Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

Annual Report for 2012-13 - Mangalore Refinery and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Mangalore</strong> <strong>Refinery</strong> <strong>and</strong> Petrochemicals Limited<br />

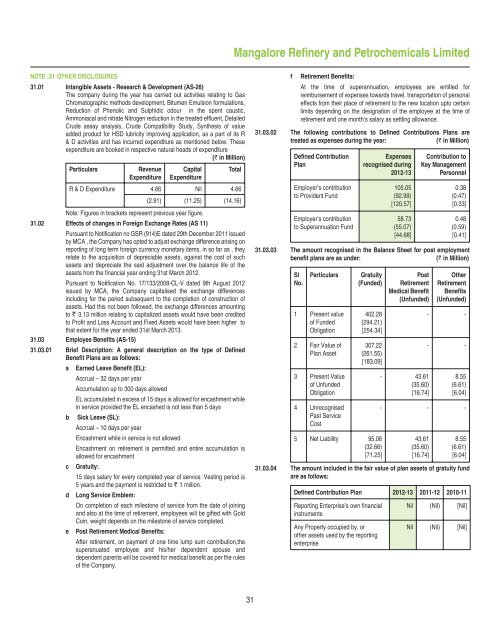

NOTE :31 OTHER DISCLOSURES<br />

31.01 Intangible Assets - Research & Development (AS-26)<br />

The company during the year has carried out activities relating to Gas<br />

Chromatographic methods development, Bitumen Emulsion <strong>for</strong>mulations,<br />

Reduction of Phenolic <strong>and</strong> Sulphidic odour in the spent caustic,<br />

Ammoniacal <strong>and</strong> nitrate Nitrogen reduction in the treated effl uent, Detailed<br />

Crude assay analysis, Crude Compatibility Study, Synthesis of value<br />

added product <strong>for</strong> HSD lubricity improving application, as a part of its R<br />

& D activities <strong>and</strong> has incurred expenditure as mentioned below. These<br />

expenditure are booked in respective natural heads of expenditure<br />

(` in Million)<br />

Particulars<br />

Revenue<br />

Expenditure<br />

Capital<br />

Expenditure<br />

Total<br />

R & D Expenditure 4.66 Nil 4.66<br />

(2.91) (11.25) (14.16)<br />

Note: Figures in brackets represent previous year fi gure.<br />

31.02 Effects of changes in Foreign Exchange Rates (AS 11)<br />

Pursuant to Notifi cation no GSR (914)E dated 29th December 2011 issued<br />

by MCA , the Company has opted to adjust exchange difference arising on<br />

reporting of long term <strong>for</strong>eign currency monetary items, in so far as , they<br />

relate to the acquisition of depreciable assets, against the cost of such<br />

assets <strong>and</strong> depreciate the said adjustment over the balance life of the<br />

assets from the fi nancial year ending 31st March <strong>2012</strong>.<br />

Pursuant to Notifi cation No. 17/<strong>13</strong>3/2008-CL-V dated 9th August <strong>2012</strong><br />

issued by MCA, the Company capitalised the exchange differences<br />

including <strong>for</strong> the period subsequent to the completion of construction of<br />

assets. Had this not been followed, the exchange differences amounting<br />

to ` 3.<strong>13</strong> million relating to capitalized assets would have been credited<br />

to Profi t <strong>and</strong> Loss Account <strong>and</strong> Fixed Assets would have been higher to<br />

that extent <strong>for</strong> the year ended 31st March 20<strong>13</strong>.<br />

31.03 Employee Benefits (AS-15)<br />

31.03.01 Brief Description: A general description on the type of Defined<br />

Benefit Plans are as follows:<br />

a Earned Leave Benefit (EL):<br />

Accrual – 32 days per year<br />

Accumulation up to 300 days allowed<br />

EL accumulated in excess of 15 days is allowed <strong>for</strong> encashment while<br />

in service provided the EL encashed is not less than 5 days<br />

b<br />

c<br />

d<br />

e<br />

Sick Leave (SL):<br />

Accrual – 10 days per year<br />

Encashment while in service is not allowed<br />

Encashment on retirement is permitted <strong>and</strong> entire accumulation is<br />

allowed <strong>for</strong> encashment<br />

Gratuity:<br />

15 days salary <strong>for</strong> every completed year of service. Vesting period is<br />

5 years <strong>and</strong> the payment is restricted to ` 1 miilion.<br />

Long Service Emblem:<br />

On completion of each milestone of service from the date of joining<br />

<strong>and</strong> also at the time of retirement, employees will be gifted with Gold<br />

Coin, weight depends on the milestone of service completed.<br />

Post Retirement Medical Benefits:<br />

After retirement, on payment of one time lump sum contribution,the<br />

superanuated employee <strong>and</strong> his/her dependent spouse <strong>and</strong><br />

dependent parents will be covered <strong>for</strong> medical benefi t as per the rules<br />

of the Company.<br />

f Retirement Benefits:<br />

At the time of superannuation, employees are entitled <strong>for</strong><br />

reimbursement of expenses towards travel, transportation of personal<br />

effects from their place of retirement to the new location upto certain<br />

limits depending on the designation of the employee at the time of<br />

retirement <strong>and</strong> one month’s salary as settling allowance.<br />

31.03.02 The following contributions to Defined Contributions Plans are<br />

treated as expenses during the year:<br />

(` in Million)<br />

Defined Contribution<br />

Plan<br />

Employer’s contribution<br />

to Provident Fund<br />

Employer’s contribution<br />

to Superannuation Fund<br />

Expenses<br />

recognised during<br />

<strong>2012</strong>-<strong>13</strong><br />

105.05<br />

(92.99)<br />

[120.57]<br />

58.73<br />

(55.07)<br />

[44.68]<br />

Contribution to<br />

Key Management<br />

Personnel<br />

0.38<br />

(0.47)<br />

[0.33]<br />

0.48<br />

(0.59)<br />

[0.41]<br />

31.03.03 The amount recognised in the Balance Sheet <strong>for</strong> post employment<br />

benefit plans are as under:<br />

(` in Million)<br />

Sl<br />

No.<br />

Particulars<br />

1 Present value<br />

of Funded<br />

Obligation<br />

2 Fair Value of<br />

Plan Asset<br />

3 Present Value<br />

of Unfunded<br />

Obligation<br />

4 Unrecognised<br />

Past Service<br />

Cost<br />

Gratuity<br />

(Funded)<br />

402.28<br />

(294.21)<br />

[254.34]<br />

307.22<br />

(261.55)<br />

[183.09]<br />

5 Net Liability 95.06<br />

(32.66)<br />

[71.25]<br />

Post<br />

Retirement<br />

Medical Benefit<br />

(Unfunded)<br />

- 43.61<br />

(35.60)<br />

[16.74]<br />

Other<br />

Retirement<br />

Benefits<br />

(Unfunded)<br />

- -<br />

- -<br />

8.55<br />

(6.61)<br />

[6.04]<br />

- - -<br />

43.61<br />

(35.60)<br />

[16.74]<br />

8.55<br />

(6.61)<br />

[6.04]<br />

31.03.04 The amount included in the fair value of plan assets of gratuity fund<br />

are as follows:<br />

Defined Contribution Plan <strong>2012</strong>-<strong>13</strong> 2011-12 2010-11<br />

<strong>Report</strong>ing Enterprise’s own fi nancial<br />

instruments<br />

Any Property occupied by, or<br />

other assets used by the reporting<br />

enterprise<br />

Nil (Nil) [Nil]<br />

Nil (Nil) [Nil]<br />

31