GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

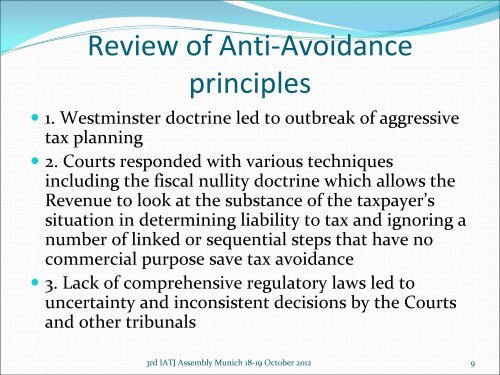

Review of Anti‐Avoidance<br />

principles<br />

• 1. Westminster doctrine led to outbreak of aggressive<br />

tax planning<br />

• 2. Courts responded with various techniques<br />

including the fiscal nullity doctrine which allows the<br />

Revenue to look at the substance of the taxpayer’s<br />

situation in determining liability to tax and ignoring a<br />

number of linked or sequential steps that have no<br />

commercial purpose save tax avoidance<br />

• 3. Lack of comprehensive regulatory laws led to<br />

uncertainty and inconsistent decisions by the Courts<br />

and other tribunals<br />

3rd IATJ Assembly Munich 18‐19 October 2012 9