GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

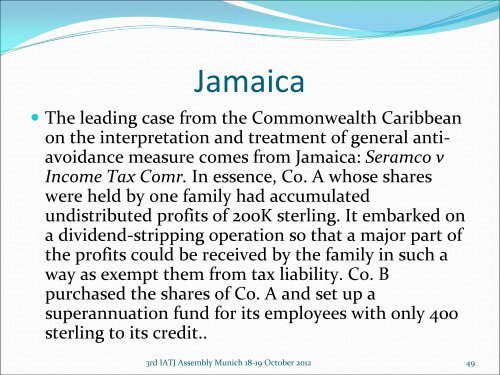

Jamaica<br />

• The leading case from the Commonwealth Caribbean<br />

on the interpretation and treatment of general antiavoidance<br />

measure comes from Jamaica: Seramco v<br />

Income Tax Comr. In essence, Co. A whose shares<br />

were held by one family had accumulated<br />

undistributed profits of 200K sterling. It embarked on<br />

a dividend‐stripping operation so that a major part of<br />

the profits could be received by the family in such a<br />

way as exempt them from tax liability. Co. B<br />

purchased the shares of Co. A and set up a<br />

superannuation fund for its employees with only 400<br />

sterling to its credit..<br />

3rd IATJ Assembly Munich 18‐19 October 2012 49