GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

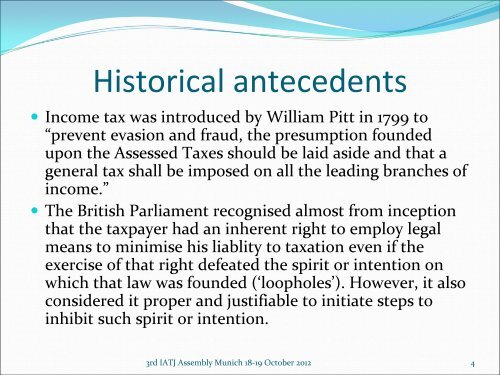

Historical antecedents<br />

• Income tax was introduced by William Pitt in 1799 to<br />

“prevent evasion and fraud, the presumption founded<br />

upon the Assessed Taxes should be laid aside and that a<br />

general tax shall be imposed on all the leading branches of<br />

income.”<br />

• The British Parliament recognised almost from inception<br />

that the taxpayer had an inherent right to employ legal<br />

means to minimise his liablity to taxation even if the<br />

exercise of that right defeated the spirit or intention on<br />

which that law was founded (‘loopholes’). However, it also<br />

considered it proper and justifiable to initiate steps to<br />

inhibit such spirit or intention.<br />

3rd IATJ Assembly Munich 18‐19 October 2012 4