GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

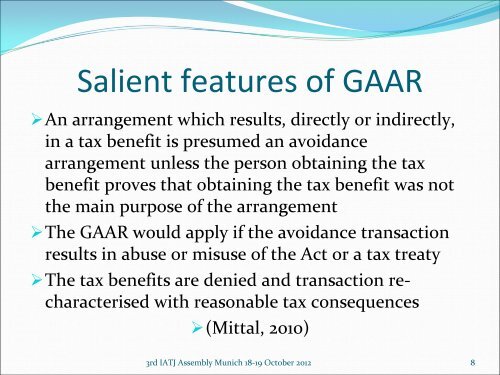

Salient features of <strong>GAAR</strong><br />

‣An arrangement which results, directly or indirectly,<br />

in a tax benefit is presumed an avoidance<br />

arrangement unless the person obtaining the tax<br />

benefit proves that obtaining the tax benefit was not<br />

the main purpose of the arrangement<br />

‣The <strong>GAAR</strong> would apply if the avoidance transaction<br />

results in abuse or misuse of the Act or a tax treaty<br />

‣The tax benefits are denied and transaction recharacterised<br />

with reasonable tax consequences<br />

‣(Mittal, 2010)<br />

3rd IATJ Assembly Munich 18‐19 October 2012 8