May/June 2013 - The ASIA Miner

May/June 2013 - The ASIA Miner

May/June 2013 - The ASIA Miner

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Central Asia<br />

Chaarat to begin with Tulkubash heap leach<br />

CHAARAT Gold Holdings is targeting the second<br />

half of the year to begin heap leach<br />

production at Tulkubash, which is part of the<br />

Chaarat project in the Kyrgyz Republic. Starting<br />

with the heap leach process (HLP) rather<br />

than the carbon-in-leach (CIL) method<br />

will reduce the project’s capital cost and<br />

power requirements.<br />

<strong>The</strong> first stage development of Tulkubash involves<br />

processing low-sulphur clean ore. During<br />

the 2012 exploration season the company<br />

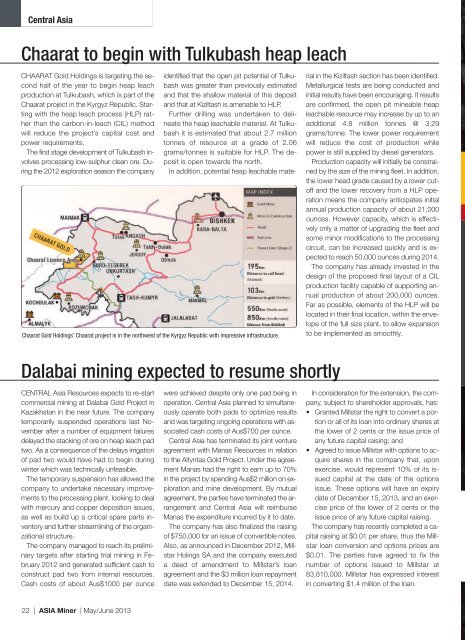

Chaarat Gold Holdings’ Chaarat project is in the northwest of the Kyrgyz Republic with impressive infrastructure.<br />

identified that the open pit potential of Tulkubash<br />

was greater than previously estimated<br />

and that the shallow material of this deposit<br />

and that at Kiziltash is amenable to HLP.<br />

Further drilling was undertaken to delineate<br />

the heap leachable material. At Tulkubash<br />

it is estimated that about 2.7 million<br />

tonnes of resource at a grade of 2.06<br />

grams/tonnes is suitable for HLP. <strong>The</strong> deposit<br />

is open towards the north.<br />

In addition, potential heap leachable material<br />

in the Kiziltash section has been identified.<br />

Metallurgical tests are being conducted and<br />

initial results have been encouraging. If results<br />

are confirmed, the open pit mineable heap<br />

leachable resource may increase by up to an<br />

additional 4.8 million tonnes @ 3.29<br />

grams/tonne. <strong>The</strong> lower power requirement<br />

will reduce the cost of production while<br />

power is still supplied by diesel generators.<br />

Production capacity will initially be constrained<br />

by the size of the mining fleet. In addition,<br />

the lower head grade caused by a lower cutoff<br />

and the lower recovery from a HLP operation<br />

means the company anticipates initial<br />

annual production capacity of about 21,000<br />

ounces. However capacity, which is effectively<br />

only a matter of upgrading the fleet and<br />

some minor modifications to the processing<br />

circuit, can be increased quickly and is expected<br />

to reach 50,000 ounces during 2014.<br />

<strong>The</strong> company has already invested in the<br />

design of the proposed final layout of a CIL<br />

production facility capable of supporting annual<br />

production of about 200,000 ounces.<br />

Far as possible, elements of the HLP will be<br />

located in their final location, within the envelope<br />

of the full size plant, to allow expansion<br />

to be implemented as smoothly.<br />

Dalabai mining expected to resume shortly<br />

CENTRAL Asia Resources expects to re-start<br />

commercial mining at Dalabai Gold Project in<br />

Kazakhstan in the near future. <strong>The</strong> company<br />

temporarily suspended operations last November<br />

after a number of equipment failures<br />

delayed the stacking of ore on heap leach pad<br />

two. As a consequence of the delays irrigation<br />

of pad two would have had to begin during<br />

winter which was technically unfeasible.<br />

<strong>The</strong> temporary suspension has allowed the<br />

company to undertake necessary improvements<br />

to the processing plant, looking to deal<br />

with mercury and copper deposition issues,<br />

as well as build up a critical spare parts inventory<br />

and further streamlining of the organizational<br />

structure.<br />

<strong>The</strong> company managed to reach its preliminary<br />

targets after starting trial mining in February<br />

2012 and generated sufficient cash to<br />

construct pad two from internal resources.<br />

Cash costs of about Aus$1000 per ounce<br />

were achieved despite only one pad being in<br />

operation. Central Asia planned to simultaneously<br />

operate both pads to optimize results<br />

and was targeting ongoing operations with associated<br />

cash costs of Aus$700 per ounce.<br />

Central Asia has terminated its joint venture<br />

agreement with Manas Resources in relation<br />

to the Altyntas Gold Project. Under the agreement<br />

Manas had the right to earn up to 70%<br />

in the project by spending Aus$2 million on exploration<br />

and mine development. By mutual<br />

agreement, the parties have terminated the arrangement<br />

and Central Asia will reimburse<br />

Manas the expenditure incurred by it to date.<br />

<strong>The</strong> company has also finalized the raising<br />

of $750,000 for an issue of convertible notes.<br />

Also, as announced in December 2012, Millstar<br />

Holings SA and the company executed<br />

a deed of amendment to Millstar’s loan<br />

agreement and the $3 million loan repayment<br />

date was extended to December 15, 2014.<br />

In consideration for the extension, the company,<br />

subject to shareholder approvals, has:<br />

• Granted Millstar the right to convert a portion<br />

or all of its loan into ordinary shares at<br />

the lower of 2 cents or the issue price of<br />

any future capital raising; and<br />

• Agreed to issue Millstar with options to acquire<br />

shares in the company that, upon<br />

exercise, would represent 10% of its issued<br />

capital at the date of the options<br />

issue. <strong>The</strong>se options will have an expiry<br />

date of December 15, <strong>2013</strong>, and an exercise<br />

price of the lower of 2 cents or the<br />

issue price of any future capital raising.<br />

<strong>The</strong> company has recently completed a capital<br />

raising at $0.01 per share, thus the Millstar<br />

loan conversion and options prices are<br />

$0.01. <strong>The</strong> parties have agreed to fix the<br />

number of options issued to Millstar at<br />

83,810,000. Millstar has expressed interest<br />

in converting $1.4 million of the loan.<br />

22 | <strong>ASIA</strong> <strong>Miner</strong> | <strong>May</strong>/<strong>June</strong> <strong>2013</strong>