Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

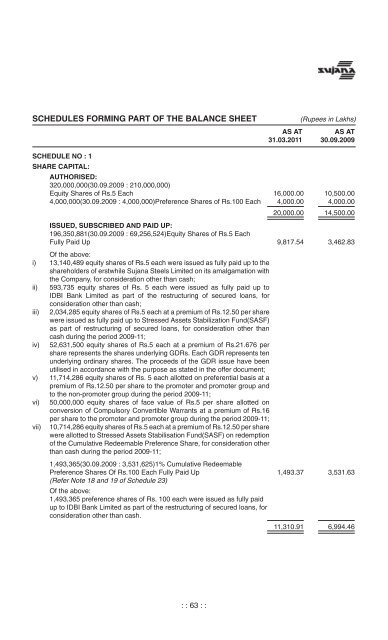

SCHEDULES FORMING PART OF THE BALANCE SHEET<br />

(Rupees in Lakhs)<br />

AS AT AS AT<br />

31.03.2011 30.09.2009<br />

SCHEDULE NO : 1<br />

SHARE CAPITAL:<br />

AUTHORISED:<br />

320,000,000(30.09.2009 : 210,000,000)<br />

Equity Shares of Rs.5 Each 16,000.00 10,500.00<br />

4,000,000(30.09.2009 : 4,000,000)Preference Shares of Rs.100 Each 4,000.00 4,000.00<br />

20,000.00 14,500.00<br />

ISSUED, SUBSCRIBED AND PAID UP:<br />

196,350,881(30.09.2009 : 69,256,524)Equity Shares of Rs.5 Each<br />

Fully Paid Up 9,817.54 3,462.83<br />

Of the above:<br />

i) 13,140,489 equity shares of Rs.5 each were issued as fully paid up to the<br />

shareholders of erstwhile <strong>Sujana</strong> Steels Limited on its amalgamation with<br />

the Company, for consideration other than cash;<br />

ii) 593,735 equity shares of Rs. 5 each were issued as fully paid up to<br />

IDBI Bank Limited as part of the restructuring of secured loans, for<br />

consideration other than cash;<br />

iii) 2,034,285 equity shares of Rs.5 each at a premium of Rs.12.50 per share<br />

were issued as fully paid up to Stressed Assets Stabilization Fund(SASF)<br />

as part of restructuring of secured loans, for consideration other than<br />

cash during the period 2009-11;<br />

iv)<br />

52,631,500 equity shares of Rs.5 each at a premium of Rs.21.676 per<br />

share represents the shares underlying GDRs. Each GDR represents ten<br />

underlying ordinary shares. The proceeds of the GDR issue have been<br />

utilised in accordance with the purpose as stated in the offer document;<br />

v) 11,714,286 equity shares of Rs. 5 each allotted on preferential basis at a<br />

premium of Rs.12.50 per share to the promoter and promoter group and<br />

to the non-promoter group during the period 2009-11;<br />

vi)<br />

vii)<br />

50,000,000 equity shares of face value of Rs.5 per share allotted on<br />

conversion of Compulsory Convertible Warrants at a premium of Rs.16<br />

per share to the promoter and promoter group during the period 2009-11;<br />

10,714,286 equity shares of Rs.5 each at a premium of Rs.12.50 per share<br />

were allotted to Stressed Assets Stabilisation Fund(SASF) on redemption<br />

of the Cumulative Redeemable Preference Share, for consideration other<br />

than cash during the period 2009-11;<br />

1,493,365(30.09.2009 : 3,531,625)1% Cumulative Redeemable<br />

Preference Shares Of Rs.100 Each Fully Paid Up 1,493.37 3,531.63<br />

(Refer Note 18 and 19 of Schedule 23)<br />

Of the above:<br />

1,493,365 preference shares of Rs. 100 each were issued as fully paid<br />

up to IDBI Bank Limited as part of the restructuring of secured loans, for<br />

consideration other than cash.<br />

11,310.91 6,994.46<br />

: : 63 : :