GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

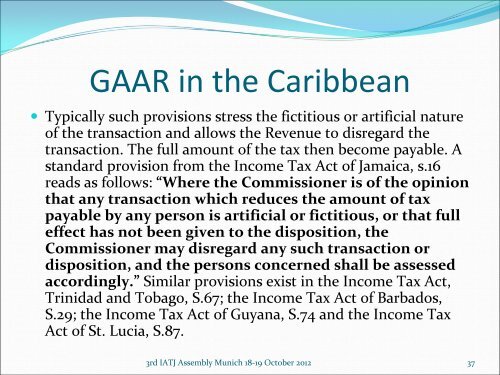

<strong>GAAR</strong> in the Caribbean<br />

• Typically such provisions stress the fictitious or artificial nature<br />

of the transaction and allows the Revenue to disregard the<br />

transaction. The full amount of the tax then become payable. A<br />

standard provision from the Income Tax Act of Jamaica, s.16<br />

reads as follows: “Where the Commissioner is of the opinion<br />

that any transaction which reduces the amount of tax<br />

payable by any person is artificial or fictitious, or that full<br />

effect has not been given to the disposition, the<br />

Commissioner may disregard any such transaction or<br />

disposition, and the persons concerned shall be assessed<br />

accordingly.” Similar provisions exist in the Income Tax Act,<br />

<strong>Trinidad</strong> and <strong>Tobago</strong>, S.67; the Income Tax Act of Barbados,<br />

S.29; the Income Tax Act of Guyana, S.74 and the Income Tax<br />

Act of St. Lucia, S.87.<br />

3rd IATJ Assembly Munich 18‐19 October 2012 37