May/June 2013 - The ASIA Miner

May/June 2013 - The ASIA Miner

May/June 2013 - The ASIA Miner

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mine Design<br />

TOOLS TO ASSIST IN<br />

planninganddesign<br />

As mining companies face rising costs and volatile commodity markets, making the right design decisions is a must. <strong>The</strong> <strong>ASIA</strong><br />

<strong>Miner</strong> looks at worrying capex trends, and some of the software available to help keep costs under control.<br />

By Simon Walker, European editor E&MJ<br />

OPTIMIZING resource utilization has always<br />

been a challenge for mine designers,<br />

with nature still eminently capable of<br />

throwing up surprises that can both delight<br />

or confound. Brownfield exploration is<br />

often the key to the former—take Neves<br />

Corvo in Portugal or Garpenberg in Sweden<br />

as examples here—while unforeseen<br />

stress regimes, water or weak strata are<br />

often the cause of forced changes in plan.<br />

Cameco’s flood-related tribulations at<br />

Cigar Lake are a case in point.<br />

In consequence, mine design systems<br />

have to be capable of addressing sudden<br />

amendments as well as providing the overall<br />

framework for getting the most out of a<br />

given deposit, in both tonnage and financial<br />

terms. Soviet-style planning focused on the<br />

former at the expense of the latter, while examples<br />

abound of operations that have<br />

been run exclusively on financial rails and<br />

have closed early, only to find new leases<br />

on life under a different operating regime.<br />

<strong>The</strong> development of mine design software,<br />

which has been on-going since the<br />

first systems such as Datamine were introduced<br />

over 30 years ago, has resulted in a<br />

strong supply base of competitive concepts.<br />

Not surprisingly, there has been a degree<br />

of consolidation within the mainstream<br />

players in recent years, as well as acquisitions<br />

of suppliers by larger companies who<br />

have realized that the mining-sector market<br />

is no longer a niche. Such moves can, of<br />

course, bring significant benefits in terms of<br />

having greater development resources<br />

available, as well as the potential to merge<br />

software systems with different focuses into<br />

more comprehensive packages. As with<br />

machinery manufacturers, the goal is often<br />

to be able to meet all of a customer’s needs<br />

from one source, rather than risking part of<br />

the business (and its potential for long-term<br />

support) going elsewhere.<br />

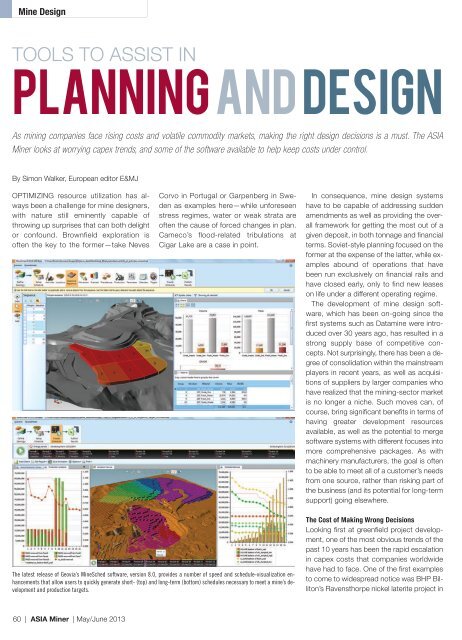

<strong>The</strong> latest release of Geovia’s MineSched software, version 8.0, provides a number of speed and schedule-visualization enhancements<br />

that allow users to quickly generate short- (top) and long-term (bottom) schedules necessary to meet a mine’s development<br />

and production targets.<br />

<strong>The</strong> Cost of Making Wrong Decisions<br />

Looking first at greenfield project development,<br />

one of the most obvious trends of the<br />

past 10 years has been the rapid escalation<br />

in capex costs that companies worldwide<br />

have had to face. One of the first examples<br />

to come to widespread notice was BHP Billiton’s<br />

Ravensthorpe nickel laterite project in<br />

60 | <strong>ASIA</strong> <strong>Miner</strong> | <strong>May</strong>/<strong>June</strong> <strong>2013</strong>