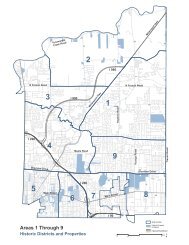

3.0 Land Use and Development - Town of Amherst

3.0 Land Use and Development - Town of Amherst

3.0 Land Use and Development - Town of Amherst

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TOWN OF AMHERST BICENTENNIAL COMPREHENSIVE PLAN<br />

The <strong>Town</strong> <strong>of</strong> <strong>Amherst</strong> also has been able to <strong>of</strong>fer exemptions<br />

that are limited both by their scope <strong>and</strong> their geography under<br />

Section 485-b <strong>of</strong> the New York State Code. Section 485-b<br />

exemptions only apply to the <strong>Town</strong>’s share <strong>of</strong> property taxes,<br />

which is a small percentage <strong>of</strong> what property owners pay.<br />

These benefits are only available in certain redevelopment<br />

areas within the <strong>Town</strong>, including older commercial districts<br />

like Eggertsville <strong>and</strong> Snyder, as well as highway-oriented strips<br />

like older sections <strong>of</strong> Sheridan Drive <strong>and</strong> Transit Road.<br />

Recent policy changes by the <strong>Amherst</strong> <strong>Town</strong> Board (see<br />

below) may help, as they authorize the IDA to assist by<br />

<strong>of</strong>fering abatements for sales taxes on construction materials<br />

<strong>and</strong> mortgage recording taxes to properties located in 485-b<br />

zones.<br />

In the past, the bulk <strong>of</strong> these abatements have only been<br />

available for new construction; abatements for rehabilitation<br />

only applied to the value added by renovation, excluding the<br />

existing property assessment amount. However, recent<br />

changes in policy have broadened the scope <strong>of</strong> IDA<br />

abatements. The <strong>Amherst</strong> IDA has recently joined with the<br />

Erie County IDA <strong>and</strong> the other four local IDA’s in the<br />

county to develop a st<strong>and</strong>ard, county-wide eligibility policy for<br />

tax abatements.<br />

In addition to the “greenfield” industrial <strong>and</strong> commercial<br />

development, the new eligibility policy has broadened the<br />

horizons <strong>of</strong> the tax abatements to include:<br />

• Multi-tenant commercial buildings: Multi-tenant<br />

<strong>of</strong>fice or industrial buildings are now included in the<br />

abatement program, provided that at least two-thirds <strong>of</strong> a<br />

given building’s tenants are in one <strong>of</strong> the IDA’s priority<br />

industry designations (manufacturing, distribution,<br />

business services, <strong>and</strong> arts/entertainment/recreation).<br />

This policy may allow for more multi-tenant, urbanoriented<br />

<strong>of</strong>fice developments, as such locations are likely<br />

to be more desirable for multi-user rather than single-user<br />

buildings.<br />

• Long-term care/assisted living: Residential projects<br />

<strong>of</strong>fering continuing medical care to senior citizens in need<br />

<strong>of</strong> such living arrangements are now eligible for<br />

abatements. Since it was determined for the Inventory <strong>and</strong><br />

Analysis Report that the economics <strong>of</strong> assisted living<br />

facilities in <strong>Amherst</strong> are difficult, sales tax <strong>and</strong> property<br />

tax abatement (10-year) for such projects can help make<br />

them viable for private operators.<br />

• Civic facilities: Three categories <strong>of</strong> civic facilities in<br />

particular are specified in the IDA eligibility criteria –<br />

3-12<br />

<strong>Town</strong> Board Adopted Plan (Amended March 2009) – <strong>L<strong>and</strong></strong> <strong>Use</strong> <strong>and</strong> <strong>Development</strong>