Sustainability Report 2009 - The Co-operative

Sustainability Report 2009 - The Co-operative

Sustainability Report 2009 - The Co-operative

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Delivering value<br />

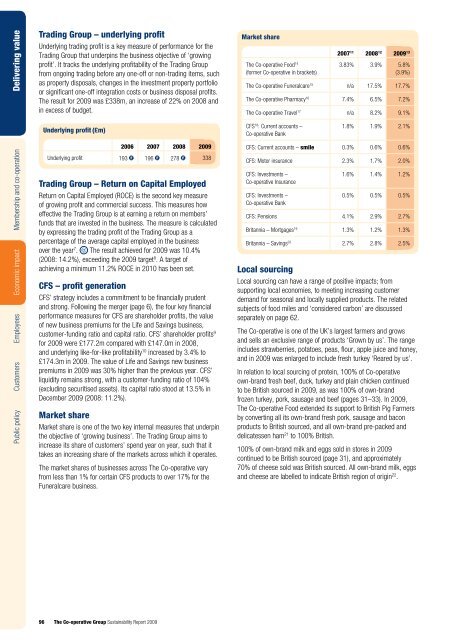

Trading Group – underlying profit<br />

Underlying trading profit is a key measure of performance for the<br />

Trading Group that underpins the business objective of ‘growing<br />

profit’. It tracks the underlying profitability of the Trading Group<br />

from ongoing trading before any one-off or non-trading items, such<br />

as property disposals, changes in the investment property portfolio<br />

or significant one-off integration costs or business disposal profits.<br />

<strong>The</strong> result for <strong>2009</strong> was £338m, an increase of 22% on 2008 and<br />

in excess of budget.<br />

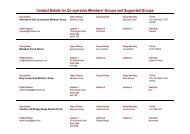

Market share<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Food 14<br />

(former <strong>Co</strong>-<strong>operative</strong> in brackets)<br />

2007 11 2008 12 <strong>2009</strong> 13<br />

3.83% 3.9% 5.8%<br />

(3.9%)<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Funeralcare 15 n/a 17.5% 17.7%<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Pharmacy 16 7.4% 6.5% 7.2%<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Travel 17 n/a 8.2% 9.1%<br />

Underlying profit (£m)<br />

CFS 18 : Current accounts –<br />

<strong>Co</strong>-<strong>operative</strong> Bank<br />

1.8% 1.9% 2.1%<br />

Public policy Customers Employees Economic impact Membership and co-operation<br />

2006 2007 2008 <strong>2009</strong><br />

Underlying profit 193 r 196 r 278 r 338<br />

Trading Group – Return on Capital Employed<br />

Return on Capital Employed (ROCE) is the second key measure<br />

of growing profit and commercial success. This measures how<br />

effective the Trading Group is at earning a return on members’<br />

funds that are invested in the business. <strong>The</strong> measure is calculated<br />

by expressing the trading profit of the Trading Group as a<br />

percentage of the average capital employed in the business<br />

over the year 7 . <strong>The</strong> result achieved for <strong>2009</strong> was 10.4%<br />

(2008: 14.2%), exceeding the <strong>2009</strong> target 8 . A target of<br />

achieving a minimum 11.2% ROCE in 2010 has been set.<br />

CFS – profit generation<br />

CFS’ strategy includes a commitment to be financially prudent<br />

and strong. Following the merger (page 6), the four key financial<br />

performance measures for CFS are shareholder profits, the value<br />

of new business premiums for the Life and Savings business,<br />

customer-funding ratio and capital ratio. CFS’ shareholder profits 9<br />

for <strong>2009</strong> were £177.2m compared with £147.0m in 2008,<br />

and underlying like-for-like profitability 10 increased by 3.4% to<br />

£174.3m in <strong>2009</strong>. <strong>The</strong> value of Life and Savings new business<br />

premiums in <strong>2009</strong> was 30% higher than the previous year. CFS’<br />

liquidity remains strong, with a customer-funding ratio of 104%<br />

(excluding securitised assets). Its capital ratio stood at 13.5% in<br />

December <strong>2009</strong> (2008: 11.2%).<br />

Market share<br />

Market share is one of the two key internal measures that underpin<br />

the objective of ‘growing business’. <strong>The</strong> Trading Group aims to<br />

increase its share of customers’ spend year on year, such that it<br />

takes an increasing share of the markets across which it operates.<br />

<strong>The</strong> market shares of businesses across <strong>The</strong> <strong>Co</strong>-<strong>operative</strong> vary<br />

from less than 1% for certain CFS products to over 17% for the<br />

Funeralcare business.<br />

CFS: Current accounts – smile 0.3% 0.6% 0.6%<br />

CFS: Motor insurance 2.3% 1.7% 2.0%<br />

CFS: Investments –<br />

<strong>Co</strong>-<strong>operative</strong> Insurance<br />

CFS: Investments –<br />

<strong>Co</strong>-<strong>operative</strong> Bank<br />

1.6% 1.4% 1.2%<br />

0.5% 0.5% 0.5%<br />

CFS: Pensions 4.1% 2.9% 2.7%<br />

Britannia – Mortgages 19 1.3% 1.2% 1.3%<br />

Britannia – Savings 20 2.7% 2.8% 2.5%<br />

Local sourcing<br />

Local sourcing can have a range of positive impacts; from<br />

supporting local economies, to meeting increasing customer<br />

demand for seasonal and locally supplied products. <strong>The</strong> related<br />

subjects of food miles and ‘considered carbon’ are discussed<br />

separately on page 62.<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> is one of the UK’s largest farmers and grows<br />

and sells an exclusive range of products ‘Grown by us’. <strong>The</strong> range<br />

includes strawberries, potatoes, peas, flour, apple juice and honey,<br />

and in <strong>2009</strong> was enlarged to include fresh turkey ‘Reared by us’.<br />

In relation to local sourcing of protein, 100% of <strong>Co</strong>-<strong>operative</strong><br />

own-brand fresh beef, duck, turkey and plain chicken continued<br />

to be British sourced in <strong>2009</strong>, as was 100% of own-brand<br />

frozen turkey, pork, sausage and beef (pages 31–33). In <strong>2009</strong>,<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Food extended its support to British Pig Farmers<br />

by converting all its own-brand fresh pork, sausage and bacon<br />

products to British sourced, and all own-brand pre-packed and<br />

delicatessen ham 21 to 100% British.<br />

100% of own-brand milk and eggs sold in stores in <strong>2009</strong><br />

continued to be British sourced (page 31), and approximately<br />

70% of cheese sold was British sourced. All own-brand milk, eggs<br />

and cheese are labelled to indicate British region of origin 22 .<br />

96<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Group <strong>Sustainability</strong> <strong>Report</strong> <strong>2009</strong>