Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Mangalore</strong> <strong>Refinery</strong> <strong>and</strong> Petrochemicals Limited<br />

(v) a) In our opinion <strong>and</strong> according to the in<strong>for</strong>mation <strong>and</strong> explanations given to<br />

us, there is no contract arrangement that needs to be entered in the register<br />

required to be maintained in pursuance of section 301 of the Companies Act,<br />

1956.<br />

b) Accordingly, the reporting requirement of clause (v) (b) of paragraph 4 of the<br />

Companies (Auditor’s <strong>Report</strong>) Order, 2003 is not applicable<br />

(vi) According to the in<strong>for</strong>mation <strong>and</strong> explanations given to us, the Company has not<br />

accepted any deposits from the public during the year <strong>and</strong> hence the directives<br />

issued by the Reserve Bank of India <strong>and</strong> provisions of sections 58A, 58AA or any<br />

other relevant provisions of the Companies Act, 1956 <strong>and</strong> the rules framed there<br />

under are not applicable.<br />

(vii) In our Opinion, the Company has an internal audit system commensurate with the<br />

size <strong>and</strong> nature of its business.<br />

(viii) We have broadly reviewed the Cost Records maintained by the Company pursuant<br />

to the Companies (Cost Accounting Records) Rules. 2011 prescribed by the<br />

Central Government under section 209 (1) (d) of the Companies Act 1956, <strong>for</strong><br />

maintenance of Cost Records <strong>and</strong> we are of the opinion that prima facie the<br />

prescribed accounts <strong>and</strong> records have been made <strong>and</strong> maintained.<br />

(ix) a) According to the in<strong>for</strong>mation <strong>and</strong> explanations given to us <strong>and</strong> as per<br />

the records of the company, the Company has been generally regular in<br />

depositing undisputed statutory dues including Provident Fund, Investor<br />

Education <strong>and</strong> Protection Fund, Employee’s State Insurance, Income Tax,<br />

Sales Tax, Wealth Tax, Service Tax, Customs Duty, Excise Duty <strong>and</strong> other<br />

statutory dues with the appropriate authorities during the year. There are<br />

no arrears of undisputed statutory dues of material nature outst<strong>and</strong>ing <strong>for</strong> a<br />

period of more than 6 months, from the date on which they became payable.<br />

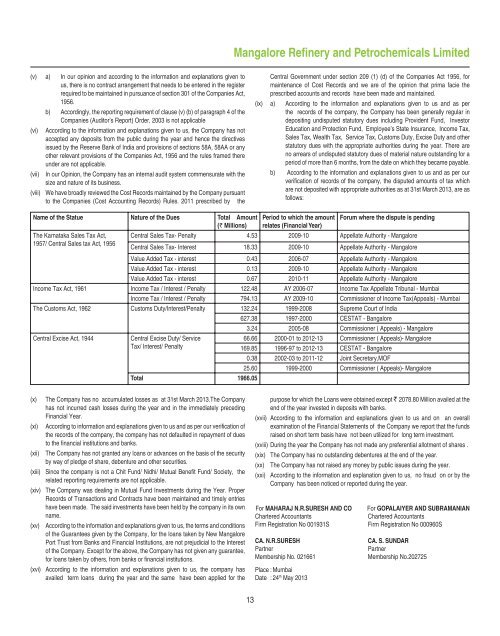

b) According to the in<strong>for</strong>mation <strong>and</strong> explanations given to us <strong>and</strong> as per our<br />

verifi cation of records of the company, the disputed amounts of tax which<br />

are not deposited with appropriate authorities as at 31st March 20<strong>13</strong>, are as<br />

follows:<br />

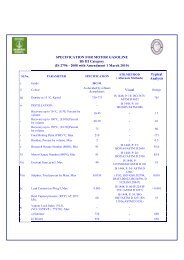

Name of the Statue Nature of the Dues Total Amount<br />

(` Millions)<br />

The Karnataka Sales Tax Act,<br />

1957/ Central Sales tax Act, 1956<br />

Period to which the amount<br />

relates (Financial Year)<br />

Forum where the dispute is pending<br />

Central Sales Tax- Penalty 4.53 2009-10 Appellate Authority - <strong>Mangalore</strong><br />

Central Sales Tax- Interest 18.33 2009-10 Appellate Authority - <strong>Mangalore</strong><br />

Value Added Tax - interest 0.43 2006-07 Appellate Authority - <strong>Mangalore</strong><br />

Value Added Tax - interest 0.<strong>13</strong> 2009-10 Appellate Authority - <strong>Mangalore</strong><br />

Value Added Tax - interest 0.67 2010-11 Appellate Authority - <strong>Mangalore</strong><br />

Income Tax Act, 1961 Income Tax / Interest / Penalty 122.48 AY 2006-07 Income Tax Appellate Tribunal - Mumbai<br />

Income Tax / Interest / Penalty 794.<strong>13</strong> AY 2009-10 Commissioner of Income Tax(Appeals) - Mumbai<br />

The Customs Act, 1962 Customs Duty/Interest/Penalty <strong>13</strong>2.24 1999-2008 Supreme Court of India<br />

627.38 1997-2000 CESTAT - Bangalore<br />

3.24 2005-08 Commissioner ( Appeals) - <strong>Mangalore</strong><br />

Central Excise Act, 1944<br />

Central Excise Duty/ Service<br />

66.66 2000-01 to <strong>2012</strong>-<strong>13</strong> Commissioner ( Appeals)- <strong>Mangalore</strong><br />

Tax/ Interest/ Penalty<br />

169.85 1996-97 to <strong>2012</strong>-<strong>13</strong> CESTAT - Bangalore<br />

0.38 2002-03 to 2011-12 Joint Secretary,MOF<br />

25.60 1999-2000 Commissioner ( Appeals)- <strong>Mangalore</strong><br />

Total 1966.05<br />

(x) The Company has no accumulated losses as at 31st March 20<strong>13</strong>.The Company<br />

has not incurred cash losses during the year <strong>and</strong> in the immediately preceding<br />

Financial Year.<br />

(xi) According to in<strong>for</strong>mation <strong>and</strong> explanations given to us <strong>and</strong> as per our verifi cation of<br />

the records of the company, the company has not defaulted in repayment of dues<br />

to the fi nancial institutions <strong>and</strong> banks.<br />

(xii) The Company has not granted any loans or advances on the basis of the security<br />

by way of pledge of share, debenture <strong>and</strong> other securities.<br />

(xiii) Since the company is not a Chit Fund/ Nidhi/ Mutual Benefi t Fund/ Society, the<br />

related reporting requirements are not applicable.<br />

(xiv) The Company was dealing in Mutual Fund Investments during the Year. Proper<br />

Records of Transactions <strong>and</strong> Contracts have been maintained <strong>and</strong> timely entries<br />

have been made. The said investments have been held by the company in its own<br />

name.<br />

(xv) According to the in<strong>for</strong>mation <strong>and</strong> explanations given to us, the terms <strong>and</strong> conditions<br />

of the Guarantees given by the Company, <strong>for</strong> the loans taken by New <strong>Mangalore</strong><br />

Port Trust from Banks <strong>and</strong> Financial Institutions, are not prejudicial to the Interest<br />

of the Company. Except <strong>for</strong> the above, the Company has not given any guarantee,<br />

<strong>for</strong> loans taken by others, from banks or fi nancial institutions.<br />

(xvi) According to the in<strong>for</strong>mation <strong>and</strong> explanations given to us, the company has<br />

availed term loans during the year <strong>and</strong> the same have been applied <strong>for</strong> the<br />

purpose <strong>for</strong> which the Loans were obtained except ` 2078.80 Million availed at the<br />

end of the year invested in deposits with banks.<br />

(xvii) According to the in<strong>for</strong>mation <strong>and</strong> explanations given to us <strong>and</strong> on an overall<br />

examination of the Financial Statements of the Company we report that the funds<br />

raised on short term basis have not been utilized <strong>for</strong> long term investment.<br />

(xviii) During the year the Company has not made any preferential allotment of shares .<br />

(xix) The Company has no outst<strong>and</strong>ing debentures at the end of the year.<br />

(xx) The Company has not raised any money by public issues during the year.<br />

(xxi) According to the in<strong>for</strong>mation <strong>and</strong> explanation given to us, no fraud on or by the<br />

Company has been noticed or reported during the year.<br />

For MAHARAJ N.R.SURESH AND CO<br />

Chartered Accountants<br />

Firm Registration No 001931S<br />

CA. N.R.SURESH<br />

Partner<br />

Membership No. 021661<br />

Place : Mumbai<br />

Date : 24 th May 20<strong>13</strong><br />

For GOPALAIYER AND SUBRAMANIAN<br />

Chartered Accountants<br />

Firm Registration No 000960S<br />

CA. S. SUNDAR<br />

Partner<br />

Membership No.202725<br />

<strong>13</strong>