SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

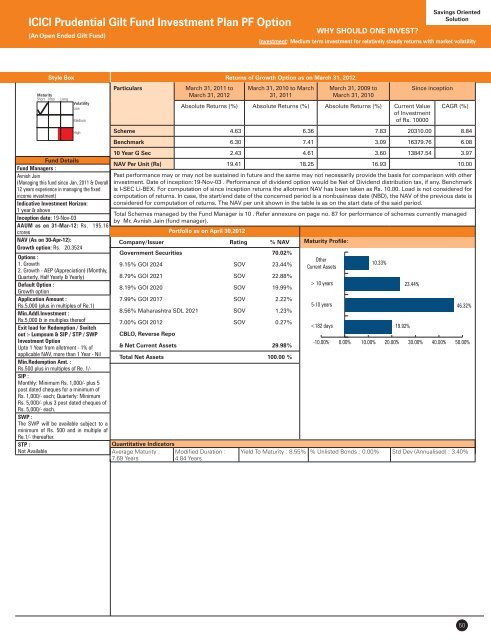

<strong>ICICI</strong> <strong>Prudential</strong> Gilt Fund Investment Plan PF Option<br />

(An Open Ended Gilt Fund)<br />

WHY SHOULD ONE INVEST<br />

Savings Oriented<br />

Solution<br />

Investment: Medium term investment for relatively steady returns with market volatility<br />

Style Box<br />

Fund Details<br />

Fund Managers :<br />

Avnish Jain<br />

(Managing this fund since Jan, 2011 & Overall<br />

12 years experience in managing the fixed<br />

income investment)<br />

Indicative Investment Horizon:<br />

1 year & above<br />

Inception date: 19-Nov-03<br />

AAUM as on 31-Mar-12: Rs. 195.16<br />

crores<br />

NAV (As on 30-Apr-12):<br />

Growth option: Rs. 20.3524<br />

Options :<br />

1. Growth<br />

2. Growth - AEP (Appreciation) (Monthly,<br />

Quarterly, Half Yearly & Yearly)<br />

Default Option :<br />

Growth option<br />

Application Amount :<br />

Rs.5,000 (plus in multiples of Re.1)<br />

Min.Addl.Investment :<br />

Rs.5,000 & in multiples thereof<br />

Exit load for Redemption / Switch<br />

out :- Lumpsum & <strong>SIP</strong> / STP / SWP<br />

Investment Option<br />

Upto 1 Year from allotment - 1% of<br />

applicable NAV, more than 1 Year - Nil<br />

Min.Redemption Amt. :<br />

Rs.500 plus in multiples of Re. 1/-<br />

<strong>SIP</strong> :<br />

Monthly: Minimum Rs. 1,000/- plus 5<br />

post dated cheques for a minimum of<br />

Rs. 1,000/- each; Quarterly: Minimum<br />

Rs. 5,000/- plus 3 post dated cheques of<br />

Rs. 5,000/- each.<br />

SWP :<br />

The SWP will be available subject to a<br />

minimum of Rs. 500 and in multiple of<br />

Re.1/- thereafter.<br />

STP :<br />

Not Available<br />

Particulars<br />

March 31, 2011 to<br />

March 31, 2012<br />

Quantitative Indicators<br />

Average Maturity : Modified Duration :<br />

7.69 Years<br />

4.84 Years<br />

March 31, 2010 to March<br />

31, 2011<br />

Maturity Profile:<br />

Other<br />

Current <strong>Asset</strong>s<br />

> 10 years<br />

5-10 years<br />