Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Mangalore</strong> <strong>Refinery</strong> <strong>and</strong> Petrochemicals Limited<br />

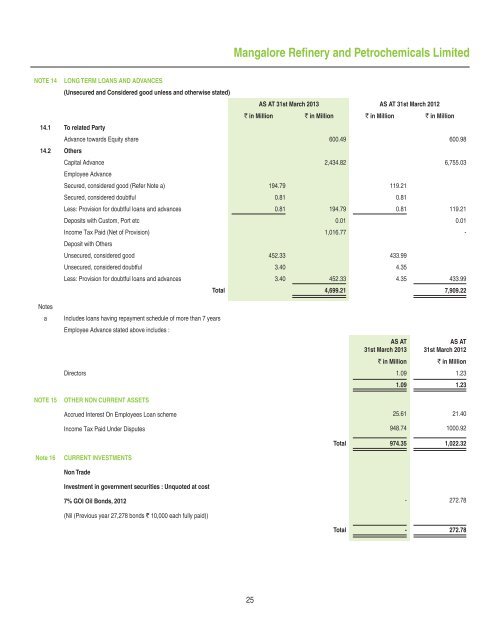

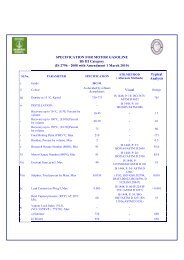

NOTE 14 LONG TERM LOANS AND ADVANCES<br />

(Unsecured <strong>and</strong> Considered good unless <strong>and</strong> otherwise stated)<br />

AS AT 31st March 20<strong>13</strong> AS AT 31st March <strong>2012</strong><br />

` in Million ` in Million ` in Million ` in Million<br />

14.1 To related Party<br />

Advance towards Equity share 600.49 600.98<br />

14.2 Others<br />

Capital Advance 2,434.82 6,755.03<br />

Employee Advance<br />

Secured, considered good (Refer Note a) 194.79 119.21<br />

Secured, considered doubtful 0.81 0.81<br />

Less: Provision <strong>for</strong> doubtful loans <strong>and</strong> advances 0.81 194.79 0.81 119.21<br />

Deposits with Custom, Port etc 0.01 0.01<br />

Income Tax Paid (Net of Provision) 1,016.77 -<br />

Deposit with Others<br />

Unsecured, considered good 452.33 433.99<br />

Unsecured, considered doubtful 3.40 4.35<br />

Less: Provision <strong>for</strong> doubtful loans <strong>and</strong> advances 3.40 452.33 4.35 433.99<br />

Total 4,699.21 7,909.22<br />

Notes<br />

a<br />

NOTE 15<br />

Includes loans having repayment schedule of more than 7 years<br />

Employee Advance stated above includes :<br />

AS AT<br />

31st March 20<strong>13</strong><br />

` in Million<br />

AS AT<br />

31st March <strong>2012</strong><br />

` in Million<br />

Directors 1.09 1.23<br />

OTHER NON CURRENT ASSETS<br />

1.09 1.23<br />

Accrued Interest On Employees Loan scheme 25.61 21.40<br />

Income Tax Paid Under Disputes 948.74 1000.92<br />

Total 974.35 1,022.32<br />

Note 16<br />

CURRENT INVESTMENTS<br />

Non Trade<br />

Investment in government securities : Unquoted at cost<br />

7% GOI Oil Bonds, <strong>2012</strong> - 272.78<br />

(Nil (Previous year 27,278 bonds ` 10,000 each fully paid))<br />

Total - 272.78<br />

25