Annual Report 2012/13 - Clas Ohlson

Annual Report 2012/13 - Clas Ohlson

Annual Report 2012/13 - Clas Ohlson

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

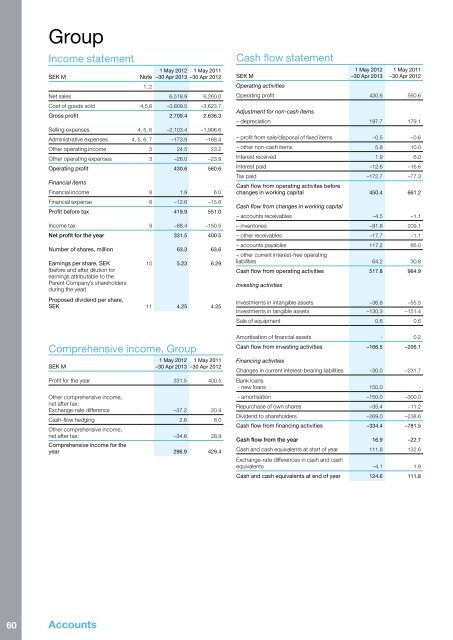

Group<br />

Income statement<br />

SEK M<br />

Note<br />

1, 2<br />

1 May <strong>2012</strong> 1 May 2011<br />

–30 Apr 20<strong>13</strong> –30 Apr <strong>2012</strong><br />

Net sales 6,518.9 6,260.0<br />

Cost of goods sold 4,5,6 –3,809.5 –3,623.7<br />

Gross profit 2,709.4 2,636.3<br />

Selling expenses 4, 5, 6 –2,103.4 –1,906.6<br />

Administrative expenses 4, 5, 6, 7 –173.9 –168.4<br />

Other operating income 3 24.5 23.2<br />

Other operating expenses 3 –26.0 –23.9<br />

Operating profit 430.6 560.6<br />

Financial items<br />

Financial income 8 1.9 6.0<br />

Financial expense 8 –12.6 –15.6<br />

Profit before tax 419.9 551.0<br />

Income tax 9 –88.4 –150.5<br />

Net profit for the year 331.5 400.5<br />

Number of shares, million 63.3 63.6<br />

Earnings per share, SEK 10 5.23 6.29<br />

(before and after dilution for<br />

earnings attributable to the<br />

Parent Company’s shareholders<br />

during the year)<br />

Proposed dividend per share,<br />

SEK 11 4.25 4.25<br />

Comprehensive income, Group<br />

SEK M<br />

1 May <strong>2012</strong> 1 May 2011<br />

–30 Apr 20<strong>13</strong> –30 Apr <strong>2012</strong><br />

Profit for the year 331.5 400.5<br />

Other comprehensive income,<br />

net after tax:<br />

Exchange-rate difference –37.2 20.9<br />

Cash-flow hedging 2.6 8.0<br />

Other comprehensive income,<br />

net after tax: –34.6 28.9<br />

Comprehensive income for the<br />

year 296.9 429.4<br />

Cash flow statement<br />

SEK M<br />

1 May <strong>2012</strong><br />

–30 Apr 20<strong>13</strong><br />

1 May 2011<br />

–30 Apr <strong>2012</strong><br />

Operating activities<br />

Operating profit 430.6 560.6<br />

Adjustment for non-cash items<br />

– depreciation 197.7 179.1<br />

– profit from sale/disposal of fixed items –0.5 –0.6<br />

– other non-cash items 5.8 10.0<br />

Interest received 1.9 6.0<br />

Interest paid –12.6 –16.6<br />

Tax paid –172.7 –77.3<br />

Cash flow from operating activites before<br />

changes in working capital 450.4 661.2<br />

Cash flow from changes in working capital<br />

– accounts receivables –4.5 –1.1<br />

– inventories –91.8 209.1<br />

– other receivables –17.7 –1.1<br />

– accounts payables 117.2 66.0<br />

– other current interest-free operating<br />

liabilities 64.2 30.8<br />

Cash flow from operating activities 517.8 964.9<br />

Investing activities<br />

Investments in intangible assets –36.8 –55.5<br />

Investments in tangible assets –<strong>13</strong>0.3 –151.4<br />

Sale of equipment 0.6 0.6<br />

Amortisation of financial assets - 0.2<br />

Cash flow from investing activities –166.5 –206.1<br />

Financing activities<br />

Changes in current interest-bearing liabilities –30.0 –231.7<br />

Bank loans<br />

- new loans 150.0 -<br />

- amortisation –150.0 –300.0<br />

Repurchase of own shares –35.4 –11.2<br />

Dividend to shareholders –269.0 –238.6<br />

Cash flow from financing activities –334.4 –781.5<br />

Cash flow from the year 16.9 –22.7<br />

Cash and cash equivalents at start of year 111.8 <strong>13</strong>2.6<br />

Exchange-rate differences in cash and cash<br />

equivalents –4.1 1.9<br />

Cash and cash equivalents at end of year 124.6 111.8<br />

60<br />

Accounts