india going global.indd - The IIPM Think Tank

india going global.indd - The IIPM Think Tank

india going global.indd - The IIPM Think Tank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

RESEARCH<br />

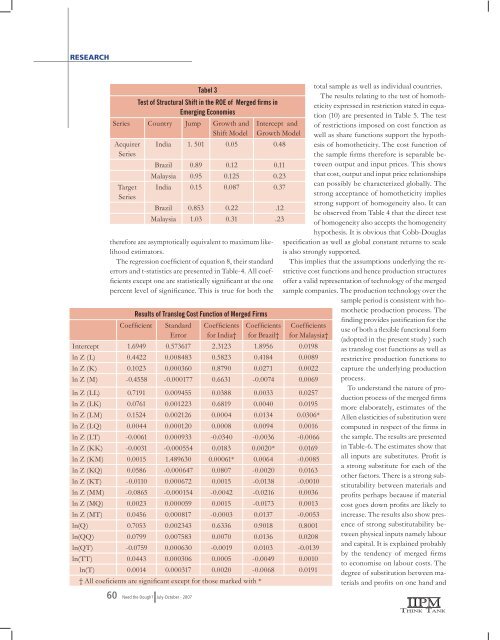

Tabel 3<br />

Test of Structural Shift in the ROE of Merged firms in<br />

Emerging Economies<br />

Series Country Jump Growth and<br />

Shift Model<br />

Acquirer<br />

Series<br />

Target<br />

Series<br />

therefore are asymptotically equivalent to maximum likelihood<br />

estimators.<br />

<strong>The</strong> regression coefficient of equation 8, their standard<br />

errors and t-statistics are presented in Table-4. All coefficients<br />

except one are statistically significant at the one<br />

percent level of significance. This is true for both the<br />

Results of Translog Cost Function of Merged Firms<br />

Coefficient Standard<br />

Error<br />

Coefficients<br />

for India†<br />

60 Need the Dough July-October - 2007<br />

Intercept and<br />

Growth Model<br />

India 1. 501 0.05 0.48<br />

Brazil 0.89 0.12 0.11<br />

Malaysia 0.95 0.125 0.23<br />

India 0.15 0.087 0.37<br />

Brazil 0.853 0.22 .12<br />

Malaysia 1.03 0.31 .23<br />

Coefficients<br />

for Brazil†<br />

total sample as well as individual countries.<br />

<strong>The</strong> results relating to the test of homotheticity<br />

expressed in restriction stated in equation<br />

(10) are presented in Table 5. <strong>The</strong> test<br />

of restrictions imposed on cost function as<br />

well as share functions support the hypothesis<br />

of homotheticity. <strong>The</strong> cost function of<br />

the sample firms therefore is separable between<br />

output and input prices. This shows<br />

that cost, output and input price relationships<br />

can possibly be characterized <strong>global</strong>ly. <strong>The</strong><br />

strong acceptance of homotheticity implies<br />

strong support of homogeneity also. It can<br />

be observed from Table 4 that the direct test<br />

of homogeneity also accepts the homogeneity<br />

hypothesis. It is obvious that Cobb-Douglas<br />

specification as well as <strong>global</strong> constant returns to scale<br />

is also strongly supported.<br />

This implies that the assumptions underlying the restrictive<br />

cost functions and hence production structures<br />

offer a valid representation of technology of the merged<br />

sample companies. <strong>The</strong> production technology over the<br />

sample period is consistent with homothetic<br />

production process. <strong>The</strong><br />

Coefficients<br />

for Malaysia†<br />

Intercept 1.6949 0.573617 2.3123 1.8956 0.0198<br />

ln Z (L) 0.4422 0.008483 0.5823 0.4184 0.0089<br />

ln Z (K) 0.1023 0.000360 0.8790 0.0271 0.0022<br />

ln Z (M) -0.4558 -0.000177 0.6631 -0.0074 0.0069<br />

ln Z (LL) 0.7191 0.009455 0.0388 0.0033 0.0257<br />

ln Z (LK) 0.0761 0.001223 0.6819 0.0040 0.0195<br />

ln Z (LM) 0.1524 0.002126 0.0004 0.0134 0.0306*<br />

ln Z (LQ) 0.0044 0.000120 0.0008 0.0094 0.0016<br />

ln Z (LT) -0.0061 0.000933 -0.0340 -0.0036 -0.0066<br />

ln Z (KK) -0.0031 -0.000554 0.0183 0.0020* 0.0169<br />

ln Z (KM) 0.0015 1.489630 0.00061* 0.0064 -0.0085<br />

ln Z (KQ) 0.0586 -0.000647 0.0807 -0.0020 0.0163<br />

ln Z (KT) -0.0110 0.000672 0.0015 -0.0138 -0.0010<br />

ln Z (MM) -0.0865 -0.000154 -0.0042 -0.0216 0.0036<br />

ln Z (MQ) 0.0023 0.000059 0.0015 -0.0173 0.0013<br />

ln Z (MT) 0.0456 0.000817 -0.0003 0.0137 -0.0053<br />

ln(Q) 0.7053 0.002343 0.6336 0.9018 0.8001<br />

ln(QQ) 0.0799 0.007583 0.0070 0.0136 0.0208<br />

ln(QT) -0.0759 0.000630 -0.0019 0.0103 -0.0139<br />

ln(TT) 0.0443 0.000306 0.0005 -0.0049 0.0010<br />

ln(T) 0.0014 0.000317 0.0020 -0.0068 0.0191<br />

† All coeficients are significant except for those marked with *<br />

finding provides justification for the<br />

use of both a flexible functional form<br />

(adopted in the present study ) such<br />

as translog cost functions as well as<br />

restrictive production functions to<br />

capture the underlying production<br />

process.<br />

To understand the nature of production<br />

process of the merged firms<br />

more elaborately, estimates of the<br />

Allen elasticities of substitution were<br />

computed in respect of the firms in<br />

the sample. <strong>The</strong> results are presented<br />

in Table-6. <strong>The</strong> estimates show that<br />

all inputs are substitutes. Profit is<br />

a strong substitute for each of the<br />

other factors. <strong>The</strong>re is a strong substitutability<br />

between materials and<br />

profits perhaps because if material<br />

cost goes down profits are likely to<br />

increase. <strong>The</strong> results also show presence<br />

of strong substitutability between<br />

physical inputs namely labour<br />

and capital. It is explained probably<br />

by the tendency of merged firms<br />

to economise on labour costs. <strong>The</strong><br />

degree of substitution between materials<br />

and profits on one hand and

![[Feb 2008, Volume V Annual Issue] Pdf File size - The IIPM Think Tank](https://img.yumpu.com/43961117/1/190x245/feb-2008-volume-v-annual-issue-pdf-file-size-the-iipm-think-tank.jpg?quality=85)

![[June 2008, Volume V Quarterly Issue] Pdf File size - The IIPM Think ...](https://img.yumpu.com/41693247/1/190x245/june-2008-volume-v-quarterly-issue-pdf-file-size-the-iipm-think-.jpg?quality=85)

![[Dec 2007, Volume 4 Quarterly Issue] Pdf File size - The IIPM Think ...](https://img.yumpu.com/29766298/1/190x245/dec-2007-volume-4-quarterly-issue-pdf-file-size-the-iipm-think-.jpg?quality=85)

![[Volume VI | Quarterly Issue: 31st May 2009] Pdf File size](https://img.yumpu.com/27796051/1/190x245/volume-vi-quarterly-issue-31st-may-2009-pdf-file-size.jpg?quality=85)