SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

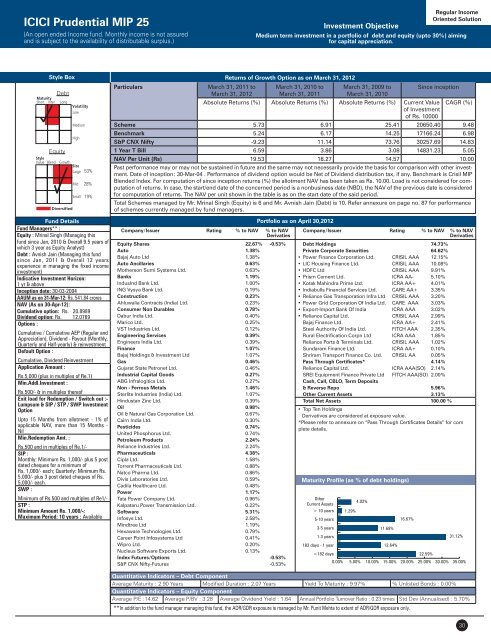

<strong>ICICI</strong> <strong>Prudential</strong> MIP 25<br />

(An open ended Income fund. Monthly income is not assured<br />

and is subject to the availability of distributable surplus.)<br />

Investment Objective<br />

Regular Income<br />

Oriented Solution<br />

Medium term investment in a portfolio of debt and equity (upto 30%) aiming<br />

for capital appreciation.<br />

Style Box<br />

Debt<br />

Equity<br />

53%<br />

28%<br />

19%<br />

Fund Details<br />

Fund Managers** :<br />

Equity : Mrinal Singh (Managing this<br />

fund since Jan, 2010 & Overall 9.5 years of<br />

which 3 year as Equity Analyst)<br />

Debt : Avnish Jain (Managing this fund<br />

since Jan, 2011 & Overall 12 years<br />

experience in managing the fixed income<br />

investment)<br />

Indicative Investment Horizon:<br />

1 yr & above<br />

Inception date: 30-03-2004<br />

AAUM as on 31-Mar-12: Rs. 541.84 crores<br />

NAV (As on 30-Apr-12):<br />

Cumulative option: Rs. 20.8989<br />

Dividend option: Rs. 12.0769<br />

Options :<br />

Cumulative / Cumulative AEP (Regular and<br />

Appreciation), Dividend - Payout (Monthly,<br />

Quarterly and Half-yearly) & reinvestment<br />

Default Option :<br />

Cumulative, Dividend Reinvestment<br />

Application Amount :<br />

Rs.5,000 (plus in multiples of Re.1)<br />

Min.Addl.Investment :<br />

Rs.500/- & in multiples thereof<br />

Exit load for Redemption / Switch out :-<br />

Lumpsum & <strong>SIP</strong> / STP / SWP Investment<br />

Option<br />

Upto 15 Months from allotment - 1% of<br />

applicable NAV, more than 15 Months -<br />

Nil<br />

Min.Redemption Amt. :<br />

Rs.500 and in multiples of Re.1/-<br />

<strong>SIP</strong> :<br />

Monthly: Minimum Rs. 1,000/- plus 5 post<br />

dated cheques for a minimum of<br />

Rs. 1,000/- each; Quarterly: Minimum Rs.<br />

5,000/- plus 3 post dated cheques of Rs.<br />

5,000/- each.<br />

SWP :<br />

Minimum of Rs.500 and multiples of Re1/-<br />

STP :<br />

Minimum Amount Rs. 1,000/-;<br />

Maximum Period: 10 years : Available<br />

Particulars<br />

Returns of Growth Option as on March 31, 2012<br />

March 31, 2011 to<br />

March 31, 2012<br />

March 31, 2010 to<br />

March 31, 2011<br />

Debt Holdings 74.73%<br />

Private Corporate Securities 64.62%<br />

• Power Finance Corporation Ltd. CRISIL AAA 12.15%<br />

• LIC Housing Finance Ltd. CRISIL AAA 10.08%<br />

• HDFC Ltd CRISIL AAA 9.91%<br />

• Prism Cement Ltd. ICRA AA- 5.10%<br />

• Kotak Mahindra Prime Ltd. ICRA AA+ 4.01%<br />

• Indiabulls Financial Services Ltd. CARE AA+ 3.35%<br />

• Reliance Gas Transporation Infra Ltd CRISIL AAA 3.20%<br />

• Power Grid Corporation Of India Ltd. CARE AAA 3.03%<br />

• Export-Import Bank Of India ICRA AAA 3.02%<br />

• Reliance Capital Ltd. CRISIL AAA 2.99%<br />

Bajaj Finance Ltd. ICRA AA+ 2.41%<br />

Steel Authority Of India Ltd. FITCH AAA 2.35%<br />

Rural Electrification Corpn Ltd ICRA AAA 1.85%<br />

Reliance Ports & Terminals Ltd. CRISIL AAA 1.02%<br />

Sundaram Finance Ltd. ICRA AA+ 0.10%<br />

Shriram Transport Finance Co. Ltd. CRISIL AA 0.05%<br />

Pass Through Certificates* 4.14%<br />

Reliance Capital Ltd. ICRA AAA(SO) 2.14%<br />

SREI Equipment Finance Private Ltd FITCH AAA(SO) 2.00%<br />

Cash, Call, CBLO, Term Deposits<br />

& Reverse Repo 5.96%<br />

Other Current <strong>Asset</strong>s 3.13%<br />

Total Net <strong>Asset</strong>s 100.00 %<br />

• Top Ten Holdings<br />

Derivatives are considered at exposure value.<br />

*Please refer to annexure on “Pass Through Certificates Details” for com<br />

plete details.<br />

Maturity Profile (as % of debt holdings)<br />

Other<br />

Current <strong>Asset</strong>s<br />

> 10 years<br />

5-10 years<br />

3-5 years<br />

1-3 years<br />

182 days - 1 year<br />

March 31, 2009 to<br />

March 31, 2010<br />

4.02%<br />

1.29%<br />

11.68%<br />

12.64%<br />

16.67%<br />

31.12%<br />