GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

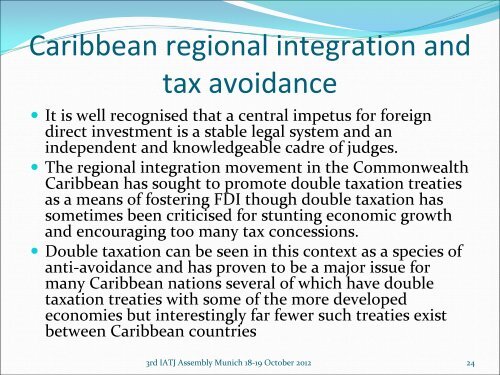

Caribbean regional integration and<br />

tax avoidance<br />

• It is well recognised that a central impetus for foreign<br />

direct investment is a stable legal system and an<br />

independent and knowledgeable cadre of judges.<br />

• The regional integration movement in the Commonwealth<br />

Caribbean has sought to promote double taxation treaties<br />

as a means of fostering FDI though double taxation has<br />

sometimes been criticised for stunting economic growth<br />

and encouraging too many tax concessions.<br />

• Double taxation can be seen in this context as a species of<br />

anti‐avoidance and has proven to be a major issue for<br />

many Caribbean nations several of which have double<br />

taxation treaties with some of the more developed<br />

economies but interestingly far fewer such treaties exist<br />

between Caribbean countries<br />

3rd IATJ Assembly Munich 18‐19 October 2012 24