The Hungarian Communications Market Developments and ...

The Hungarian Communications Market Developments and ...

The Hungarian Communications Market Developments and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>Hungarian</strong> <strong>Communications</strong> <strong>Market</strong> <strong>Developments</strong> <strong>and</strong> Regulation between 2004 <strong>and</strong> 2008<br />

ratios: e.g. on 31 December 2006, cable modem Internet service was<br />

available in 60 percent of the households <strong>and</strong> in mid-2007, mobile<br />

broadb<strong>and</strong> was available for 48 percent of the population.<br />

<strong>The</strong> two leading technologies of the broadb<strong>and</strong> market across Europe<br />

are ADSL <strong>and</strong> cable modem Internet. <strong>The</strong> situation in Hungary<br />

is the same, yet with one difference. Cable infrastructure in Hungary<br />

plays a greater role than in Europe. <strong>The</strong> comparison of the proportion<br />

of cable modem <strong>and</strong> ADSL subscribers in the EU 25 states illustrates<br />

well the importance of the role of cable modem Internet in the<br />

<strong>Hungarian</strong> broadb<strong>and</strong> market. As regards this index, Hungary ranks<br />

far ahead even of countries with traditionally high penetration rates<br />

(Belgium, Netherl<strong>and</strong>s, Austria) as the cable/ADSL ratio in Hungary is<br />

more than 80 percent.<br />

In addition to cable modem access, the number of mobile Internet<br />

users has also increased remarkably since 2007, so mobile technology<br />

appeared in the market as a new competitor of broadb<strong>and</strong> data<br />

transmission technology. According to a residential survey carried<br />

out by NHH in February 2008, six percent of the households had<br />

mobile Internet subscriptions, with narrowb<strong>and</strong> <strong>and</strong> broadb<strong>and</strong> connections<br />

to the Internet equally distributed among them. <strong>The</strong> ratio of<br />

fixed wireless (WiFi) access also reached six percent.<br />

<strong>The</strong> past four years have seen a drastic fall in the prices of<br />

broadb<strong>and</strong> services. While in 2003 the price of the cheapest broadb<strong>and</strong><br />

package with the leading service providers was HUF 8 to 10<br />

thous<strong>and</strong>, the same package was available for only HUF 5 thous<strong>and</strong><br />

in 2007. In addition, for the 2007-year price subscribers could use<br />

three or four times higher b<strong>and</strong>widths than in 2003.<br />

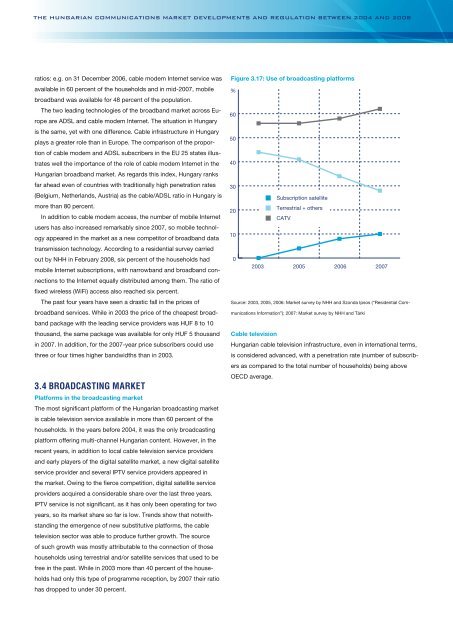

3.4 Broadcasting market<br />

Platforms in the broadcasting market<br />

<strong>The</strong> most significant platform of the <strong>Hungarian</strong> broadcasting market<br />

is cable television service available in more than 60 percent of the<br />

households. In the years before 2004, it was the only broadcasting<br />

platform offering multi-channel <strong>Hungarian</strong> content. However, in the<br />

recent years, in addition to local cable television service providers<br />

<strong>and</strong> early players of the digital satellite market, a new digital satellite<br />

service provider <strong>and</strong> several IPTV service providers appeared in<br />

the market. Owing to the fierce competition, digital satellite service<br />

providers acquired a considerable share over the last three years.<br />

IPTV service is not significant, as it has only been operating for two<br />

years, so its market share so far is low. Trends show that notwithst<strong>and</strong>ing<br />

the emergence of new substitutive platforms, the cable<br />

television sector was able to produce further growth. <strong>The</strong> source<br />

of such growth was mostly attributable to the connection of those<br />

households using terrestrial <strong>and</strong>/or satellite services that used to be<br />

free in the past. While in 2003 more than 40 percent of the households<br />

had only this type of programme reception, by 2007 their ratio<br />

has dropped to under 30 percent.<br />

Figure 3.17: Use of broadcasting platforms<br />

%<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Subscription satellite<br />

Bírságok Terrestrial együttes + others<br />

CATV<br />

2003 2005 2006 2007<br />

Source: 2003, 2005, 2006: <strong>Market</strong> survey by NHH <strong>and</strong> Szonda Ipsos (“Residential <strong>Communications</strong><br />

Information”); 2007: <strong>Market</strong> survey by NHH <strong>and</strong> Tárki<br />

Cable television<br />

<strong>Hungarian</strong> cable television infrastructure, even in international terms,<br />

is considered advanced, with a penetration rate (number of subscribers<br />

as compared to the total number of households) being above<br />

OECD average.