November 2009 - Nordea Bank Lietuva

November 2009 - Nordea Bank Lietuva

November 2009 - Nordea Bank Lietuva

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

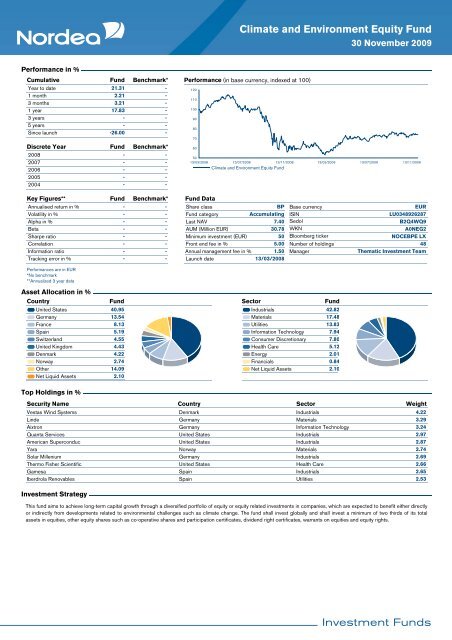

Climate and Environment Equity Fund<br />

30 <strong>November</strong> <strong>2009</strong><br />

Performance in %<br />

Cumulative Fund Benchmark*<br />

Year to date<br />

21.31<br />

-<br />

1 month<br />

2.21<br />

-<br />

3 months<br />

3.21<br />

-<br />

1 year<br />

17.83<br />

-<br />

3 years<br />

-<br />

-<br />

5 years<br />

-<br />

-<br />

Since launch<br />

-26.00<br />

-<br />

Discrete Year<br />

2008<br />

2007<br />

2006<br />

2005<br />

2004<br />

Fund<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Benchmark*<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Performance (in base currency, indexed at 100)<br />

120<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

13/03/2008 13/07/2008 13/11/2008 13/03/<strong>2009</strong> 13/07/<strong>2009</strong> 13/11/<strong>2009</strong><br />

Climate and Environment Equity Fund<br />

Key Figures**<br />

Annualised return in %<br />

Volatility in %<br />

Alpha in %<br />

Beta<br />

Sharpe ratio<br />

Correlation<br />

Information ratio<br />

Tracking error in %<br />

Fund<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Benchmark*<br />

-<br />

-<br />

-<br />

-<br />

-<br />

Fund Data<br />

Share class<br />

Fund category<br />

Last NAV<br />

AUM (Million EUR)<br />

Minimum investment (EUR)<br />

- Front end fee in %<br />

- Annual management fee in %<br />

- Launch date<br />

BP<br />

Accumulating<br />

7.40<br />

30.78<br />

50<br />

5.00<br />

1.50<br />

13/03/2008<br />

Base currency<br />

ISIN<br />

Sedol<br />

WKN<br />

Bloomberg ticker<br />

Number of holdings<br />

Manager<br />

EUR<br />

LU0348926287<br />

B2Q4WQ9<br />

A0NEG2<br />

NOCEBPE LX<br />

48<br />

Thematic Investment Team<br />

Performances are in EUR<br />

*No benchmark<br />

**Annualized 3 year data<br />

Asset Allocation in %<br />

Country<br />

Fund<br />

United States 40.95<br />

Germany 13.54<br />

France 8.13<br />

Spain 5.19<br />

Switzerland 4.55<br />

United Kingdom 4.43<br />

Denmark 4.22<br />

Norway 2.74<br />

Other 14.09<br />

Net Liquid Assets 2.10<br />

Sector<br />

Fund<br />

Industrials 42.82<br />

Materials 17.48<br />

Utilities 13.83<br />

Information Technology 7.94<br />

Consumer Discretionary 7.80<br />

Health Care 5.12<br />

Energy 2.01<br />

Financials 0.84<br />

Net Liquid Assets 2.10<br />

Top Holdings in %<br />

Security Name Country<br />

Sector Weight<br />

Vestas Wind Systems Denmark<br />

Industrials<br />

4.22<br />

Linde Germany<br />

Materials<br />

3.29<br />

Aixtron Germany<br />

Information Technology<br />

3.24<br />

Quanta Services United States<br />

Industrials<br />

2.97<br />

American Superconduc United States<br />

Industrials<br />

2.87<br />

Yara Norway<br />

Materials<br />

2.74<br />

Solar Millenium Germany<br />

Industrials<br />

2.69<br />

Thermo Fisher Scientific United States<br />

Health Care<br />

2.66<br />

Gamesa Spain<br />

Industrials<br />

2.65<br />

Iberdrola Renovables Spain<br />

Utilities<br />

2.53<br />

Investment Strategy<br />

This fund aims to achieve long-term capital growth through a diversified portfolio of equity or equity related investments in companies, which are expected to benefit either directly<br />

or indirectly from developments related to environmental challenges such as climate change. The fund shall invest globally and shall invest a minimum of two thirds of its total<br />

assets in equities, other equity shares such as co-operative shares and participation certificates, dividend right certificates, warrants on equities and equity rights.