Saigon in Vietnam. It also completed the<br />

expansion of its terminal in Jebel Ali.<br />

This year, it will bring further capacity<br />

as port construction of Callao in Peru and<br />

Vallarpadam in India nears completion.<br />

The opera<strong>to</strong>r is currently working on the<br />

quay wall for the London Gateway (UK)<br />

terminal development. DP World, whose<br />

shares trade on the Nasdaq Dubai market,<br />

said it would list on the London S<strong>to</strong>ck<br />

Exchange as early as the second quarter<br />

of this year.<br />

Whether more shares will be issued or<br />

not, company officials said the premium<br />

listing, set <strong>to</strong> be achieved through deposi<strong>to</strong>ry<br />

interest on the LSE, is <strong>to</strong> improve liquidity<br />

and not <strong>to</strong> raise more capital.<br />

<strong>SCLG</strong>ME ENDORSED<br />

EVENTS.......<br />

Malaysia<br />

Sustainable Urban Transport<br />

Integration<br />

May 12 & 13, 2010, Prince Hotel,<br />

Kuala Lumpur<br />

Overcoming challenges in implementing<br />

and establishing a safe, reliable and<br />

seamless mass transit system. Efficient<br />

and reliable urban transport systems<br />

are crucial in present city development.<br />

The Urban transport problems are<br />

growing acute mainly because of rapid<br />

mo<strong>to</strong>rization. The major challenge is how<br />

<strong>to</strong> improve the current urban transport<br />

situation in order <strong>to</strong> accommodate the<br />

rising demand for more efficient and<br />

accessible public transportation.<br />

Kingdom of Saudi Arabia<br />

Supply Chain Saudi Arabia<br />

20-23 June 2010, Radisson Blu Hotel,<br />

Jeddah, KSA<br />

Exploring innovative global supply chain<br />

and logistics methods and applying them<br />

<strong>to</strong> your business in the Saudi Arabian<br />

market.<br />

Saudi Transtec<br />

Saudi Arabia’s Transportation, Material<br />

Handling, Warehousing & Logistics<br />

Exhibition<br />

25-27 Oct 2010, Dammam, KSA<br />

Saudi Transtec is the Saudi’s<br />

international Transportation, Handling,<br />

Warehousing & Logistic exhibition &<br />

conference. The exhibition will showcase<br />

all transportation services, Warehousing<br />

and Logistic services.<br />

Belgium<br />

Demand Driven Supply Chain 2020<br />

15-16 June 2010, Brussels,<br />

uRedesigning your supply chain <strong>to</strong><br />

meet cus<strong>to</strong>mer and business needs in a<br />

dynamic economic environment<br />

uMaximizing opportunities and<br />

minimizing risk as the global economy<br />

enters a new phase<br />

uFocusing on demand-management<br />

collaboration – internally and externally<br />

uPlanning integrated sourcing,<br />

production, distribution, inven<strong>to</strong>ry and<br />

service strategies and processes<br />

May 2010 Link 15

COVER STORY<br />

Transportation<br />

that the “we did not see any decline in<br />

volume in 2009 and 2010 seems <strong>to</strong> have<br />

started well.” Indicative of this consistency<br />

is the arrival of a new regular feeder service<br />

operated by Yang Ming Lines (YML),<br />

whose ‘YM XIAMEN’ is now a regular weekly<br />

visi<strong>to</strong>r at SCT.<br />

Hennessy welcomes the start of calls by<br />

the 350 TEU, 107m long vessel. “The ship<br />

is easy for us <strong>to</strong> work and as always, we get<br />

first class professional assistance from Yang<br />

Ming and their agents. We hope that YML<br />

and their cus<strong>to</strong>mers have a successful 2010<br />

and increased regular business at SCT.”<br />

Civil works <strong>to</strong> improve the facilities at<br />

SCT are also moving ahead well with the<br />

renovation of Berths 1 through 3 newly<br />

completed. The modifications include a<br />

new, strengthened quay wall, constructed<br />

3 metres seaward of the existing quay wall,<br />

<strong>to</strong> facilitate dredging work; Mobile Harbour<br />

Crane power supply sockets installed<br />

along the berths, a new 33kv substation,<br />

new bollards and fenders installed along<br />

the length of the three berths; and a new<br />

9.9<br />

per cent throughput growth<br />

in 2009 <strong>to</strong> TEU 2.75m by<br />

Gulftainer<br />

interlocked quay surface laid between the<br />

seaward and landward rails.<br />

Gulftainer has been operating in the<br />

UAE since 1976, and operates two ports<br />

in the country, SCT and the Khorfakkan<br />

Container Terminal (KCT). SCT was the first<br />

purpose-built and fully-equipped modern<br />

Container Terminal in the Middle East, and<br />

lies adjacent <strong>to</strong> Sharjah’s industrial area,<br />

which accommodates over 45 percent of the<br />

non-oil manufacturing capacity of the UAE.<br />

It handles containers on behalf of over 30<br />

shipping lines, including all of the world’s <strong>to</strong>p<br />

20 companies.<br />

KCT is strategically located on Sharjah’s<br />

Indian Ocean coast, outside the sensitive<br />

Straits of Hormuz and close <strong>to</strong> the main<br />

east-west shipping routes, and is one<br />

of the world’s leading container<br />

transshipment ports with numerous feeder<br />

ship connections <strong>to</strong> Gulf Ports, Iran, India,<br />

Pakistan and East Africa.<br />

18 Link May 2010

COVER STORY<br />

Transportation<br />

Global container<br />

trade in recovery<br />

mode: 2010<br />

Container trade is on a recovery path, led by<br />

res<strong>to</strong>cking in developed markets, even as the Middle<br />

East consolidates its position as a trans-shipment hub<br />

on the Asia-Europe trade. Savio Pimenta reports<br />

Container trade is on a recovery<br />

path, led by res<strong>to</strong>cking in developed<br />

markets, even as the Middle East<br />

consolidates its position as a transshipment<br />

hub on the Asia-Europe trade, according <strong>to</strong> a<br />

recent research analysis by Credit Suisse.<br />

Capacity constraints will likely reappear<br />

as throughput will grow at a 5.5 per cent<br />

CAGR globally in 2009E–2017E, 3.2 times<br />

faster than the capacity, the report predicts.<br />

The Middle Eastern countries are<br />

investing significantly <strong>to</strong> expand the ports<br />

infrastructure and the region will consolidate<br />

its position as a transshipment hub on the<br />

Asia-Europe trade. The growth expected in<br />

O&D cargo throughout the region already<br />

seems <strong>to</strong> be driving the need for capacity<br />

upgrades, the report said.<br />

Container traffic growth typically<br />

replicates the trend of world GDP growth<br />

with a multiplier of c2.7x as global trade<br />

tends <strong>to</strong> be widely affected by protectionist<br />

measures in recession periods as well as<br />

openness during years of expansion. “We<br />

believe the main change over the past 60<br />

years is the emergence of Asia as the world<br />

trade hub. International trade is now greatly<br />

containerised. Although this process is<br />

seen by industry experts Drewry as having<br />

reached maturity at c80 per cent of volumes,<br />

we think there is still room for expansion in<br />

emerging markets,” the report published.<br />

According <strong>to</strong> the report, macro data<br />

from the main developed economies shows<br />

that the currently high level of inven<strong>to</strong>ry<br />

rebuilding in GDP growth, which directly<br />

affects the dry bulk and container volumes<br />

traded, is forecast by the Credit Suisse<br />

Global Economics team <strong>to</strong> decline <strong>to</strong> below<br />

16 Link May 2010

Transportation<br />

COVERSTORY<br />

switching <strong>to</strong>wards Asia. China has become<br />

the world’s number one exporter with 26.5<br />

per cent of volumes of containers by far.”<br />

With regard <strong>to</strong> the recent boom of intra-<br />

Asia trade, out of the 20 busiest container<br />

trade routes 11 involve Greater China as<br />

origin or destination representing 37.6% of<br />

world volumes. “It is also worth noting that<br />

seven routes have an emerging market for<br />

both origin and destination for 21.3 per cent<br />

of <strong>to</strong>tal volumes,” the report said.<br />

During a year of anticipated volumes<br />

recovery, regional differences are expected<br />

<strong>to</strong> be as large in 2010 as in 2009 in<br />

emerging markets, according <strong>to</strong> Drewry’s<br />

container volumes forecasts, ranging from<br />

a continued drop of 7.7 per cent in Eastern<br />

Europe <strong>to</strong> growth of 5.7 per cent in the Far<br />

East sub-region.<br />

“This number includes China, where<br />

there would be a throughput growth of 14.8<br />

per cent,” according <strong>to</strong> Credit Suisse’s ports<br />

5.5<br />

per cent CAGR globally in<br />

2009E–2017E, 3.2 times faster<br />

than the capacity<br />

analyst, Ingrid Wei. Meanwhile, the Middle<br />

Eastern countries are investing significantly<br />

<strong>to</strong> expand the ports infrastructure. “We<br />

expect the region <strong>to</strong> consolidate its position<br />

as a transshipment hub on the Asia-Europe<br />

trade. The growth expected in O&D cargo<br />

through out the region already seems <strong>to</strong> be<br />

driving the need for capacity upgrades,” the<br />

analysts said.<br />

With Gulftainer, originally operating from<br />

the Sharjah terminal and now expanding in<br />

Kuwait, there is competition <strong>to</strong> DP World in<br />

the Middle East, <strong>to</strong> some extent. “Although<br />

we do not think this competition is as strong<br />

as the one that HPH and PSA seem <strong>to</strong> be<br />

facing in Asia, it could limit the pricing power<br />

of DP World in the region in the future,” the<br />

analysts said.<br />

Gulftainer already reported throughput<br />

growth of 9.9 per cent in 2009 <strong>to</strong> TEU 2.75m<br />

compared with an expected decrease of 7.2<br />

per cent over the region. The steady flow of<br />

containers through the Sharjah Container<br />

Terminal (SCT) has not diminished as<br />

imported goods continue <strong>to</strong> move <strong>to</strong><br />

supply the businesses in Sharjah and<br />

beyond, according <strong>to</strong> Sharjah-based<br />

terminal and logistics firm Gulftainer, which<br />

operates the Terminal on behalf of the<br />

Sharjah Ports Authority.<br />

SCT Manager Paul Hennessy confirms<br />

one per cent in as early as third quarter of<br />

2010, and stay below 0.5 per cent in Japan<br />

for the whole period.<br />

The medium <strong>to</strong> longer-term growth<br />

outlook looks quite moderate and “in<br />

our view, that industry experts rely on<br />

a much more measured recovery than<br />

what would have traditionally occurred with<br />

the past pattern”.<br />

The report also argues that the global<br />

emerging markets regional differences<br />

are high. “Containerised cargo trade has,<br />

for some time already, been significantly<br />

May 2010 Link 17

Transportation<br />

COVERSTORY<br />

Leading international ports management<br />

and logistics company, Gulftainer, has<br />

announced that the Khorfakkan Container<br />

Terminal, which it operates on behalf of<br />

the Sharjah Ports Authority, has achieved<br />

another miles<strong>to</strong>ne - eight gantries working<br />

on a single vessel.<br />

The 350 metre-long, 120,000 deadweight<br />

<strong>to</strong>nnage (DWT), 9,700 TEU ‘CMA CGM<br />

Pelleas’ called at KCT on Monday 15 March<br />

2010, where work was carried out under<br />

eight gantries, for the first time in the his<strong>to</strong>ry<br />

of the terminal.<br />

The recent acquisition and delivery of<br />

four new ‘Megamax’ Liebherr container<br />

gantries at the end of 2009 now being<br />

put through their paces on the 440m Berth<br />

extension, allowed this his<strong>to</strong>ric event <strong>to</strong><br />

take place.<br />

Terminal Manager Dag Froehmcke<br />

commented “it was a great sight <strong>to</strong> have 8<br />

gantries over the ship, and this has been a<br />

busy time - the last 48 hours have seen the<br />

terminal handling nearly 20, 000 teu - so we<br />

certainly appreciate the new cranes and the<br />

extra quay space.”<br />

Speaking of the latest miles<strong>to</strong>ne,<br />

Gulftainer Group Managing Direc<strong>to</strong>r Peter<br />

Richards said, “It is clear that the expansion<br />

is already strengthening the terminal’s<br />

already impressive performance, and I<br />

am confident that this will continue. KCT<br />

is now well known for its efficient, speedy<br />

performance, and is already regularly<br />

handling ships of over 11,000 TEU. The<br />

terminal is recognized as one of the<br />

fastest container terminals in the world, as<br />

evidenced by the continued high productivity<br />

figures and with the expansion of the<br />

terminal having brought the <strong>to</strong>tal number of<br />

gantries up <strong>to</strong> 20, as well as adding over 400<br />

metres of quay, I am confident that we will<br />

continue <strong>to</strong> increase our reputation for fast,<br />

efficient handling”.<br />

KCT is one of the world’s leading<br />

container transshipment ports, and is<br />

SCT Manager Paul<br />

Hennessy confirms that<br />

the “we did not see any<br />

decline in volume in 2009<br />

and 2010 seems <strong>to</strong> have<br />

started well.”<br />

strategically located on Sharjah’s Indian<br />

Ocean east coast, outside the sensitive<br />

Straits of Hormuz, close <strong>to</strong> the main eastwest<br />

shipping routes. Only three hours<br />

from the UAE’s main centres of population,<br />

Dubai, Sharjah and Abu Dhabi, KCT is an<br />

ideal transshipment hub port with numerous<br />

feeder ship connections <strong>to</strong> Gulf Ports, Iran,<br />

India, Pakistan and East Africa.<br />

The only presence of global opera<strong>to</strong>rs<br />

in the region comprises APMT in Salalah<br />

(Oman) and HPH in Dammam (Saudi<br />

Arabia). In other regions, Russia’s port<br />

industry is export-orientated with the majority<br />

of goods exiting the country directed <strong>to</strong><br />

Europe. “Africa is the only sub-region in the<br />

world where we expect capacity <strong>to</strong> grow<br />

faster than throughput and privatizations<br />

will be the main driver of port investments,<br />

especially by global opera<strong>to</strong>rs looking mainly<br />

for transshipment hubs such as Tanger in<br />

Morocco or DP World in Djen Djen, Algeria.<br />

Freight rates have strongly rebounded,<br />

especially on the Europe and Mediterranean<br />

services with some lines back at their peak<br />

tariffs of early 2008. In India and South<br />

Asia although ports opera<strong>to</strong>rs see a big<br />

opportunity in terms of demand, a severe<br />

lack of infrastructure is hampering the<br />

potential in the short term.<br />

When it comes <strong>to</strong> Latin America the<br />

analysts argue that up <strong>to</strong> 2016, at least,<br />

container volumes in Brazil have potential<br />

<strong>to</strong> grow at c8-9 per cent per annum. “This<br />

May 2010 Link 19

COVER STORY<br />

Transportation<br />

assumption is based on a straightforward<br />

calculation. Brazil’s trade flow-<strong>to</strong>-GDP ratio<br />

is low, at around 21 per cent, while the world<br />

average is above 50 per cent.<br />

Countries such as Russia, India and<br />

China have numbers close <strong>to</strong> or above 50<br />

per cent. Brazil’s neighbour, Argentina, has<br />

a trade flow/GDP ratio of 45 per cent. We<br />

believe there is little doubt that the BRL<br />

appreciation has helped this ratio <strong>to</strong> stay low<br />

in the case of Brazil. However, both Brazil<br />

and Argentina had similar ratios, around<br />

21–22 per cent.<br />

Credit Suisse’s Brazil analyst, Ivan Fadel,<br />

said: “In 2010 the container volume will grow<br />

by 13.5 per cent given by San<strong>to</strong>s Brasil for<br />

the San<strong>to</strong>s port (where DP World started <strong>to</strong><br />

develop a TEU one million terminal <strong>to</strong> be<br />

opened by 2012).<br />

“After showing strong signs of a<br />

slowdown across the board in 2009, we<br />

estimate that the Brazilian port industry<br />

will show some recovery in 2010. Given<br />

the appreciated BRL, we should expect<br />

a higher contribution from imports, while<br />

exports should grow by five per cent”, Fadel<br />

concluded.<br />

13.5<br />

per cent container volume<br />

growth expected in 2010<br />

Trade from Asia<br />

Ship container volumes from Asia <strong>to</strong> Europe<br />

grew by nearly 10 percent year-on-year<br />

in December, staging the biggest monthly<br />

increase in 2009 and indicating a recovery in<br />

seaborne trade, data showed.<br />

The global downturn has hit the container<br />

sec<strong>to</strong>r hard especially on key routes from<br />

Asia <strong>to</strong> consumers in the West carrying<br />

finished goods from electronics <strong>to</strong> <strong>to</strong>ys.<br />

Data from the Brussels headquartered<br />

European Liner Affairs Association (ELAA)<br />

industry group, showed westbound volumes<br />

<strong>to</strong> Europe from Asia rose 9.47 percent in<br />

December 2009 <strong>to</strong> 1.105 million TEUs<br />

(twenty foot equivalent units) from 1.009<br />

million TEUs in December 2008. Container<br />

trade is measured in TEUs.<br />

December was the second month-onmonth<br />

rise in 2009 after November, which<br />

posted a 2.52 percent rise.<br />

“Westbound December 2009 recorded<br />

the highest monthly figure for 2009, breaking<br />

the million box mark for the first time in<br />

2009,” the ELAA said in a statement.<br />

The ELAA said it should be noted that<br />

the December figure was being compared<br />

with December 2008, “a time the shipping<br />

industry was dipping deep in<strong>to</strong> recession.”<br />

“Having said that, there is little doubt that<br />

the figures show signs of a strong recovery,”<br />

it added. The last time container volume on<br />

that route rose above 1 million TEUs was in<br />

Oc<strong>to</strong>ber 2008, the ELAA said. “December<br />

shows that the trade is coming back,” Rod<br />

Riseborough of the ELAA <strong>to</strong>ld Reuters.<br />

Container volume for the fourth quarter<br />

was down 0.05 percent at 3.029 million<br />

TEUs versus 3.031 million TEUs in the same<br />

period in 2008. Total year-on-year volumes<br />

on the westbound Asia route <strong>to</strong> Europe in<br />

2009 were down 14.77% at 11.501 million<br />

TEUs versus 13.494 million TEUs in 2008.<br />

Trade from Europe<br />

Westbound trade <strong>to</strong> Europe from Asia is<br />

20 Link May 2010

Transportation<br />

COVERSTORY<br />

primarily driven by consumer goods but also<br />

includes manufactured items such as car<br />

parts. Exporting countries include China,<br />

South Korea and Japan and exclude India<br />

and Australasia.<br />

Separately, the ELAA said eastbound<br />

trade from Europe <strong>to</strong> Asia jumped 46.97<br />

percent year-on-year in December <strong>to</strong><br />

543,286 TEUs -- the highest monthly volume<br />

in 2009 and 2008. Volume rose 30.17<br />

percent in the fourth quarter versus a year<br />

ago and was up 4.5 percent for the whole of<br />

2009 versus 2008.<br />

Trade is driven by paper and plastics<br />

exports from Europe. “The big growth<br />

is east bound and it is very substantial,”<br />

Riseborough said. Paris-headquartered<br />

market intelligence provider Alphaliner<br />

said there was increased optimism among<br />

opera<strong>to</strong>rs in the liner sec<strong>to</strong>r, but added there<br />

was still significant overcapacity which would<br />

continue <strong>to</strong> “put pressure on charter rates.”<br />

“The idle fleet still remains high at<br />

10.4 percent of the <strong>to</strong>tal cellular fleet with<br />

a significant number of fresh deliveries<br />

expected in 2010 that could add <strong>to</strong> the<br />

overall capacity surplus,” it said in a report.<br />

Developing countries <strong>to</strong> contribute<br />

most <strong>to</strong> resurgence<br />

After the sharpest decline in more than 70<br />

years, world trade is set <strong>to</strong> rebound in 2010<br />

by growing at 9.5 percent, according <strong>to</strong> the<br />

World Trade Organization.<br />

WTO economists expect exports from<br />

developed economies <strong>to</strong> increase by 7.5<br />

percent in volume terms over the course of<br />

If trade continues <strong>to</strong><br />

expand at its current<br />

pace, the WTO<br />

economists predict it<br />

will take another year for<br />

trade volumes <strong>to</strong> surpass<br />

the peak level of 2008<br />

the year while shipments from the rest of the<br />

world, including developing economies and<br />

the Commonwealth of Independent States,<br />

should rise by around 11% as the world<br />

emerges from recession. The WTO said the<br />

strong expansion it expects will help recover<br />

some, but by no means all, of the ground<br />

lost in 2009 when the global economic crisis<br />

sparked a 12.2% contraction in the volume<br />

of global trade — the largest such decline<br />

since World War II.<br />

If trade continues <strong>to</strong> expand at its current<br />

pace, the WTO economists predict it will<br />

take another year for trade volumes <strong>to</strong><br />

surpass the peak level of 2008. The WTO<br />

said measuring trade in volume terms<br />

provides a more reliable basis for annual<br />

comparisons since volume measurements<br />

are not dis<strong>to</strong>rted by changes in commodity<br />

prices or currency fluctuations, as they can<br />

be when trade is measured in dollars or<br />

other currencies.<br />

The WTO noted that one positive<br />

development in 2009 was the absence of<br />

any major increase in trade barriers imposed<br />

by WTO members in response <strong>to</strong> the crisis.<br />

It said the number of trade-restricting<br />

measures applied by governments has<br />

actually declined in recent months.<br />

“We see the light at the end of the tunnel<br />

and trade promises <strong>to</strong> be an important part<br />

of the recovery. But we must avoid derailing<br />

any economic revival through protectionism,”<br />

said WTO Direc<strong>to</strong>r-General Pascal Lamy.<br />

The 12% drop in the volume of world<br />

trade in 2009 was larger than most<br />

economists had predicted. This contraction<br />

also exceeded the WTO’s earlier forecast<br />

of a 10% decline. Trade in current U.S. dollar<br />

terms dropped even further than<br />

trade in volume terms (by 23%), thanks in<br />

large part <strong>to</strong> falling prices of oil and other<br />

primary commodities.<br />

May 2010 Link 21

TRANSPORT<br />

Bridging the divide<br />

Despite all the money spent by<br />

regional governments on building<br />

air and sea ports in recent years,<br />

many of the major transport arteries of the<br />

Middle East remain narrow, congested and<br />

run down. While international sea and air<br />

links are generally strong, overland transport<br />

users have few options beyond often<br />

overcrowded or inadequate roads.<br />

Among the major international links,<br />

the Suez Canal is in healthy shape. In<br />

September 2009, 1,454 vessels passed<br />

through the canal. That was a significant<br />

rebound from the 1,272 vessels that<br />

used the route in February, the quietest<br />

month of this year for the canal, when the<br />

impact of the global economic downturn<br />

was at its worst.<br />

Some other transport links, however,<br />

have fallen in<strong>to</strong> disrepair or vanished<br />

completely. The Hejaz Railway, which once<br />

connected Damascus <strong>to</strong> Medina, is largely<br />

Transport 2010:<br />

Middle East’s<br />

Railway revival<br />

Countries across the region are upgrading their rail<br />

transport systems but investment in roads is lacking<br />

broken, although Jordan now has<br />

ambitious plans <strong>to</strong> reopen its section as<br />

part of a JD3.2bn ($4.5bn) nationwide railbuilding<br />

programme.<br />

Across the region, from Iran <strong>to</strong> Algeria,<br />

there is a revival in railway building<br />

programmes as governments seek <strong>to</strong><br />

improve their domestic and international<br />

transport networks.<br />

In the Gulf there are plans for the GCC<br />

Railway, which will link its six member states,<br />

and rail lines in Saudi Arabia: the North-<br />

South, Mecca-Medina. Given the downturn<br />

in inter-national financial markets over the<br />

past year and a half, paying for all these<br />

schemes has not been easy.<br />

Hejaz railway, Syria post 1918<br />

22 Link May 2010

Bridging the divide<br />

TRANSPORT<br />

1,454<br />

vessels passed through the<br />

Suez Canal in 2009<br />

Some countries are seeking international<br />

inves<strong>to</strong>rs <strong>to</strong> back billions of dollars worth<br />

of projects, such as the £E4.4bn ($800m)<br />

railway from Cairo <strong>to</strong> Roubiky and 10th of<br />

Ramadan cities in Egypt, and the planned<br />

Jordanian rail network.<br />

In Saudi Arabia, the government<br />

will finance key parts of the kingdom’s<br />

infrastructure itself after banks refused<br />

<strong>to</strong> lend money <strong>to</strong> two multi-billion-dollar<br />

projects: the $7bn high-speed railway<br />

between Mecca and Medina, and the $7bn<br />

Saudi Land bridge rail link connecting the<br />

Gulf and Red Sea coasts.<br />

In other cases, it is unclear whether the<br />

state or the private sec<strong>to</strong>r will finance badly<br />

needed developments. In Iraq, for example,<br />

the $1bn privatization of the deep-sea port at<br />

Umm Qasr – the country’s marine gateway<br />

– has been on hold since September,<br />

when Transport Minister Amer Abduljabbar<br />

blocked the appointment of an international<br />

consultant, the US’ Cornell Group, <strong>to</strong><br />

oversee the redevelopment of the site.<br />

Suez Canal<br />

Iran’s ability <strong>to</strong> push ahead with its<br />

major transport projects is just as doubtful,<br />

although the financing difficulties in the<br />

Islamic Republic are further complicated<br />

by the US-led international sanctions and<br />

domestic economic problems.<br />

High-speed lines from Tehran <strong>to</strong> Esfahan<br />

and Mashhad have been on hold since<br />

January 2008 because the government<br />

cannot afford <strong>to</strong> pay for them directly. The<br />

$18.5bn project <strong>to</strong> add 12 lines <strong>to</strong> the<br />

Tehran Metro before 2030 has also been<br />

stalled for two years.<br />

However, a 1,100-kilometre-long rail line<br />

running the length of the country’s eastern<br />

border, from Mashhad in the northeast <strong>to</strong> the<br />

port of Chabahar on the Arabian Sea, seems<br />

likely <strong>to</strong> go ahead at a cost of at least $1bn,<br />

if only because Chinese rail firms are likely<br />

<strong>to</strong> provide the finance.<br />

Many other international companies<br />

continue <strong>to</strong> shy away from Iraq and Iran,<br />

however, due <strong>to</strong> the inherent difficulties<br />

in working in either country and the<br />

opportunities available elsewhere.<br />

Egypt has made significant steps <strong>to</strong><br />

open itself <strong>to</strong> foreign investment since the<br />

government of Prime Minister Ahmed Nazif<br />

came <strong>to</strong> power in 2004, although further<br />

moves could yet be needed given the<br />

extent of Cairo’s plans. Investment Minister<br />

Mahmoud Mohieldin has drawn up a list<br />

of road, rail and port projects worth up <strong>to</strong><br />

£E130bn that the government hopes <strong>to</strong><br />

award by the end of June 2011.<br />

The port projects alone will require<br />

£E15bn in investment. They include plans<br />

for a £E5.2bn bulk terminal at Adabiya Port,<br />

<strong>to</strong> the south of the Suez Canal, which will<br />

import iron ore and export finished products.<br />

At the Mediterranean end of the canal, the<br />

Transport Ministry plans <strong>to</strong> build a container<br />

terminal and a ship refuelling station, and <strong>to</strong><br />

develop the port’s logistics capabilities.<br />

Other schemes cover less strategically<br />

important sites. For example, the Investment<br />

Ministry wants <strong>to</strong> build a 415km-long<br />

road linking the cities of Asyut, Qena and<br />

Sohag in Upper Egypt <strong>to</strong> the Red Sea<br />

coast, at a cost of £E1.6bn. In common<br />

with other countries in the region, Egypt is<br />

also expanding its rail system. Orascom<br />

Construction Industries, the country’s largest<br />

construction firm, is currently working on an<br />

upgrade <strong>to</strong> the Cairo Metro, which is due <strong>to</strong><br />

have six new lines by 2022.<br />

The port projects alone<br />

will require £E15bn in<br />

investment. They include<br />

plans for a £E5.2bn bulk<br />

terminal at Adabiya Port,<br />

<strong>to</strong> the south of the Suez<br />

Canal<br />

Tanger Med Port<br />

May 2010 Link 23

TRANSPORT<br />

Bridging the divide<br />

To make the project more<br />

manageable, the ministry<br />

has split it in<strong>to</strong> four<br />

phases, each of which will<br />

be developed in turn. The<br />

ministry plans <strong>to</strong> award<br />

the JD795m ($1.1bn)<br />

first phase, connecting<br />

its borders with Syria<br />

and Saudi Arabia via<br />

Irbid, Amman, Zarqa and<br />

Mafraq, in June 2010.<br />

The Transport Ministry is also looking<br />

for inves<strong>to</strong>rs for a £E360m plan <strong>to</strong> move<br />

the section of the Matruh Railway running<br />

between the <strong>to</strong>wns of Fukkah and Samalla<br />

in the northwest of the country. The ministry<br />

hopes that moving the rail line will free up<br />

beachfront land for development.<br />

The rail projects elsewhere are even<br />

more ambitious, not least Jordan’s plans<br />

for a nationwide freight network linked <strong>to</strong><br />

the borders of Saudi Arabia, Syria, Iraq<br />

and Israel. Its Transport Ministry launched<br />

the fundraising for the $4.5bn scheme <strong>to</strong><br />

inves<strong>to</strong>rs in Paris on 13 November.<br />

To make the project more manageable,<br />

$7bn<br />

high-speed railway between<br />

Mecca and Medina, and the<br />

$7bn Saudi Land bridge rail link<br />

connecting the Gulf and Red<br />

Sea coasts<br />

the ministry has split it in<strong>to</strong> four phases,<br />

each of which will be developed in turn. The<br />

ministry plans <strong>to</strong> award the JD795m ($1.1bn)<br />

first phase, connecting its borders with Syria<br />

and Saudi Arabia via Irbid, Amman, Zarqa<br />

and Mafraq, in June 2010. A developer is<br />

expected <strong>to</strong> start work the following month,<br />

with the first freight trains running on the<br />

network in mid 2013.<br />

For Jordan’s rail network <strong>to</strong> fulfill its<br />