PALMETTO GBA 2010 ANNUAL REPORT

PALMETTO GBA 2010 ANNUAL REPORT

PALMETTO GBA 2010 ANNUAL REPORT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

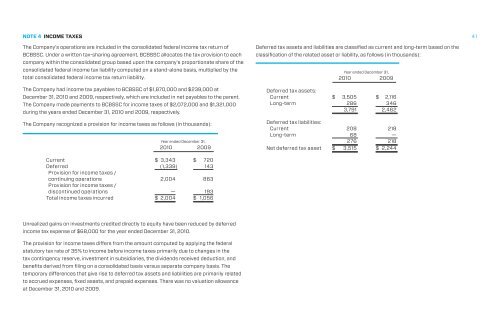

NOTE 4 INCOME TAXES<br />

41<br />

The Company’s operations are included in the consolidated federal income tax return of<br />

BCBSSC. Under a written tax-sharing agreement, BCBSSC allocates the tax provision to each<br />

company within the consolidated group based upon the company’s proportionate share of the<br />

consolidated federal income tax liability computed on a stand-alone basis, multiplied by the<br />

total consolidated federal income tax return liability.<br />

The Company had income tax payables to BCBSSC of $1,870,000 and $239,000 at<br />

December 31, <strong>2010</strong> and 2009, respectively, which are included in net payables to the parent.<br />

The Company made payments to BCBSSC for income taxes of $2,072,000 and $1,321,000<br />

during the years ended December 31, <strong>2010</strong> and 2009, respectively.<br />

The Company recognized a provision for income taxes as follows (in thousands):<br />

Year ended December 31,<br />

<strong>2010</strong> 2009<br />

Deferred tax assets and liabilities are classified as current and long-term based on the<br />

classification of the related asset or liability, as follows (in thousands):<br />

Year ended December 31,<br />

<strong>2010</strong> 2009<br />

Deferred tax assets:<br />

Current $ 3,505 $ 2,116<br />

Long-term 286 346<br />

3,791 2,462<br />

Deferred tax liabilities:<br />

Current 208 218<br />

Long-term 68 —<br />

276 218<br />

Net deferred tax asset $ 3,515 $ 2,244<br />

Current $ 3,343 $ 720<br />

Deferred (1,339) 143<br />

Provision for income taxes /<br />

continuing operations 2,004 863<br />

Provision for income taxes /<br />

discontinued operations — 193<br />

Total income taxes incurred $ 2,004 $ 1,056<br />

Unrealized gains on investments credited directly to equity have been reduced by deferred<br />

income tax expense of $68,000 for the year ended December 31, <strong>2010</strong>.<br />

The provision for income taxes differs from the amount computed by applying the federal<br />

statutory tax rate of 35% to income before income taxes primarily due to changes in the<br />

tax contingency reserve, investment in subsidiaries, the dividends received deduction, and<br />

benefits derived from filing on a consolidated basis versus separate company basis. The<br />

temporary differences that give rise to deferred tax assets and liabilities are primarily related<br />

to accrued expenses, fixed assets, and prepaid expenses. There was no valuation allowance<br />

at December 31, <strong>2010</strong> and 2009.