November 2009 - Nordea Bank Lietuva

November 2009 - Nordea Bank Lietuva

November 2009 - Nordea Bank Lietuva

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

US High Yield Bond Fund<br />

30 <strong>November</strong> <strong>2009</strong><br />

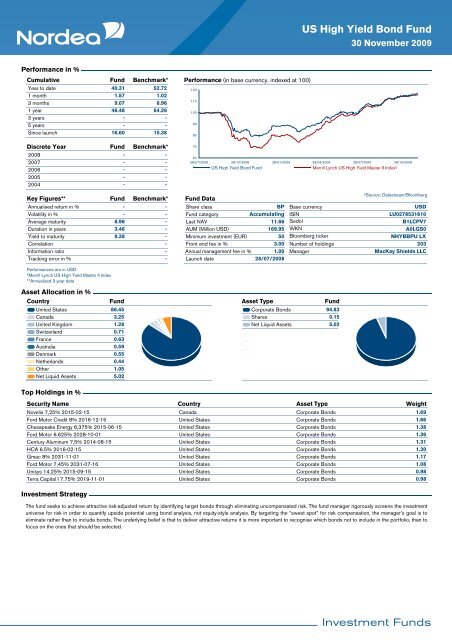

Performance in %<br />

Cumulative Fund Benchmark*<br />

Year to date<br />

40.31<br />

52.72<br />

1 month<br />

1.57<br />

1.02<br />

3 months<br />

9.07<br />

8.96<br />

1 year<br />

46.48<br />

64.26<br />

3 years<br />

-<br />

-<br />

5 years<br />

-<br />

-<br />

Since launch<br />

16.60<br />

15.38<br />

Performance (in base currency, indexed at 100)<br />

120<br />

110<br />

100<br />

90<br />

80<br />

Discrete Year<br />

2008<br />

2007<br />

2006<br />

2005<br />

2004<br />

Fund<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Benchmark*<br />

-<br />

-<br />

-<br />

-<br />

-<br />

70<br />

60<br />

28/07/2008 28/10/2008 28/01/<strong>2009</strong> 28/04/<strong>2009</strong> 28/07/<strong>2009</strong> 28/10/<strong>2009</strong><br />

US High Yield Bond Fund<br />

Merrill Lynch US High Yield Master II Index²<br />

Key Figures**<br />

Annualised return in %<br />

Volatility in %<br />

Average maturity<br />

Duration in years<br />

Yield to maturity<br />

Correlation<br />

Information ratio<br />

Tracking error in %<br />

Fund<br />

-<br />

-<br />

8.96<br />

3.46<br />

9.38<br />

Benchmark*<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Fund Data<br />

Share class<br />

Fund category<br />

Last NAV<br />

AUM (Million USD)<br />

Minimum investment (EUR)<br />

- Front end fee in %<br />

- Annual management fee in %<br />

- Launch date<br />

BP<br />

Accumulating<br />

11.66<br />

169.95<br />

50<br />

3.00<br />

1.00<br />

28/07/2008<br />

Base currency<br />

ISIN<br />

Sedol<br />

WKN<br />

Bloomberg ticker<br />

Number of holdings<br />

Manager<br />

²Source: Datastream/Bloomberg<br />

USD<br />

LU0278531610<br />

B1LCPV7<br />

A0LGS0<br />

NHYBBPU LX<br />

203<br />

MacKay Shields LLC<br />

Performances are in USD<br />

*Merrill Lynch US High Yield Master II Index<br />

**Annualized 3 year data<br />

Asset Allocation in %<br />

Country<br />

Fund<br />

United States 86.45<br />

Canada 3.25<br />

United Kingdom 1.28<br />

Switzerland 0.71<br />

France 0.63<br />

Australia 0.59<br />

Denmark 0.55<br />

Netherlands 0.44<br />

Other 1.05<br />

Net Liquid Assets 5.02<br />

Asset Type<br />

Fund<br />

Corporate Bonds 94.83<br />

Shares 0.15<br />

Net Liquid Assets 5.02<br />

Top Holdings in %<br />

Security Name<br />

Country<br />

Asset Type<br />

Weight<br />

Novelis 7,25% 2015-02-15 Canada<br />

Corporate Bonds<br />

1.69<br />

Ford Motor Credit 8% 2016-12-15 United States<br />

Corporate Bonds<br />

1.66<br />

Chesapeake Energy 6,375% 2015-06-15 United States<br />

Corporate Bonds<br />

1.38<br />

Ford Motor 6.625% 2028-10-01 United States<br />

Corporate Bonds<br />

1.36<br />

Century Aluminum 7,5% 2014-08-15 United States<br />

Corporate Bonds<br />

1.31<br />

HCA 6.5% 2016-02-15 United States<br />

Corporate Bonds<br />

1.30<br />

Gmac 8% 2031-11-01 United States<br />

Corporate Bonds<br />

1.17<br />

Ford Motor 7,45% 2031-07-16 United States<br />

Corporate Bonds<br />

1.08<br />

Unisys 14.25% 2015-09-15 United States<br />

Corporate Bonds<br />

0.98<br />

Terra Capital I 7.75% 2019-11-01 United States<br />

Corporate Bonds<br />

0.98<br />

Investment Strategy<br />

The fund seeks to achieve attractive risk-adjusted return by identifying target bonds through eliminating uncompensated risk. The fund manager rigorously screens the investment<br />

universe for risk in order to quantify upside potential using bond analysis, not equity-style analysis. By targeting the “sweet spot” for risk compensation, the manager’s goal is to<br />

eliminate rather than to include bonds. The underlying belief is that to deliver attractive returns it is more important to recognise which bonds not to include in the portfolio, than to<br />

focus on the ones that should be selected.