Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

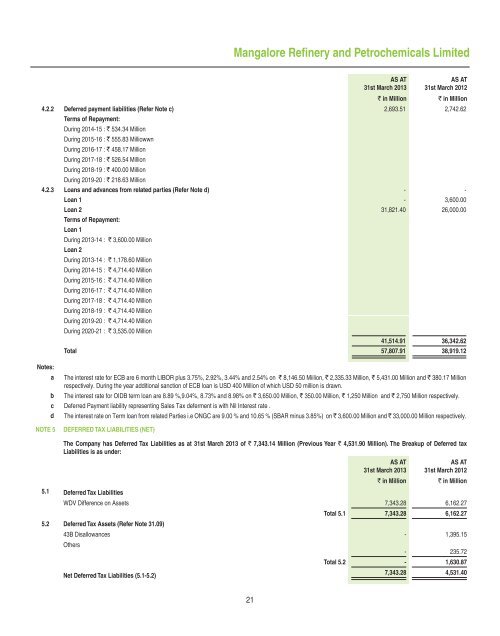

<strong>Mangalore</strong> <strong>Refinery</strong> <strong>and</strong> Petrochemicals Limited<br />

AS AT<br />

31st March 20<strong>13</strong><br />

AS AT<br />

31st March <strong>2012</strong><br />

` in Million ` in Million<br />

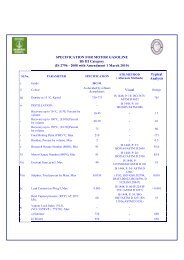

4.2.2 Deferred payment liabilities (Refer Note c) 2,693.51 2,742.62<br />

Terms of Repayment:<br />

During 2014-15 : ` 534.34 Million<br />

During 2015-16 : ` 555.83 Milliowwn<br />

During 2016-17 : ` 458.17 Million<br />

During 2017-18 : ` 526.54 Million<br />

During 2018-19 : ` 400.00 Million<br />

During 2019-20 : ` 218.63 Million<br />

4.2.3 Loans <strong>and</strong> advances from related parties (Refer Note d) - -<br />

Loan 1 - 3,600.00<br />

Loan 2 31,821.40 26,000.00<br />

Terms of Repayment:<br />

Loan 1<br />

During 20<strong>13</strong>-14 : ` 3,600.00 Million<br />

Loan 2<br />

During 20<strong>13</strong>-14 : ` 1,178.60 Million<br />

During 2014-15 : ` 4,714.40 Million<br />

During 2015-16 : ` 4,714.40 Million<br />

During 2016-17 : ` 4,714.40 Million<br />

During 2017-18 : ` 4,714.40 Million<br />

During 2018-19 : ` 4,714.40 Million<br />

During 2019-20 : ` 4,714.40 Million<br />

During 2020-21 : ` 3,535.00 Million<br />

Notes:<br />

a<br />

41,514.91 36,342.62<br />

Total 57,807.91 38,919.12<br />

The interest rate <strong>for</strong> ECB are 6 month LIBOR plus 3.75%, 2.92%, 3.44% <strong>and</strong> 2.54% on ` 8,146.50 Miilion, ` 2,335.33 Million, ` 5,431.00 Million <strong>and</strong> ` 380.17 Million<br />

respectively. During the year additional sanction of ECB loan is USD 400 Million of which USD 50 million is drawn.<br />

b The interest rate <strong>for</strong> OIDB term loan are 8.89 %,9.04%, 8.73% <strong>and</strong> 8.98% on ` 3,650.00 Million, ` 350.00 Million, ` 1,250 Million <strong>and</strong> ` 2,750 Million respectively.<br />

c Deferred Payment liability representing Sales Tax deferment is with Nil Interest rate .<br />

d The interest rate on Term loan from related Parties i.e ONGC are 9.00 % <strong>and</strong> 10.65 % (SBAR minus 3.85%) on ` 3,600.00 Million <strong>and</strong> ` 33,000.00 Million respectively.<br />

NOTE 5<br />

DEFERRED TAX LIABILITIES (NET)<br />

The Company has Deferred Tax Liabilities as at 31st March 20<strong>13</strong> of ` 7,343.14 Million (Previous Year ` 4,531.90 Million). The Breakup of Deferred tax<br />

Liabilities is as under:<br />

AS AT<br />

31st March 20<strong>13</strong><br />

` in Million<br />

AS AT<br />

31st March <strong>2012</strong><br />

` in Million<br />

5.1 Deferred Tax Liabilities<br />

WDV Difference on Assets 7,343.28 6,162.27<br />

Total 5.1 7,343.28 6,162.27<br />

5.2 Deferred Tax Assets (Refer Note 31.09)<br />

43B Disallowances - 1,395.15<br />

Others<br />

- 235.72<br />

Total 5.2 - 1,630.87<br />

Net Deferred Tax Liabilities (5.1-5.2)<br />

7,343.28 4,531.40<br />

21