Annual Report 2012/13 - Clas Ohlson

Annual Report 2012/13 - Clas Ohlson

Annual Report 2012/13 - Clas Ohlson

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

smaller, individual specialist retailers. The major chains and<br />

retailers are establishing themselves in several countries<br />

through both own stores and acquisitions. As a result,<br />

market players have become fewer and larger. During the<br />

financial year, competition intensified due to more stores<br />

and shopping centres, particularly in the Nordic region. For<br />

more information, refer to page 11.<br />

Logistics<br />

<strong>Clas</strong> <strong>Ohlson</strong>’s distribution centre in Insjön is the hub of<br />

the Group’s entire logistics chain. From here, goods are<br />

distributed to all stores and to mail order/Internet customers.<br />

In recent years, the distribution centre has been<br />

expanded to further optimise the company’s logistics.<br />

However, concentrating all logistics to one location entails<br />

risks. These include communication and infrastructure disruptions,<br />

fire and strikes.<br />

Key individuals<br />

An increasingly critical success factor is being able to attract<br />

and retain key employees. <strong>Clas</strong> <strong>Ohlson</strong>’s remuneration<br />

policy was changed in the 2008/09 financial year, following<br />

a resolution by the <strong>Annual</strong> General Meeting to allow a higher<br />

percentage of variable, performance-based remuneration.<br />

For more information, refer to page 56.<br />

The company’s geographical location requires flexible<br />

working conditions, which is essential for attracting and<br />

retaining key individuals from other locations.<br />

Shrinkage<br />

<strong>Clas</strong> <strong>Ohlson</strong> is exposed to shrinkage on a daily basis, including<br />

shoplifting, theft and other types of criminal activity.<br />

<strong>Clas</strong> <strong>Ohlson</strong> works to reduce shrinkage through longterm<br />

preventive measures such as training programmes,<br />

technical equipment and ongoing monitoring, assessment<br />

and adaptation of security measures.<br />

Financial risks<br />

Economic climate<br />

The retail market in general is adversely affected by a weak<br />

economy and although <strong>Clas</strong> <strong>Ohlson</strong> sells products for<br />

everyday use, a weak retail market will have a negative impact<br />

on the company’s sales.<br />

However, the broad and affordable product range is less<br />

sensitive to cyclical fluctuations than that of many other retailers.<br />

More than 80 per cent of the products sold by <strong>Clas</strong><br />

<strong>Ohlson</strong> are priced at less than SEK 300. The company’s<br />

broad product range, with five different product categories,<br />

also entails lower risk since demand in one product category<br />

could increase while demand in another category falls.<br />

Wage inflation in manufacturing countries<br />

<strong>Clas</strong> <strong>Ohlson</strong> is affected by wage-level changes in countries<br />

where the company’s products are manufactured. This can<br />

vary between products depending on how much labour is<br />

involved in the manufacturing process.<br />

Corporate Social Responsibility (CSR)<br />

Demands for companies to accept social responsibility<br />

(Corporate Social Responsibility) are growing. <strong>Clas</strong> <strong>Ohlson</strong><br />

works proactively with these issues, since they are strategically<br />

significant and contribute to building a long-term<br />

sustainable business. If these social responsibilities are<br />

neglected, the company risks losing sales and market<br />

shares. For more information about <strong>Clas</strong> <strong>Ohlson</strong>’s sustainability<br />

efforts, refer to pages 27–43.<br />

Product range<br />

The company’s most important task is to offer customers<br />

a broad and attractive product range. If <strong>Clas</strong> <strong>Ohlson</strong> were<br />

to misjudge new trends or product categories, this could<br />

entail lower growth and profitability.<br />

WIRELESS<br />

Wireless optical smoke alarm. Wireless connectivity. Alarms<br />

one, alarms all!<br />

36-4556<br />

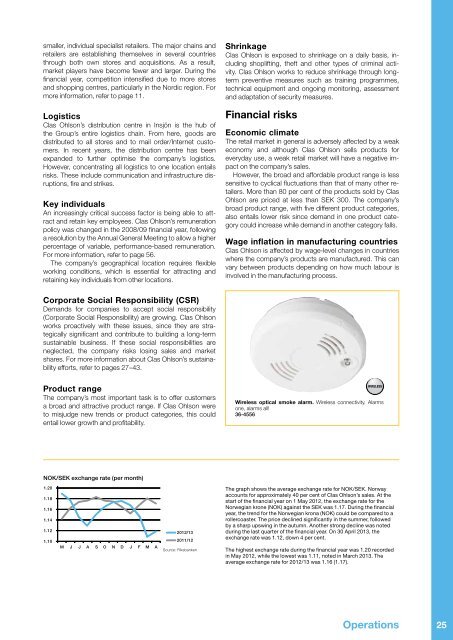

NOK/SEK exchange rate (per month)<br />

Valuta NOK/SEK<br />

1.20<br />

1.18<br />

1.16<br />

1.14<br />

1.12<br />

1.10<br />

M J J A S O N D J F M A<br />

<strong>2012</strong>/<strong>13</strong><br />

2011/12<br />

Source: Riksbanken<br />

The graph shows the average exchange rate for NOK/SEK. Norway<br />

accounts for approximately 40 per cent of <strong>Clas</strong> <strong>Ohlson</strong>’s sales. At the<br />

start of the financial year on 1 May <strong>2012</strong>, the exchange rate for the<br />

Norwegian krone (NOK) against the SEK was 1.17. During the financial<br />

year, the trend for the Norwegian krona (NOK) could be compared to a<br />

rollercoaster. The price declined significantly in the summer, followed<br />

by a sharp upswing in the autumn. Another strong decline was noted<br />

during the last quarter of the financial year. On 30 April 20<strong>13</strong>, the<br />

exchange rate was 1.12, down 4 per cent.<br />

The highest exchange rate during the financial year was 1.20 recorded<br />

in May <strong>2012</strong>, while the lowest was 1.11, noted in March 20<strong>13</strong>. The<br />

average exchange rate for <strong>2012</strong>/<strong>13</strong> was 1.16 (1.17).<br />

Operations 25