November 2009 - Nordea Bank Lietuva

November 2009 - Nordea Bank Lietuva

November 2009 - Nordea Bank Lietuva

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Norwegian Bond Fund<br />

30 <strong>November</strong> <strong>2009</strong><br />

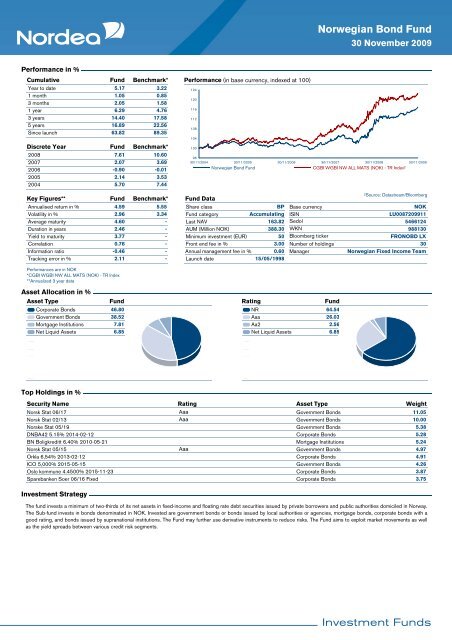

Performance in %<br />

Cumulative Fund Benchmark*<br />

Year to date<br />

5.17<br />

3.22<br />

1 month<br />

1.05<br />

0.85<br />

3 months<br />

2.05<br />

1.58<br />

1 year<br />

6.29<br />

4.76<br />

3 years<br />

14.40<br />

17.58<br />

5 years<br />

16.89<br />

22.56<br />

Since launch<br />

63.82<br />

89.35<br />

Discrete Year<br />

2008<br />

2007<br />

2006<br />

2005<br />

2004<br />

Fund<br />

7.61<br />

2.07<br />

-0.90<br />

2.14<br />

5.70<br />

Benchmark*<br />

10.60<br />

3.69<br />

-0.01<br />

3.53<br />

7.44<br />

Performance (in base currency, indexed at 100)<br />

124<br />

120<br />

116<br />

112<br />

108<br />

104<br />

100<br />

96<br />

30/11/2004 30/11/2005 30/11/2006 30/11/2007 30/11/2008 30/11/<strong>2009</strong><br />

Norwegian Bond Fund<br />

CGBI WGBI NW ALL MATS (NOK) - TR Index²<br />

Key Figures**<br />

Annualised return in %<br />

Volatility in %<br />

Average maturity<br />

Duration in years<br />

Yield to maturity<br />

Correlation<br />

Information ratio<br />

Tracking error in %<br />

Fund<br />

4.59<br />

2.96<br />

4.60<br />

2.46<br />

3.77<br />

0.76<br />

-0.46<br />

2.11<br />

Benchmark*<br />

5.55<br />

3.34<br />

-<br />

-<br />

-<br />

Fund Data<br />

Share class<br />

Fund category<br />

Last NAV<br />

AUM (Million NOK)<br />

Minimum investment (EUR)<br />

- Front end fee in %<br />

- Annual management fee in %<br />

- Launch date<br />

BP<br />

Accumulating<br />

163.82<br />

388.30<br />

50<br />

3.00<br />

0.60<br />

15/05/1998<br />

Base currency<br />

ISIN<br />

Sedol<br />

WKN<br />

Bloomberg ticker<br />

Number of holdings<br />

Manager<br />

²Source: Datastream/Bloomberg<br />

NOK<br />

LU0087209911<br />

5466124<br />

988130<br />

FRONOBD LX<br />

30<br />

Norwegian Fixed Income Team<br />

Performances are in NOK<br />

*CGBI WGBI NW ALL MATS (NOK) - TR Index<br />

**Annualized 3 year data<br />

Asset Allocation in %<br />

Asset Type<br />

Fund<br />

Corporate Bonds 46.80<br />

Government Bonds 38.52<br />

Mortgage Institutions 7.81<br />

Net Liquid Assets 6.85<br />

Rating<br />

Fund<br />

NR 64.54<br />

Aaa 26.03<br />

Aa2 2.56<br />

Net Liquid Assets 6.85<br />

Top Holdings in %<br />

Security Name<br />

Rating<br />

Asset Type<br />

Weight<br />

Norsk Stat 06/17 Aaa<br />

Government Bonds<br />

11.05<br />

Norsk Stat 02/13 Aaa<br />

Government Bonds<br />

10.00<br />

Norske Stat 05/19 Government Bonds<br />

5.38<br />

DNBA42 5.15% 2014-02-12 Corporate Bonds<br />

5.28<br />

BN Boligkreditt 6.40% 2010-05-21 Mortgage Institutions<br />

5.24<br />

Norsk Stat 05/15 Aaa<br />

Government Bonds<br />

4.97<br />

Orkla 6,54% 2013-02-12 Corporate Bonds<br />

4.91<br />

ICO 5,000% 2015-05-15 Government Bonds<br />

4.26<br />

Oslo kommune 4.4500% 2015-11-23 Corporate Bonds<br />

3.87<br />

Sparebanken Soer 06/16 Fixed Corporate Bonds<br />

3.75<br />

Investment Strategy<br />

The fund invests a minimum of two-thirds of its net assets in fixed-income and floating rate debt securities issued by private borrowers and public authorities domiciled in Norway.<br />

The Sub-fund invests in bonds denominated in NOK. Invested are government bonds or bonds issued by local authorities or agencies, mortgage bonds, corporate bonds with a<br />

good rating, and bonds issued by supranational institutions. The Fund may further use derivative instruments to reduce risks. The Fund aims to exploit market movements as well<br />

as the yield spreads between various credit risk segments.