SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

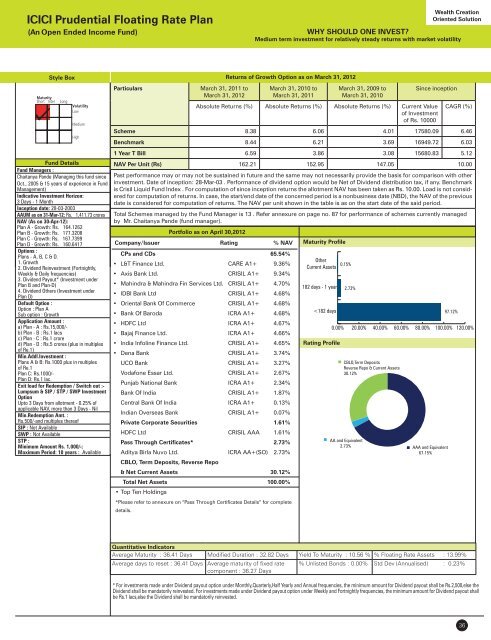

<strong>ICICI</strong> <strong>Prudential</strong> Floating Rate Plan<br />

(An Open Ended Income Fund)<br />

Wealth Creation<br />

Oriented Solution<br />

WHY SHOULD ONE INVEST<br />

Medium term investment for relatively steady returns with market volatility<br />

Style Box<br />

Fund Details<br />

Fund Managers :<br />

Chaitanya Pande (Managing this fund since<br />

Oct., 2005 & 15 years of experience in Fund<br />

<strong>Management</strong>)<br />

Indicative Investment Horizon:<br />

3 Days - 1 Month<br />

Inception date: 28-03-2003<br />

AAUM as on 31-Mar-12: Rs. 1,411.73 crores<br />

NAV (As on 30-Apr-12):<br />

Plan A - Growth: Rs. 164.1262<br />

Plan B - Growth: Rs. 177.3208<br />

Plan C - Growth: Rs. 167.7399<br />

Plan D - Growth: Rs. 160.6417<br />

Options :<br />

Plans - A, B, C & D.<br />

1. Growth<br />

2. Dividend Reinvestment (Fortnightly,<br />

Weekly & Daily frequencies)<br />

3. Dividend Payout* (Investment under<br />

Plan B and Plan-D)<br />

4. Dividend Others (Investment under<br />

Plan D)<br />

Default Option :<br />

Option : Plan A<br />

Sub option : Growth<br />

Application Amount :<br />

a) Plan - A : Rs.15,000/-<br />

b) Plan - B : Rs.1 lacs<br />

c) Plan - C : Rs.1 crore<br />

d) Plan - D : Rs.5 crores (plus in multiples<br />

of Re.1)<br />

Min.Addl.Investment :<br />

Plans A & B: Rs.1000 plus in multiples<br />

of Re.1<br />

Plan C: Rs.1000/-<br />

Plan D: Rs.1 lac.<br />

Exit load for Redemption / Switch out :-<br />

Lumpsum & <strong>SIP</strong> / STP / SWP Investment<br />

Option<br />

Upto 3 Days from allotment - 0.25% of<br />

applicable NAV, more than 3 Days - Nil<br />

Min.Redemption Amt. :<br />

Rs.500/-and multiples thereof<br />

<strong>SIP</strong> : Not Available<br />

SWP : Not Available<br />

STP :<br />

Minimum Amount Rs. 1,000/-;<br />

Maximum Period: 10 years : Available<br />

Particulars<br />

March 31, 2011 to<br />

March 31, 2012<br />

Company/Issuer Rating % NAV<br />

CPs and CDs 65.54%<br />

• L&T Finance Ltd. CARE A1+ 9.36%<br />

• Axis Bank Ltd. CRISIL A1+ 9.34%<br />

• Mahindra & Mahindra Fin Services Ltd. CRISIL A1+ 4.70%<br />

• IDBI Bank Ltd CRISIL A1+ 4.68%<br />

• Oriental Bank Of Commerce CRISIL A1+ 4.68%<br />

• Bank Of Baroda ICRA A1+ 4.68%<br />

• HDFC Ltd ICRA A1+ 4.67%<br />

• Bajaj Finance Ltd. ICRA A1+ 4.66%<br />

• India Infoline Finance Ltd. CRISIL A1+ 4.65%<br />

• Dena Bank CRISIL A1+ 3.74%<br />

UCO Bank CRISIL A1+ 3.27%<br />

Vodafone Essar Ltd. CRISIL A1+ 2.67%<br />

Punjab National Bank ICRA A1+ 2.34%<br />

Bank Of India CRISIL A1+ 1.87%<br />

Central Bank Of India ICRA A1+ 0.13%<br />

Indian Overseas Bank CRISIL A1+ 0.07%<br />

Private Corporate Securities 1.61%<br />

HDFC Ltd CRISIL AAA 1.61%<br />

Pass Through Certificates* 2.73%<br />

Aditya Birla Nuvo Ltd. ICRA AA+(SO) 2.73%<br />

CBLO, Term Deposits, Reverse Repo<br />

& Net Current <strong>Asset</strong>s 30.12%<br />

Total Net <strong>Asset</strong>s 100.00%<br />

• Top Ten Holdings<br />

*Please refer to annexure on “Pass Through Certificates Details” for complete<br />

details.<br />

March 31, 2010 to<br />

March 31, 2011<br />

Maturity Profile<br />

Other<br />

Current <strong>Asset</strong>s 0.15%<br />

182 days - 1 year 2.73%<br />