SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

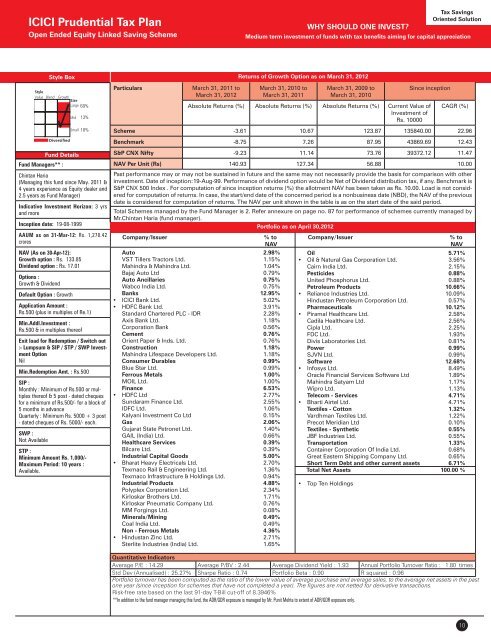

<strong>ICICI</strong> <strong>Prudential</strong> Tax Plan<br />

Open Ended Equity Linked Saving Scheme<br />

Tax Savings<br />

Oriented Solution<br />

WHY SHOULD ONE INVEST<br />

Medium term investment of funds with tax benefits aiming for capital appreciation<br />

Style Box<br />

51% 69%<br />

13%<br />

18%<br />

Fund Details<br />

Fund Managers** :<br />

Chintan Haria<br />

(Managing this fund since May. 2011 &<br />

4 years experiance as Equity dealer and<br />

2.5 years as Fund Manager)<br />

Indicative Investment Horizon: 3 yrs<br />

and more<br />

Inception date: 19-08-1999<br />

AAUM as on 31-Mar-12: Rs. 1,278.42<br />

crores<br />

NAV (As on 30-Apr-12):<br />

Growth option : Rs. 133.85<br />

Dividend option : Rs. 17.01<br />

Options :<br />

Growth & Dividend<br />

Default Option : Growth<br />

Application Amount :<br />

Rs.500 (plus in multiples of Re.1)<br />

Min.Addl.Investment :<br />

Rs.500 & in multiples thereof<br />

Exit load for Redemption / Switch out<br />

:- Lumpsum & <strong>SIP</strong> / STP / SWP Investment<br />

Option<br />

Nil<br />

Min.Redemption Amt. : Rs.500<br />

<strong>SIP</strong> :<br />

Monthly : Minimum of Rs.500 or multiples<br />

thereof & 5 post - dated cheques<br />

for a minimum of Rs.500/- for a block of<br />

5 months in advance<br />

Quarterly : Minimum Rs. 5000 + 3 post<br />

- dated cheques of Rs. 5000/- each.<br />

SWP :<br />

Not Available<br />

STP :<br />

Minimum Amount Rs. 1,000/-<br />

Maximum Period: 10 years :<br />

Available.<br />

Particulars<br />

March 31, 2011 to<br />

March 31, 2012<br />

March 31, 2010 to<br />

March 31, 2011<br />

Company/Issuer<br />

% to<br />

NAV<br />

Auto 2.98%<br />

VST Tillers Tractors Ltd. 1.15%<br />

Mahindra & Mahindra Ltd. 1.04%<br />

Bajaj Auto Ltd 0.79%<br />

Auto Ancillaries 0.75%<br />

Wabco India Ltd. 0.75%<br />

Banks 12.95%<br />

<strong>ICICI</strong> Bank Ltd. 5.02%<br />

HDFC Bank Ltd. 3.91%<br />

Standard Chartered PLC - IDR 2.28%<br />

Axis Bank Ltd. 1.18%<br />

Corporation Bank 0.56%<br />

Cement 0.76%<br />

Orient Paper & Inds. Ltd. 0.76%<br />

Construction 1.18%<br />

Mahindra Lifespace Developers Ltd. 1.18%<br />

Consumer Durables 0.99%<br />

Blue Star Ltd. 0.99%<br />

Ferrous Metals 1.00%<br />

MOIL Ltd. 1.00%<br />

Finance 6.53%<br />

HDFC Ltd 2.77%<br />

Sundaram Finance Ltd. 2.55%<br />

IDFC Ltd. 1.06%<br />

Kalyani Investment Co Ltd 0.15%<br />

Gas 2.06%<br />

Gujarat State Petronet Ltd. 1.40%<br />

GAIL (India) Ltd. 0.66%<br />

Healthcare Services 0.39%<br />

Bilcare Ltd. 0.39%<br />

Industrial Capital Goods 5.00%<br />

Bharat Heavy Electricals Ltd. 2.70%<br />

Texmaco Rail & Engineering Ltd. 1.36%<br />

Texmaco Infrastructure & Holdings Ltd. 0.94%<br />

Industrial Products 4.88%<br />

Polyplex Corporation Ltd. 2.34%<br />

Kirloskar Brothers Ltd. 1.71%<br />

Kirloskar Pneumatic Company Ltd. 0.76%<br />

MM Forgings Ltd. 0.08%<br />

Minerals/Mining 0.49%<br />

Coal India Ltd. 0.49%<br />

Non - Ferrous Metals 4.36%<br />

Hindustan Zinc Ltd. 2.71%<br />

Sterlite Industries (India) Ltd. 1.65%<br />

Returns of Growth Option as on March 31, 2012<br />

Oil 5.71%<br />

Oil & Natural Gas Corporation Ltd. 3.56%<br />

Cairn India Ltd. 2.15%<br />

Pesticides 0.88%<br />

United Phosphorus Ltd. 0.88%<br />

Petroleum Products 10.66%<br />

Reliance Industries Ltd. 10.09%<br />

Hindustan Petroleum Corporation Ltd. 0.57%<br />

Pharmaceuticals 10.12%<br />

Piramal Healthcare Ltd. 2.58%<br />

Cadila Healthcare Ltd. 2.56%<br />

Cipla Ltd. 2.25%<br />

FDC Ltd. 1.93%<br />

Divis Laboratories Ltd. 0.81%<br />

Power 0.99%<br />

SJVN Ltd. 0.99%<br />

Software 12.68%<br />

Infosys Ltd. 8.49%<br />

Oracle Financial Services Software Ltd 1.89%<br />

Mahindra Satyam Ltd 1.17%<br />

Wipro Ltd. 1.13%<br />

Telecom - Services 4.71%<br />

Bharti Airtel Ltd. 4.71%<br />

Textiles - Cotton 1.32%<br />

Vardhman Textiles Ltd. 1.22%<br />

Precot Meridian Ltd 0.10%<br />

Textiles - Synthetic 0.55%<br />

JBF Industries Ltd. 0.55%<br />

Transportation 1.33%<br />

Container Corporation Of India Ltd. 0.68%<br />

Great Eastern Shipping Company Ltd. 0.65%<br />

Short Term Debt and other current assets 6.71%<br />

Total Net <strong>Asset</strong>s 100.00 %<br />

<br />

March 31, 2009 to<br />

March 31, 2010<br />

Top Ten Holdings<br />

Since inception<br />

Absolute Returns (%) Absolute Returns (%) Absolute Returns (%) Current Value of<br />

Investment of<br />

Rs. 10000<br />

CAGR (%)<br />

Scheme -3.61 10.67 123.87 135840.00 22.96<br />

Benchmark -8.75 7.26 87.95 43869.69 12.43<br />

S&P CNX Nifty -9.23 11.14 73.76 39372.12 11.47<br />

NAV Per Unit (Rs) 140.93 127.34 56.88 10.00<br />

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other<br />

investment. Date of inception:19-Aug-99. Performance of dividend option would be Net of Dividend distribution tax, if any. Benchmark is<br />

S&P CNX 500 Index . For computation of since inception returns (%) the allotment NAV has been taken as Rs. 10.00. Load is not considered<br />

for computation of returns. In case, the start/end date of the concerned period is a nonbusiness date (NBD), the NAV of the previous<br />

date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period.<br />

Total Schemes managed by the Fund Manager is 2. Refer annexure on page no. 87 for performance of schemes currently managed by<br />

Mr.Chintan Haria (fund manager).<br />

Portfolio as on April 30,2012<br />

Company/Issuer<br />

Quantitative Indicators<br />

Average P/E : 14.29 Average P/BV : 2.44 Average Dividend Yield : 1.93 Annual Portfolio Turnover Ratio : 1.80 times<br />

Std Dev (Annualised) : 25.27% Sharpe Ratio : 0.74 Portfolio Beta : 0.90 R squared : 0.96<br />

Portfolio turnover has been computed as the ratio of the lower value of average purchase and average sales, to the average net assets in the past<br />

one year (since inception for schemes that have not completed a year). The figures are not netted for derivative transactions.<br />

Risk-free rate based on the last 91-day T-Bill cut-off of 8.3946%<br />

**In addition to the fund manager managing this fund, the ADR/GDR exposure is managed by Mr. Punit Mehta to extent of ADR/GDR exposure only.<br />

% to<br />

NAV<br />

10