GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

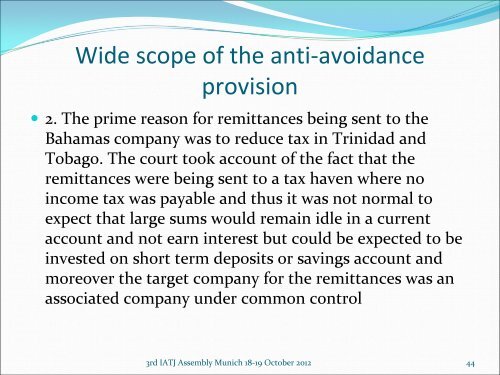

Wide scope of the anti‐avoidance<br />

provision<br />

• 2. The prime reason for remittances being sent to the<br />

Bahamas company was to reduce tax in <strong>Trinidad</strong> and<br />

<strong>Tobago</strong>. The court took account of the fact that the<br />

remittances were being sent to a tax haven where no<br />

income tax was payable and thus it was not normal to<br />

expect that large sums would remain idle in a current<br />

account and not earn interest but could be expected to be<br />

invested on short term deposits or savings account and<br />

moreover the target company for the remittances was an<br />

associated company under common control<br />

3rd IATJ Assembly Munich 18‐19 October 2012 44