SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

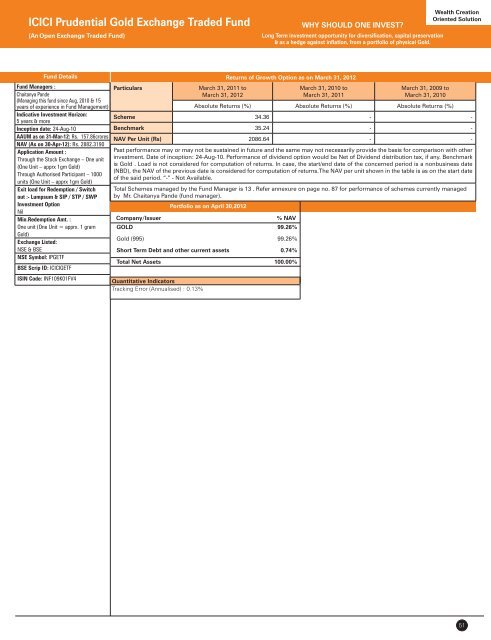

<strong>ICICI</strong> <strong>Prudential</strong> Gold Exchange Traded Fund<br />

(An Open Exchange Traded Fund)<br />

WHY SHOULD ONE INVEST<br />

Long Term investment opportunity for diversification, capital preservation<br />

& as a hedge against inflation, from a portfolio of physical Gold.<br />

Wealth Creation<br />

Oriented Solution<br />

Fund Details<br />

Fund Managers :<br />

Chaitanya Pande<br />

(Managing this fund since Aug, 2010 & 15<br />

years of experience in Fund <strong>Management</strong>)<br />

Indicative Investment Horizon:<br />

5 years & more<br />

Inception date: 24-Aug-10<br />

AAUM as on 31-Mar-12: Rs. 157.86crores<br />

NAV (As on 30-Apr-12): Rs. 2882.3190<br />

Application Amount :<br />

Through the Stock Exchange – One unit<br />

(One Unit – apprx 1gm Gold)<br />

Through Authorised Participant – 1000<br />

units (One Unit – apprx 1gm Gold)<br />

Exit load for Redemption / Switch<br />

out :- Lumpsum & <strong>SIP</strong> / STP / SWP<br />

Investment Option<br />

Nil<br />

Min.Redemption Amt. :<br />

One unit (One Unit = apprx. 1 gram<br />

Gold)<br />

Exchange Listed:<br />

NSE & BSE<br />

NSE Symbol: IPGETF<br />

BSE Scrip ID: <strong>ICICI</strong>GETF<br />

ISIN Code: INF109K01FV4<br />

Particulars<br />

Company/Issuer<br />

% NAV<br />

GOLD 99.26%<br />

Gold (995) 99.26%<br />

Short Term Debt and other current assets 0.74%<br />

Total Net <strong>Asset</strong>s 100.00%<br />

Quantitative Indicators<br />

Tracking Error (Annualised) : 0.13%<br />

March 31, 2011 to<br />

March 31, 2012<br />

March 31, 2010 to<br />

March 31, 2011<br />

March 31, 2009 to<br />

March 31, 2010<br />

Absolute Returns (%) Absolute Returns (%) Absolute Returns (%)<br />

Scheme 34.36 - -<br />

Benchmark 35.24 - -<br />

NAV Per Unit (Rs) 2086.64 - -<br />

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other<br />

investment. Date of inception: 24-Aug-10. Performance of dividend option would be Net of Dividend distribution tax, if any. Benchmark<br />

is Gold . Load is not considered for computation of returns. In case, the start/end date of the concerned period is a nonbusiness date<br />

(NBD), the NAV of the previous date is considered for computation of returns.The NAV per unit shown in the table is as on the start date<br />

of the said period. “-” - Not Available.<br />

Total Schemes managed by the Fund Manager is 13 . Refer annexure on page no. 87 for performance of schemes currently managed<br />

by Mr. Chaitanya Pande (fund manager).<br />

Portfolio as on April 30,2012<br />

Returns of Growth Option as on March 31, 2012<br />

51