hse group

hse group

hse group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2.8 FINANCIAL OPERATIONS<br />

Basic Goals<br />

During 2002 the HSE Group financial<br />

operations were aimed at the following:<br />

• Providing a sufficient level of solvency<br />

for the company and thereby indirectly<br />

also for companies within HSE<br />

Group as contractual partners of HSE<br />

• Investing<br />

• Risk management<br />

• Economically sound investing of surplus<br />

funds<br />

• Organization of the Finance Sector<br />

In its business decisions the company<br />

has to bear in mind the basic principles<br />

of long-term as well as short-term solvency.<br />

The execution of the financial<br />

function was closely linked to the specific<br />

form in which HSE was established,<br />

the financial performance in<br />

electricity trading and the adopted<br />

investment plan.<br />

In February 2002 we received two shortterm<br />

loans in a total amount of SIT 2.3<br />

billion (Banka Celje and Nova kreditna<br />

banka Maribor) in order to bridge a liquidity<br />

gap. This was to amend the gap<br />

between the purchasing and selling side<br />

of HSE operations, while at the same<br />

time this meant that sustained liquidity<br />

was provided to other companies acting<br />

as HSE suppliers. Both loans were paid<br />

off in their full amount in June 2002.<br />

Risk Fund<br />

Due to potential negative effects of<br />

electricity trading we started establishing<br />

a liquidity risk fund in the second<br />

part of 2002. We were able to do so by<br />

consistently collecting debts from all of<br />

the company’s buyers, utilizing detailed<br />

cash flow planning, and consistently<br />

investing short-term liquidity surplus<br />

funds under the most favorable conditions<br />

currently available in the capital<br />

market. In doing so we took into consideration<br />

the criteria of maximum<br />

investment diversification in:<br />

• Bank deposits in SIT<br />

• Foreign currency bank deposits<br />

• High-liquidity securities and treasury<br />

bonds<br />

• Securities repurchase and granting<br />

security loans<br />

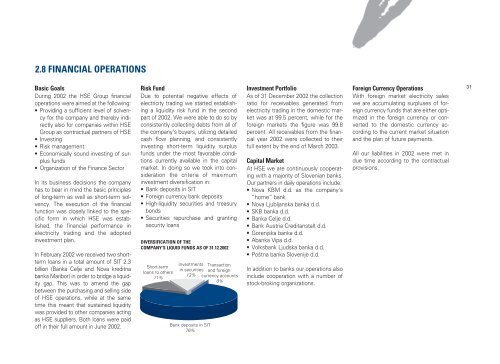

DIVERSIFICATION OF THE<br />

COMPANY’S LIQUID FUNDS AS OF 31.12.2002<br />

Short-term<br />

loans to others<br />

11%<br />

Investments<br />

in securities<br />

13%<br />

Bank deposits in SIT<br />

76%<br />

Transaction<br />

and foreign<br />

currency accounts<br />

0%<br />

Investment Portfolio<br />

As of 31 December 2002 the collection<br />

ratio for receivables generated from<br />

electricity trading in the domestic market<br />

was at 99.5 percent, while for the<br />

foreign markets the figure was 99.8<br />

percent. All receivables from the financial<br />

year 2002 were collected to their<br />

full extent by the end of March 2003.<br />

Capital Market<br />

At HSE we are continuously cooperating<br />

with a majority of Slovenian banks.<br />

Our partners in daily operations include:<br />

• Nova KBM d.d. as the company’s<br />

“home” bank<br />

• Nova Ljubljanska banka d.d.<br />

• SKB banka d.d.<br />

• Banka Celje d.d.<br />

• Bank Austria Creditanstalt d.d.<br />

• Gorenjska banka d.d.<br />

• Abanka Vipa d.d.<br />

• Volksbank Ljudska banka d.d.<br />

• Poπtna banka Slovenije d.d.<br />

In addition to banks our operations also<br />

include cooperation with a number of<br />

stock-broking organizations.<br />

Foreign Currency Operations<br />

With foreign market electricity sales<br />

we are accumulating surpluses of foreign<br />

currency funds that are either optimized<br />

in the foreign currency or converted<br />

to the domestic currency according<br />

to the current market situation<br />

and the plan of future payments.<br />

All our liabilities in 2002 were met in<br />

due time according to the contractual<br />

provisions.<br />

31