Sustainability Report 2009 - The Co-operative

Sustainability Report 2009 - The Co-operative

Sustainability Report 2009 - The Co-operative

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Diversity Social inclusion Ethical finance Diet and health Animal welfare International development and human rights <strong>Co</strong>mmunity investment Social responsibility<br />

In December 2006, following lobbying by <strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Bank 7 ,<br />

the LINK Network Members <strong>Co</strong>uncil agreed the introduction of a<br />

new financial inclusion premium, which incentivises ATM operators<br />

to deploy free-to-use cash machines in financially excluded target<br />

communities. <strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Bank currently has 37 ATMs<br />

located in such communities, helping to meet basic banking needs<br />

in these areas. By the end of 2007, charges were removed from<br />

all <strong>Co</strong>-<strong>operative</strong> Bank ATMs – either by way of conversion to free<br />

machines, or physical removal of the ATM from the site.<br />

Ethical finance<br />

Banking support for small businesses in deprived areas<br />

CFS’ provision of finance to small businesses in deprived areas<br />

remains significantly above the industry average, despite a small<br />

decline in provision from 2008, in line with an overall decrease<br />

in lending across the industry.<br />

Performance benchmark<br />

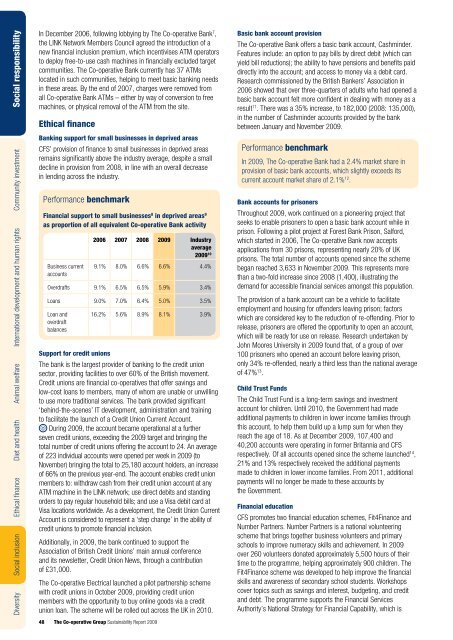

Financial support to small businesses 8 in deprived areas 9<br />

as proportion of all equivalent <strong>Co</strong>-<strong>operative</strong> Bank activity<br />

Business current<br />

accounts<br />

2006 2007 2008 <strong>2009</strong> Industry<br />

average<br />

<strong>2009</strong> 10<br />

9.1% 8.0% 6.6% 6.6% 4.4%<br />

Overdrafts 9.1% 6.5% 6.5% 5.9% 3.4%<br />

Loans 9.0% 7.0% 6.4% 5.0% 3.5%<br />

Loan and<br />

overdraft<br />

balances<br />

16.2% 5.6% 8.9% 8.1% 3.9%<br />

Support for credit unions<br />

<strong>The</strong> bank is the largest provider of banking to the credit union<br />

sector, providing facilities to over 60% of the British movement.<br />

Credit unions are financial co-<strong>operative</strong>s that offer savings and<br />

low-cost loans to members, many of whom are unable or unwilling<br />

to use more traditional services. <strong>The</strong> bank provided significant<br />

‘behind-the-scenes’ IT development, administration and training<br />

to facilitate the launch of a Credit Union Current Account.<br />

During <strong>2009</strong>, the account became operational at a further<br />

seven credit unions, exceeding the <strong>2009</strong> target and bringing the<br />

total number of credit unions offering the account to 24. An average<br />

of 223 individual accounts were opened per week in <strong>2009</strong> (to<br />

November) bringing the total to 25,180 account holders, an increase<br />

of 66% on the previous year-end. <strong>The</strong> account enables credit union<br />

members to: withdraw cash from their credit union account at any<br />

ATM machine in the LINK network; use direct debits and standing<br />

orders to pay regular household bills; and use a Visa debit card at<br />

Visa locations worldwide. As a development, the Credit Union Current<br />

Account is considered to represent a ‘step change’ in the ability of<br />

credit unions to promote financial inclusion.<br />

Additionally, in <strong>2009</strong>, the bank continued to support the<br />

Association of British Credit Unions’ main annual conference<br />

and its newsletter, Credit Union News, through a contribution<br />

of £31,000.<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Electrical launched a pilot partnership scheme<br />

with credit unions in October <strong>2009</strong>, providing credit union<br />

members with the opportunity to buy online goods via a credit<br />

union loan. <strong>The</strong> scheme will be rolled out across the UK in 2010.<br />

Basic bank account provision<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Bank offers a basic bank account, Cashminder.<br />

Features include: an option to pay bills by direct debit (which can<br />

yield bill reductions); the ability to have pensions and benefits paid<br />

directly into the account; and access to money via a debit card.<br />

Research commissioned by the British Bankers’ Association in<br />

2006 showed that over three-quarters of adults who had opened a<br />

basic bank account felt more confident in dealing with money as a<br />

result 11 . <strong>The</strong>re was a 35% increase, to 182,000 (2008: 135,000),<br />

in the number of Cashminder accounts provided by the bank<br />

between January and November <strong>2009</strong>.<br />

Performance benchmark<br />

In <strong>2009</strong>, <strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Bank had a 2.4% market share in<br />

provision of basic bank accounts, which slightly exceeds its<br />

current account market share of 2.1% 12 .<br />

Bank accounts for prisoners<br />

Throughout <strong>2009</strong>, work continued on a pioneering project that<br />

seeks to enable prisoners to open a basic bank account while in<br />

prison. Following a pilot project at Forest Bank Prison, Salford,<br />

which started in 2006, <strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Bank now accepts<br />

applications from 30 prisons, representing nearly 20% of UK<br />

prisons. <strong>The</strong> total number of accounts opened since the scheme<br />

began reached 3,633 in November <strong>2009</strong>. This represents more<br />

than a two-fold increase since 2008 (1,400), illustrating the<br />

demand for accessible financial services amongst this population.<br />

<strong>The</strong> provision of a bank account can be a vehicle to facilitate<br />

employment and housing for offenders leaving prison; factors<br />

which are considered key to the reduction of re-offending. Prior to<br />

release, prisoners are offered the opportunity to open an account,<br />

which will be ready for use on release. Research undertaken by<br />

John Moores University in <strong>2009</strong> found that, of a group of over<br />

100 prisoners who opened an account before leaving prison,<br />

only 34% re-offended, nearly a third less than the national average<br />

of 47% 13 .<br />

Child Trust Funds<br />

<strong>The</strong> Child Trust Fund is a long-term savings and investment<br />

account for children. Until 2010, the Government had made<br />

additional payments to children in lower income families through<br />

this account, to help them build up a lump sum for when they<br />

reach the age of 18. As at December <strong>2009</strong>, 107,400 and<br />

40,200 accounts were operating in former Britannia and CFS<br />

respectively. Of all accounts opened since the scheme launched 14 ,<br />

21% and 13% respectively received the additional payments<br />

made to children in lower income families. From 2011, additional<br />

payments will no longer be made to these accounts by<br />

the Government.<br />

Financial education<br />

CFS promotes two financial education schemes, Fit4Finance and<br />

Number Partners. Number Partners is a national volunteering<br />

scheme that brings together business volunteers and primary<br />

schools to improve numeracy skills and achievement. In <strong>2009</strong><br />

over 260 volunteers donated approximately 5,500 hours of their<br />

time to the programme, helping approximately 900 children. <strong>The</strong><br />

Fit4Finance scheme was developed to help improve the financial<br />

skills and awareness of secondary school students. Workshops<br />

cover topics such as savings and interest, budgeting, and credit<br />

and debt. <strong>The</strong> programme supports the Financial Services<br />

Authority’s National Strategy for Financial Capability, which is<br />

48<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Group <strong>Sustainability</strong> <strong>Report</strong> <strong>2009</strong>