india going global.indd - The IIPM Think Tank

india going global.indd - The IIPM Think Tank

india going global.indd - The IIPM Think Tank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MERGERS & ACQUISITIONS<br />

– Distress sale<br />

● Schemes of arrangement by companies, etc. – Supporting<br />

management buy outs<br />

<strong>The</strong>re is also a rising trend in buyback of issued equity<br />

by companies. Disinvestment is also an acquisition by<br />

the new owners of the business hitherto owned by the<br />

government. This trend is as significant at the State level<br />

(if not more) as compared to the Central government.<br />

Private Equity or PE players are actively promoting<br />

all forms in this trend. Along with dedicated foreign<br />

funds with Asia / India / Emerging Markets specific<br />

nature, funds scout around for profitable and promising<br />

ventures and organizations wherein they can participate<br />

and fund the action deals.<br />

Composition and Constituents:<br />

M & A activity which started as stray instances in the<br />

80s started to trickle in the 90s and becoming a surging<br />

phenomenon in this decade, thereby taking tsunami<br />

– like proportions in 2007. <strong>The</strong> figures tell the entire<br />

story: considered in no. of deals, in terms of deal size,<br />

in the sector of economy covered, competition faced,<br />

et all. <strong>The</strong> absolute numbers were to the tune of <strong>global</strong>ly<br />

transacted 24806 deals amounting to US$ 2059 bn<br />

worldwide while India’s share in that was roughly to the<br />

tune of 394 transactions amounting to around US $ 10<br />

bn in the year 2005 which saw a steep rise of 52% over<br />

the previous year and thereby promising to outbeat the<br />

previous year by a good measure in 2006.<br />

While the activity was seen mainly in the domestic<br />

markets, with firms acquiring a certain critical mass,<br />

the focus then shifted overseas. <strong>The</strong>n again in 2005<br />

the majority of action was seen in the IT and ITES<br />

sectors, the following year saw transactions in general<br />

engineering industry and infrastructure segments. <strong>The</strong><br />

average size of the deal also rose significantly – US $<br />

794 mn for the top 20 transactions – much higher than<br />

the previous years` average of US $ 538 mn.<br />

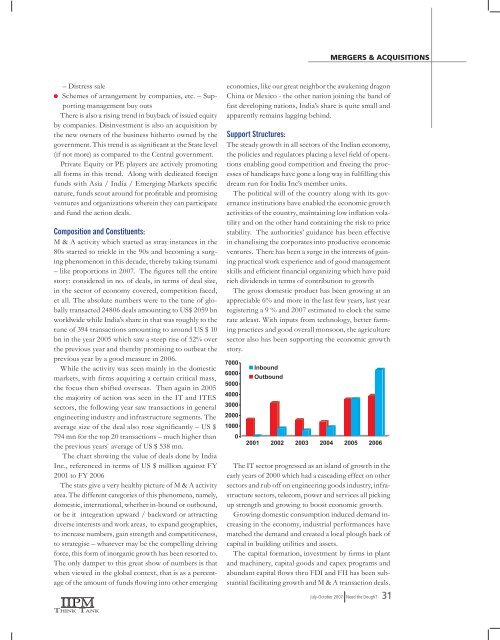

<strong>The</strong> chart showing the value of deals done by India<br />

Inc., referenced in terms of US $ million against FY<br />

2001 to FY 2006<br />

<strong>The</strong> stats give a very healthy picture of M & A activity<br />

area. <strong>The</strong> different categories of this phenomena, namely,<br />

domestic, international, whether in-bound or outbound,<br />

or be it integration upward / backward or attracting<br />

diverse interests and work areas, to expand geographies,<br />

to increase numbers, gain strength and competitiveness,<br />

to strategise – whatever may be the compelling driving<br />

force, this form of inorganic growth has been resorted to.<br />

<strong>The</strong> only damper to this great show of numbers is that<br />

when viewed in the <strong>global</strong> context, that is as a percentage<br />

of the amount of funds flowing into other emerging<br />

economies, like our great neighbor the awakening dragon<br />

China or Mexico - the other nation joining the band of<br />

fast developing nations, India’s share is quite small and<br />

apparently remains lagging behind.<br />

Support Structures:<br />

<strong>The</strong> steady growth in all sectors of the Indian economy,<br />

the policies and regulators placing a level field of operations<br />

enabling good competition and freeing the processes<br />

of handicaps have gone a long way in fulfilling this<br />

dream run for India Inc’s member units.<br />

<strong>The</strong> political will of the country along with its governance<br />

institutions have enabled the economic growth<br />

activities of the country, maintaining low inflation volatility<br />

and on the other hand containing the risk to price<br />

stability. <strong>The</strong> authorities’ guidance has been effective<br />

in chanelising the corporates into productive economic<br />

ventures. <strong>The</strong>re has been a surge in the interests of gaining<br />

practical work experience and of good management<br />

skills and efficient financial organizing which have paid<br />

rich dividends in terms of contribution to growth<br />

<strong>The</strong> gross domestic product has been growing at an<br />

appreciable 6% and more in the last few years, last year<br />

registering a 9 % and 2007 estimated to clock the same<br />

rate atleast. With inputs from technology, better farming<br />

practices and good overall monsoon, the agriculture<br />

sector also has been supporting the economic growth<br />

story.<br />

<strong>The</strong> IT sector progressed as an island of growth in the<br />

early years of 2000 which had a cascading effect on other<br />

sectors and rub off on engineering goods industry, infrastructure<br />

sectors, telecom, power and services all picking<br />

up strength and growing to boost economic growth.<br />

Growing domestic consumption induced demand increasing<br />

in the economy, industrial performances have<br />

matched the demand and created a local plough back of<br />

capital in building utilities and assets.<br />

<strong>The</strong> capital formation, investment by firms in plant<br />

and machinery, capital goods and capex programs and<br />

abundant capital flows thru FDI and FII has been substantial<br />

facilitating growth and M & A transaction deals.<br />

July-October 2007 Need the Dough<br />

31

![[Feb 2008, Volume V Annual Issue] Pdf File size - The IIPM Think Tank](https://img.yumpu.com/43961117/1/190x245/feb-2008-volume-v-annual-issue-pdf-file-size-the-iipm-think-tank.jpg?quality=85)

![[June 2008, Volume V Quarterly Issue] Pdf File size - The IIPM Think ...](https://img.yumpu.com/41693247/1/190x245/june-2008-volume-v-quarterly-issue-pdf-file-size-the-iipm-think-.jpg?quality=85)

![[Dec 2007, Volume 4 Quarterly Issue] Pdf File size - The IIPM Think ...](https://img.yumpu.com/29766298/1/190x245/dec-2007-volume-4-quarterly-issue-pdf-file-size-the-iipm-think-.jpg?quality=85)

![[Volume VI | Quarterly Issue: 31st May 2009] Pdf File size](https://img.yumpu.com/27796051/1/190x245/volume-vi-quarterly-issue-31st-may-2009-pdf-file-size.jpg?quality=85)