World Bank Document - Mumbai Railway Vikas Corporation Ltd ...

World Bank Document - Mumbai Railway Vikas Corporation Ltd ...

World Bank Document - Mumbai Railway Vikas Corporation Ltd ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

accordingly by both administrations. However, this does not make MRVC a permanent structure<br />

and MRVC will remain in existence only as long as it is judged necessary beyond the year 2014,<br />

the end of the current MOU. An amendment to the MOU will be signed to ensure that MRVC<br />

continues as implementing agency of MUTP-2A until its completion.<br />

D. Critical Risks and Possible Controversial Aspects<br />

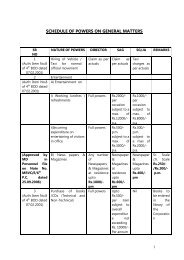

Risks Risk Mitigation Measures Risk Rating with Mitigation Risk Rating<br />

Operation-specific Risks<br />

Technical Design Demand assessment risk: demand may<br />

exceed the forecast, thereby reducing<br />

the expected passenger comfort<br />

benefits (reduced overcrowding). This<br />

can happen because population or<br />

Additional counts will be made during<br />

project preparation and project<br />

implementation to monitor passenger<br />

loadings. The pace of implementation of<br />

the Strategic Transport Plan may be<br />

economic growth does not change as<br />

forecast. It can also happen because<br />

the fare does not rise at the same pace<br />

as the cost escalation index. Based on<br />

recent traffic counts, this risk is<br />

moderate.<br />

revised accordingly.<br />

Moderate<br />

Implementation<br />

Capacity and<br />

Sustainability<br />

Financial<br />

Management<br />

About ten percent of electric motors<br />

have failed in trains so far delivered<br />

under MUTP-1, with a small impact<br />

on operations as the Vendor has<br />

replaced them, but with moderate<br />

future risk.<br />

Financial sustainability: continuation<br />

of the present fare level trend will<br />

increase the financial deficit of the<br />

suburban operation, creating a<br />

medium-term financial risk for IR.<br />

Possibility of certain gaps in corporate<br />

governance and financial<br />

accountability and management<br />

practices in MRVC. (MRVC is in the<br />

process of implementing MUTP-1 and<br />

is already familiar with <strong>Bank</strong><br />

procedures).<br />

The <strong>Bank</strong> team will encourage IR to pay<br />

more attention to qualification of critical<br />

items of rolling stock procurement.<br />

The impact of the project on IR’s financial<br />

performance as a whole is considered small<br />

and not liable to affect significantly the<br />

sustainability of the suburban operations<br />

and maintenance.<br />

An assessment of corporate governance<br />

and financial accountability (CGFA)<br />

arrangements in MRVC has been<br />

completed. The objective of the assessment<br />

is to (i) benchmark current CGFA practices<br />

in MRVC against industry standards and<br />

good practices and (ii) agree on an action<br />

plan with dates for implementing capacity<br />

building measures that are identified.<br />

Progress on the agreed action plan would<br />

be monitored during project preparation<br />

and prior to implementation.<br />

Funds will flow to MRVC through budget<br />

release, which will be replenished by the<br />

<strong>Bank</strong> on the basis of quarterly interim<br />

unaudited financial reports and expenditure<br />

forecasts. Direct payment by the <strong>Bank</strong> to<br />

the suppliers will be the likely option under<br />

the project. The project will comprise only<br />

a few large supply contracts, which will be<br />

subject to prior review by the <strong>Bank</strong>.<br />

Low<br />

Low<br />

Moderate<br />

(subject to<br />

progress of<br />

implementati<br />

on of agreed<br />

CGFA action<br />

plan<br />

10