SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

SIP Insure - Prudential ICICI Asset Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ICICI</strong> <strong>Prudential</strong> Gilt Fund Investment Plan<br />

(An Open Ended Gilt Fund)<br />

WHY SHOULD ONE INVEST<br />

Investment Plan: Medium term investment in a portfolio of G-Secs for relatively steady<br />

returns with market volatility<br />

Savings Oriented<br />

Solution<br />

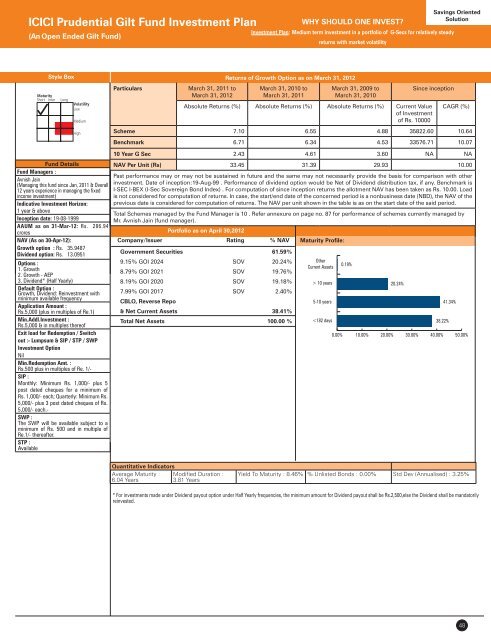

Style Box<br />

Particulars<br />

March 31, 2011 to<br />

March 31, 2012<br />

Returns of Growth Option as on March 31, 2012<br />

March 31, 2010 to<br />

March 31, 2011<br />

March 31, 2009 to<br />

March 31, 2010<br />

Since inception<br />

Absolute Returns (%) Absolute Returns (%) Absolute Returns (%) Current Value<br />

of Investment<br />

of Rs. 10000<br />

CAGR (%)<br />

Scheme 7.10 6.55 4.88 35822.60 10.64<br />

Benchmark 6.71 6.34 4.53 33576.71 10.07<br />

Fund Details<br />

Fund Managers :<br />

Avnish Jain<br />

(Managing this fund since Jan, 2011 & Overall<br />

12 years experience in managing the fixed<br />

income investment)<br />

Indicative Investment Horizon:<br />

1 year & above<br />

Inception date: 19-08-1999<br />

AAUM as on 31-Mar-12: Rs. 286.94<br />

crores<br />

NAV (As on 30-Apr-12):<br />

Growth option : Rs. 35.9487<br />

Dividend option: Rs. 13.0951<br />

Options :<br />

1. Growth<br />

2. Growth - AEP<br />

3. Dividend* (Half Yearly)<br />

Default Option :<br />

Growth, Dividend: Reinvestment with<br />

minimum available frequency<br />

Application Amount :<br />

Rs.5,000 (plus in multiples of Re.1)<br />

Min.Addl.Investment :<br />

Rs.5,000 & in multiples thereof<br />

Exit load for Redemption / Switch<br />

out :- Lumpsum & <strong>SIP</strong> / STP / SWP<br />

Investment Option<br />

Nil<br />

Min.Redemption Amt. :<br />

Rs.500 plus in multiples of Re. 1/-<br />

<strong>SIP</strong> :<br />

Monthly: Minimum Rs. 1,000/- plus 5<br />

post dated cheques for a minimum of<br />

Rs. 1,000/- each; Quarterly: Minimum Rs.<br />

5,000/- plus 3 post dated cheques of Rs.<br />

5,000/- each.-<br />

SWP :<br />

The SWP will be available subject to a<br />

minimum of Rs. 500 and in multiple of<br />

Re.1/- thereafter.<br />

STP :<br />

Available<br />

10 Year G Sec 2.43 4.61 3.60 NA NA<br />

NAV Per Unit (Rs) 33.45 31.39 29.93 10.00<br />

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other<br />

investment. Date of inception:19-Aug-99 . Performance of dividend option would be Net of Dividend distribution tax, if any. Benchmark is<br />

I-SEC I-BEX (I-Sec Sovereign Bond Index) . For computation of since inception returns the allotment NAV has been taken as Rs. 10.00. Load<br />

is not considered for computation of returns. In case, the start/end date of the concerned period is a nonbusiness date (NBD), the NAV of the<br />

previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period.<br />

Total Schemes managed by the Fund Manager is 10 . Refer annexure on page no. 87 for performance of schemes currently managed by<br />

Mr. Avnish Jain (fund manager).<br />

Portfolio as on April 30,2012<br />

Company/Issuer Rating % NAV<br />

Government Securities 61.59%<br />

9.15% GOI 2024 SOV 20.24%<br />

8.79% GOI 2021 SOV 19.76%<br />

8.19% GOI 2020 SOV 19.18%<br />

7.99% GOI 2017 SOV 2.40%<br />

CBLO, Reverse Repo<br />

& Net Current <strong>Asset</strong>s 38.41%<br />

Total Net <strong>Asset</strong>s 100.00 %<br />

Maturity Profile:<br />

Other<br />

Current <strong>Asset</strong>s<br />

> 10 years<br />

5-10 years<br />