GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

GAAR - Trinidad & Tobago - Iatj.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

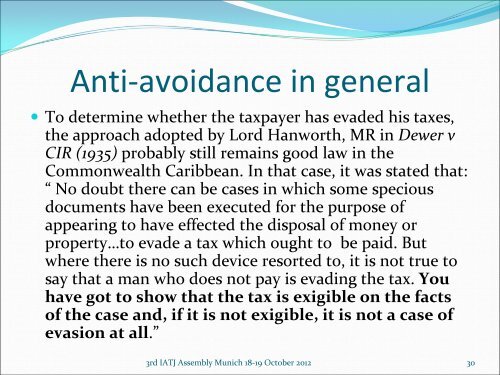

Anti‐avoidance in general<br />

• To determine whether the taxpayer has evaded his taxes,<br />

the approach adopted by Lord Hanworth, MR in Dewer v<br />

CIR (1935) probably still remains good law in the<br />

Commonwealth Caribbean. In that case, it was stated that:<br />

“No doubt there can be cases in which some specious<br />

documents have been executed for the purpose of<br />

appearing to have effected the disposal of money or<br />

property…to evade a tax which ought to be paid. But<br />

where there is no such device resorted to, it is not true to<br />

say that a man who does not pay is evading the tax. You<br />

have got to show that the tax is exigible on the facts<br />

of the case and, if it is not exigible, it is not a case of<br />

evasion at all.”<br />

3rd IATJ Assembly Munich 18‐19 October 2012 30