Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>-<strong>13</strong><br />

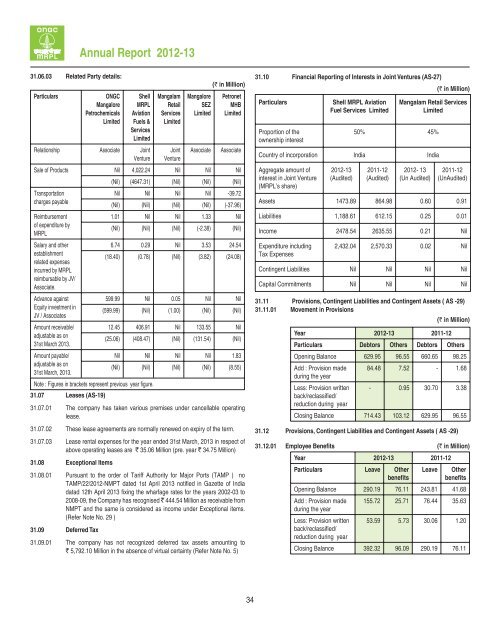

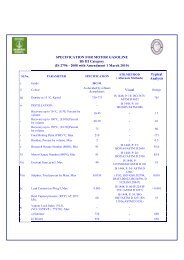

31.06.03 Related Party details:<br />

Particulars<br />

ONGC<br />

<strong>Mangalore</strong><br />

Petrochemicals<br />

Limited<br />

Shell<br />

MRPL<br />

Aviation<br />

Fuels &<br />

Services<br />

Limited<br />

Relationship Associate Joint<br />

Venture<br />

Mangalam<br />

Retail<br />

Services<br />

Limited<br />

Joint<br />

Venture<br />

<strong>Mangalore</strong><br />

SEZ<br />

Limited<br />

Associate<br />

(` in Million)<br />

Petronet<br />

MHB<br />

Limited<br />

Associate<br />

Sale of Products Nil 4,022.24 Nil Nil Nil<br />

(Nil) (4647.31) (Nil) (Nil) (Nil)<br />

Transportation<br />

Nil Nil Nil Nil -39.72<br />

charges payable<br />

(Nil) (Nil) (Nil) (Nil) (-37.96)<br />

Reimbursement<br />

1.01 Nil Nil 1.33 Nil<br />

of expenditure by<br />

MRPL<br />

(Nil) (Nil) (Nil) (-2.38) (Nil)<br />

Salary <strong>and</strong> other<br />

6.74 0.29 Nil 3.53 24.54<br />

establishment<br />

related expenses<br />

incurred by MRPL<br />

reimbursable by JV/<br />

Associate.<br />

(18.40) (0.78) (Nil) (3.82) (24.08)<br />

Advance against<br />

599.99 Nil 0.05 Nil Nil<br />

Equity investment in<br />

JV / Associates<br />

(599.99) (Nil) (1.00) (Nil) (Nil)<br />

Amount receivable/<br />

12.45 406.91 Nil <strong>13</strong>3.55 Nil<br />

adjustable as on<br />

31st March 20<strong>13</strong>.<br />

(25.06) (408.47) (Nil) (<strong>13</strong>1.54) (Nil)<br />

Amount payable/<br />

Nil Nil Nil Nil 1.83<br />

adjustable as on<br />

31st March, 20<strong>13</strong>.<br />

(Nil) (Nil) (Nil) (Nil) (8.55)<br />

Note : Figures in brackets represent previous year fi gure.<br />

31.07 Leases (AS-19)<br />

31.07.01 The company has taken various premises under cancellable operating<br />

lease.<br />

31.07.02 These lease agreements are normally renewed on expiry of the term.<br />

31.07.03 Lease rental expenses <strong>for</strong> the year ended 31st March, 20<strong>13</strong> in respect of<br />

above operating leases are ` 35.06 Million (pre. year ` 34.75 Million)<br />

31.08 Exceptional Items<br />

31.08.01 Pursuant to the order of Tariff Authority <strong>for</strong> Major Ports (TAMP ) no<br />

TAMP/22/<strong>2012</strong>-NMPT dated 1st April 20<strong>13</strong> notifi ed in Gazette of India<br />

datad 12th April 20<strong>13</strong> fi xing the wharfage rates <strong>for</strong> the years 2002-03 to<br />

2008-09, the Company has recognised ` 444.54 Million as receivable from<br />

NMPT <strong>and</strong> the same is considered as income under Exceptional items.<br />

(Refer Note No. 29 )<br />

31.09 Deferred Tax<br />

31.09.01 The company has not recognized deferred tax assets amounting to<br />

` 5,792.10 Million in the absence of virtual certainty (Refer Note No. 5)<br />

31.10 Financial <strong>Report</strong>ing of Interests in Joint Ventures (AS-27)<br />

(` in Million)<br />

Particulars<br />

Proportion of the<br />

ownership interest<br />

Shell MRPL Aviation<br />

Fuel Services Limited<br />

Mangalam Retail Services<br />

Limited<br />

50% 45%<br />

Country of incorporation India India<br />

Aggregate amount of<br />

interest in Joint Venture<br />

(MRPL’s share)<br />

<strong>2012</strong>-<strong>13</strong><br />

(Audited)<br />

2011-12<br />

(Audited)<br />

<strong>2012</strong>- <strong>13</strong><br />

(Un Audited)<br />

2011-12<br />

(UnAudited)<br />

Assets 1473.89 864.98 0.60 0.91<br />

Liabilities 1,188.61 612.15 0.25 0.01<br />

Income 2478.54 2635.55 0.21 Nil<br />

Expenditure including<br />

Tax Expenses<br />

2,432.04 2,570.33 0.02 Nil<br />

Contingent Liabilities Nil Nil Nil Nil<br />

Capital Commitments Nil Nil Nil Nil<br />

31.11 Provisions, Contingent Liabilities <strong>and</strong> Contingent Assets ( AS -29)<br />

31.11.01 Movement in Provisions<br />

(` in Million)<br />

Year <strong>2012</strong>-<strong>13</strong> 2011-12<br />

Particulars Debtors Others Debtors Others<br />

Opening Balance 629.95 96.55 660.65 98.25<br />

Add : Provision made 84.48 7.52 - 1.68<br />

during the year<br />

Less: Provision written<br />

back/reclassifi ed/<br />

reduction during year<br />

- 0.95 30.70 3.38<br />

Closing Balance 714.43 103.12 629.95 96.55<br />

31.12 Provisions, Contingent Liabilities <strong>and</strong> Contingent Assets ( AS -29)<br />

31.12.01 Employee Benefits (` in Million)<br />

Year <strong>2012</strong>-<strong>13</strong> 2011-12<br />

Particulars Leave Other<br />

benefits<br />

Leave<br />

Other<br />

benefits<br />

Opening Balance 290.19 76.11 243.81 41.68<br />

Add : Provision made 155.72 25.71 76.44 35.63<br />

during the year<br />

Less: Provision written<br />

back/reclassifi ed/<br />

reduction during year<br />

53.59 5.73 30.06 1.20<br />

Closing Balance 392.32 96.09 290.19 76.11<br />

34