Sustainability Report 2009 - The Co-operative

Sustainability Report 2009 - The Co-operative

Sustainability Report 2009 - The Co-operative

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

British sourced, traditional Hampshire breed pigs on one of<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Food’s supplier farms.<br />

Tax<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> operates within a clearly defined Tax Strategy<br />

and Policy that has been approved by the Board and which is<br />

central to tax governance within the business. <strong>The</strong> policy covers<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong>’s approach to tax compliance, planning and the<br />

management of risks associated with tax. <strong>The</strong> <strong>Co</strong>-<strong>operative</strong> does<br />

not enter into what it considers to be aggressive tax planning and<br />

is particularly mindful of the reputational risks associated with<br />

undertaking such planning 23 .<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong>’s <strong>2009</strong> tax payments and credits are detailed<br />

in the Annual <strong>Report</strong> and Accounts. <strong>The</strong> <strong>2009</strong> tax charge on<br />

continuing business was £114.4m (2008: £2.9m credit) excluding<br />

£6.4m (2008: £52.1m credit) relating to tax attributable to<br />

<strong>Co</strong>-<strong>operative</strong> Insurance policyholders’ returns. <strong>The</strong> charge<br />

including tax relating to policyholders was £121.8m (2008:<br />

£55.0m credit). <strong>The</strong> effective tax rate is 38.8% compared<br />

with a standard rate of 28% 24 .<br />

A revised <strong>Co</strong>-<strong>operative</strong> Bank Ethical Policy, launched at the<br />

beginning of <strong>2009</strong>, following extensive consultation with customers<br />

(page 40), contains a new policy position on corporate payment<br />

of tax. As such, from <strong>2009</strong>, <strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Bank has operated<br />

a policy not to finance organisations that take an irresponsible<br />

approach to the payment of tax in the least developed countries.<br />

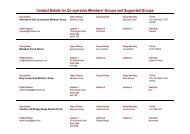

Value added<br />

Economic value added expresses the contribution to national<br />

wealth made by a commercial organisation, and seeks to illustrate<br />

how a range of stakeholders can benefit from such wealth creation.<br />

For example, economic value can be dispersed to: employees<br />

in the form of salaries; the State in the form of taxes; charitable<br />

causes in the form of donations; and owners in the form of profit,<br />

dividend and reserves.<br />

added 25<br />

402<br />

812 Central & Eastern<br />

North<br />

723<br />

North West &<br />

North Midlands<br />

Value<br />

Scotland &<br />

Northern Ireland<br />

739<br />

South East<br />

2007<br />

South<br />

2008<br />

West<br />

<strong>2009</strong><br />

£m £m £m<br />

1,355<br />

Wales<br />

892 Operating profit = Profit before<br />

tax 26 + gross interest cost less gains<br />

(or plus losses) arising from sale/<br />

disposal of businesses or assets.<br />

158.0 r<br />

991<br />

284.4 r 465.5<br />

Employee costs = Total<br />

employment costs (wages and<br />

salaries, social security and<br />

pension costs).<br />

Depreciation and amortisation<br />

= Depreciation on owned assets<br />

and assets held under financial<br />

leases + amortisation of intangible<br />

assets + impairment of property,<br />

plant and equipment; goodwill and<br />

intangible assets.<br />

1,246.4 1,313.5 1,701.4<br />

259.0 298.2 390.2<br />

Significant items 142.6 113.0 95.9<br />

Value added 1,806.0 r 2,009.1 r 2,653.0<br />

Distribution of value added <strong>2009</strong>: total £2,653.0m 27<br />

435.7<br />

116.1<br />

11.3<br />

97.1<br />

384.1<br />

1,608.7<br />

Employee wages and<br />

pension benefits<br />

Payments to<br />

Government<br />

Distributed to members<br />

Paid to the community<br />

Paid to providers<br />

of capital<br />

Set aside for capital<br />

maintenance and<br />

future growth<br />

In order to demonstrate the productivity and efficiency of business<br />

operations and enable benchmarking against competitors in these<br />

areas, regardless of company size, two further measures can be<br />

calculated based on value-added information: Labour Productivity<br />

(P1) 28 ; and Wealth Creation Efficiency (P2) 29 .<br />

Performance benchmark<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong>’s 30 P1 was £23,400 in <strong>2009</strong> (2008:<br />

£24,600), and its P2 was 136% (2008: 135%). <strong>The</strong><br />

Department for Innovation, Universities and Skills’ <strong>2009</strong> Value<br />

Added Scoreboard presents results for the UK’s top 800<br />

companies by value added 31 . Of the food and drug retailers<br />

listed, the average P1 is £20,387 and average P2 is 134.2%.<br />

Banks score significantly higher on both measures, due to the<br />

nature of their business, with an average P1 of £109,744 and<br />

an average P2 of 204.6%.<br />

Delivering value Membership and co-operation Economic impact Employees Customers Public policy<br />

<strong>The</strong> <strong>Co</strong>-<strong>operative</strong> Group <strong>Sustainability</strong> <strong>Report</strong> <strong>2009</strong> 97