May/June 2013 - The ASIA Miner

May/June 2013 - The ASIA Miner

May/June 2013 - The ASIA Miner

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Mining Success Stories<br />

Matthew Gill says, “In 2008/09 Castlemaine<br />

Goldfields was one of hundreds of<br />

junior mining companies competing for equity<br />

funding but complicated by an historic<br />

perception among some investors and analysts<br />

that successful gold mining in the<br />

modern era will never work in Central Victoria.<br />

This was partly environmental (‘green<br />

tape’) but primarily due to the narrow vein,<br />

nuggetty geology, which presents difficulties<br />

in drilling out to JORC standard due to the<br />

large amount of drilling needed as well as<br />

the volatility and variability of quartz mineralization<br />

and grades. History backs up the<br />

perception with Bendigo starting and stopping<br />

several times while the Ballarat operation<br />

took 20 years of gestation and lots of<br />

money to get anywhere near production<br />

and then it was sold to Lihir Gold which put<br />

more into the project but didn’t proceed.”<br />

Enter Lihir Gold<br />

“<strong>The</strong> company Ballarat Goldfields was floated<br />

in the 1980s, consolidated the entire goldfield<br />

under one owner and tried putting in shafts<br />

to access the ore but ran into technical issues<br />

which consumed a lot of time and money,”<br />

he says. “<strong>The</strong>y finally put in a decline but got<br />

to a point in 2007 where funding to develop<br />

further was beyond its capacity. <strong>The</strong>n Lihir<br />

entered the story. It was a successful company,<br />

annually producing 800,000 ounces on<br />

Lihir Island in Papua New Guinea and looking<br />

to diversify. Lihir paid around $350 million<br />

for the asset in a share swap arrangement<br />

and then spent $400 million from 2007 to<br />

2009, building a large office complex, 500 vehicle<br />

car park, twin declines, a 600,000<br />

tonne/annum capacity mill and tailings dam,<br />

and buying equipment, but then realized it<br />

wasn’t going to deliver the 200,000 ounces<br />

of gold/annum ‘tier one’ asset it hoped for.<br />

“Lihir bought a vision that it was a 200,000<br />

ounce/annum, 20-year mine life ore body<br />

with a JORC inferred resource of 1.5 million<br />

ounces and took two years developing it,<br />

spending accordingly. <strong>The</strong> geology was more<br />

complex and in my opinion it was always<br />

going to be a challenge as a large-scale mining<br />

operation.<br />

“<strong>The</strong> old adage that grade is king is true<br />

here and the cost to move a tonne of rock in<br />

this environment is expensive, particularly if<br />

there is no gold in it. <strong>The</strong> Ballarat goldfields’<br />

average historical yield is around 8 or 9<br />

grams/tonne and in 2012 Castlemaine’s yield<br />

from Ballarat was around 7.4 grams/tonne<br />

Drilling and mining operations are taking place about 600 metres below Ballarat and about four blocks from the centre of the city.<br />

<strong>The</strong> mill is processing 200,000 tonnes annually for about 50,000 ounces of gold, and has plenty of spare capacity.<br />

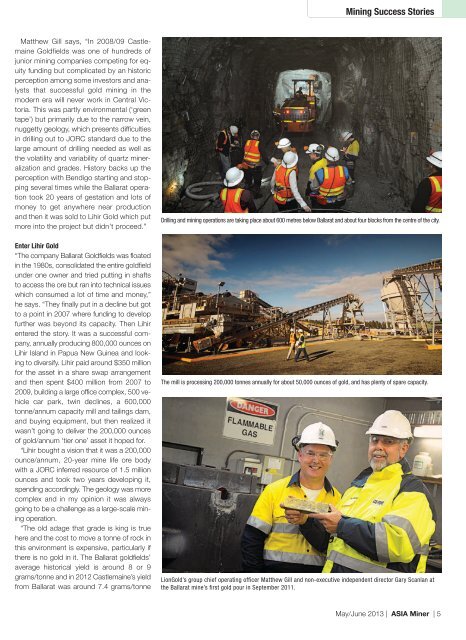

LionGold’s group chief operating officer Matthew Gill and non-executive independent director Gary Scanlan at<br />

the Ballarat mine’s first gold pour in September 2011.<br />

<strong>May</strong>/<strong>June</strong> <strong>2013</strong> | <strong>ASIA</strong> <strong>Miner</strong> | 5